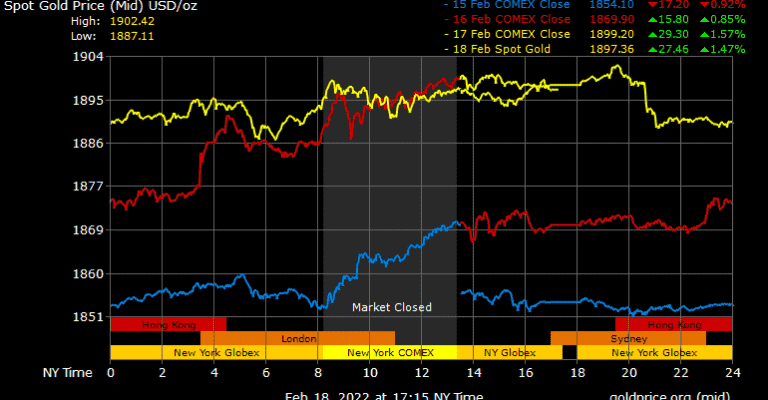

While the stock and crypto markets were fluctuating in the previous week, the gold price increased by 3.85%. On February 10, the price of pure gold rose from $1,826.92 to $1,897.36 an ounce. Also, 4 of today’s leading gold-based cryptocurrencies have witnessed a massive increase in demand alongside premiums above the current market price of gold.

Gold price shines amid economic uncertainty

cryptocoin.com As we have mentioned, global economic instability is based on the conflict between Russia and Ukraine and the threat of war. That caused stock markets to drop this week, and at Friday’s closing bell, all three major indices were in negative territory. At the end of Friday, the Nasdaq fell -168, the Dow Jones -232 and the NYSE -99. Moreover, the cryptocurrency market did the same as billions of dollars left the crypto economy, dropping from under $2 trillion to $1.88 trillion last week.

The value of the tokenized gold market is rising

As the price of precious metals soared, demand for tokenized gold cryptocurrencies skyrocketed. The market cap of Tether gold (XAUT), Pax Gold (PAXG), Perth Mint Gold Token (PMGT) and Digix Gold (DGX) rose between 2.4% and 8% in the previous week. Meanwhile, they oscillate between the spot market price of gold and a reasonable premium. For example, Pax Gold (PAXG) is currently trading at $1,925.71 which is 1.039 percent higher than the spot gold price. In PMGT, it is worth more than an ounce of real gold in the current market.

XAUT and PAXG recorded massive growth in 25 days and have been on the rise ever since. XAUT’s market cap reached $410 million on January 25, with a gain of approximately $20 million. PAXG’s market capitalization was $332.7 million, with $92 million added in the last 25 days. In the last two years, XAUT’s market cap has increased by approximately 20,000%, while PAXG has increased by 16,000%.

New investors prefer tokenized gold products

Those involved in the crypto economy have discovered gold-backed cryptocurrencies similar to stablecoins, and this trend appears to be a business cornerstone. Like their physical counterparts, digital gold tokens can be used to hedge against market downturns. With the current premiums, arbitrage opportunities are possible, just as in the fiat-pegged cryptocurrency markets.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.