AVAX price is in the process of forming a bullish chart pattern suggesting a new record high for the token. Avalanche (AVAX)If it manages to break above $123, a 41% rally will begin to be on the radar.

AVAX bulls seem to have marked their next target at $174. AVAX price is currently forming a bullish chart pattern that could set a new record high at $174. For the optimistic view to be confirmed, the token must overcome a number of challenges, including the toughest hurdle at $123.

If the Formation is Confirmed, 41% Rise Is Coming!

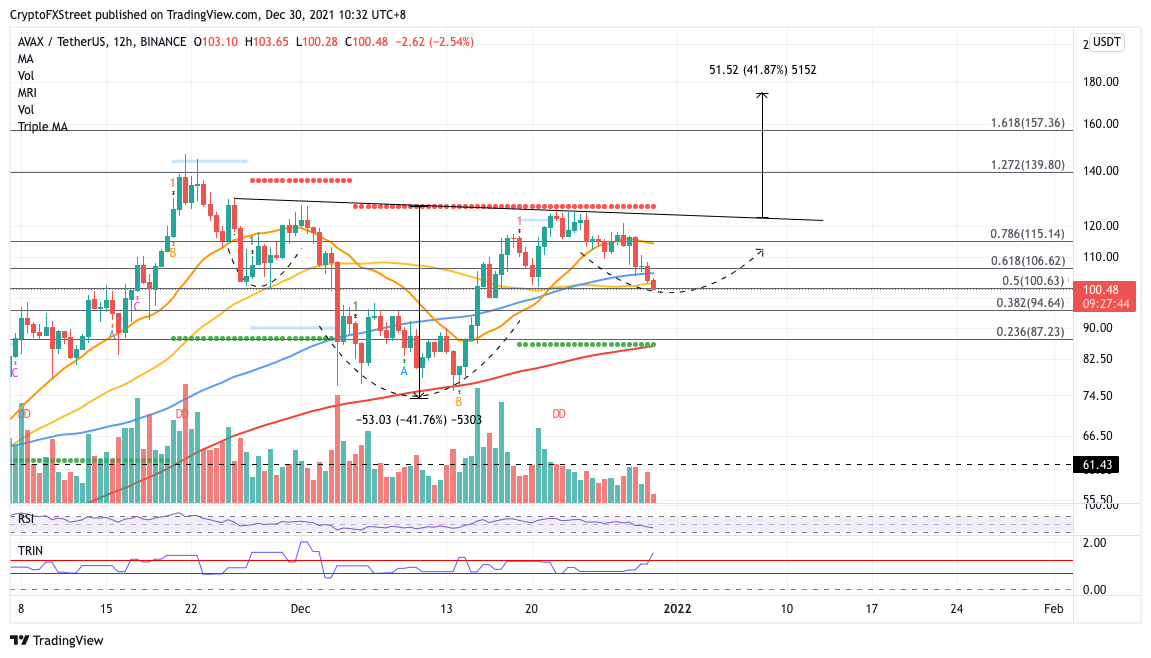

AVAX The price is producing an “inverted head-and-shoulders pattern” on the 12-hour chart, indicating a huge bullish forecast for the token.

However, traders should keep in mind that the optimistic target of a 41% rally to $174 can only be achieved if Avalanche manages to break above the neckline of the prevailing technical pattern at $123.

AVAX price is in the process of forming the right shoulder of the current chart pattern. An increase in purchasing pressure, Avalanche‘s reach the neckline, but before that he has to tackle a few hurdles.

The first line of resistance for AVAX price is at the 50 “twelve-hour Simple Moving Average (SMA)” at $101, followed by the 100 twelve-hour SMA at $105. The 61.8% Fibonacci retracement level will then act as an additional barrier for AVAX at $106.

Before approaching the neckline of the reverse head-and-shoulders pattern, AVAX price is also facing an upside head at $115 at the intersection of the 21 twelve hourly SMA and the 78.6% Fibonacci retracement level.

AVAX price will face another challenge at the neckline of the dominant technical pattern at $123, which coincides with the resistance line given by the Momentum Reversal Indicator (MRI) before targeting the 41% rally.

However, if the selling pressure builds, AVAX price could discover immediate support at the 50% retracement level at $100. The following support levels are at $94 at the 38.2% Fibonacci retracement level, which coincides with the 200 twelve-hour SMA given by MRI and the support line, followed by the 23.6% Fibonacci retracement level at $87.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.