The largest global by transaction volume cryptocurrency While government pressures continue on Binance, the negative trend continues to be reflected in the price of local token BNB.

on-chain The latest charts shared by data tracker Santiment reveal that buyers have not shown an advantage.

Funding Ratio is Negative

According to the funding rate metric from market tracker Santiment, traders in the futures market are more willing to open up trades.

The funding rate, which reached the bottom negative level especially in March, continued to decline throughout April. Today, although this metric is close to zero, the lack of a positive rate still indicates that sellers are more willing.

If the funding rate is positive, it is interpreted that the traders who take an upward position in the futures markets are in the majority, and when it is negative, the traders who take a short position outweigh.

BNB Price

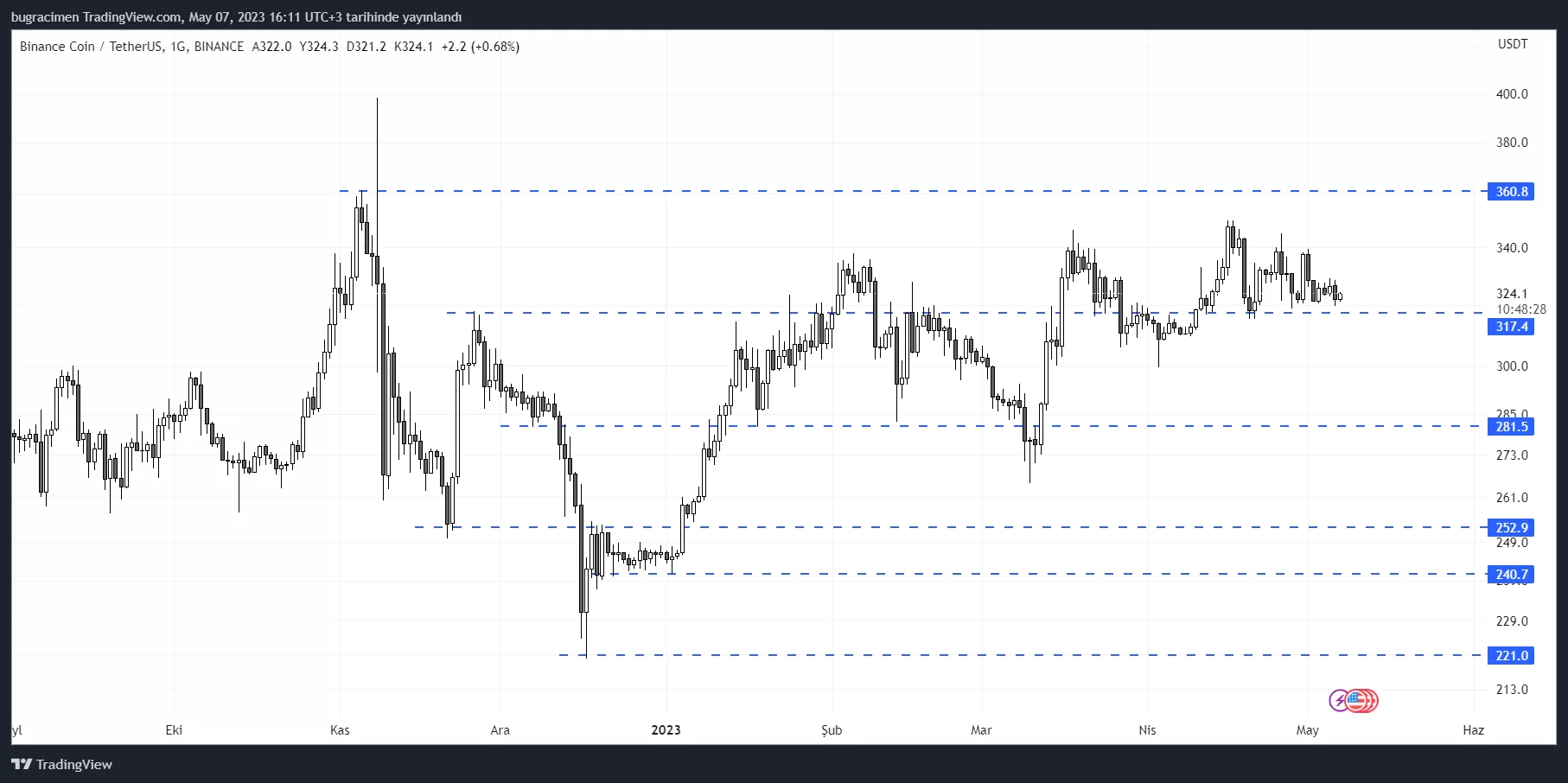

Leading crypto exchange Binance and BNB Chain’s native token BNBIt continues to hold above the $317 support since April.

BNB, which pushed $700 in the last bull season, is still a long way from its old days. However, if the $360 level is exceeded in the short term, new upward movements may come. In a negative scenario, if Binance Coin falls below the $317 support, the sell-off may continue up to $280.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price tracking right now by downloading our apps!