March is over and investors now want to know which altcoin projects to watch out for as they head into April. In this article, you can find altcoins that are maintaining bullish patterns.

Altcoin projects to watch out for in April

Currently, Solana (SOL), XRP, and Chainlink (LINK) seem to be at the forefront of continuing their bullish recovery next month. Since May of last year, SOL has been stuck on a downward sloping trendline and has failed multiple times in its efforts to escape.

While this trendline is currently leading an aggressive downtrend, a breakout could signal a trend reversal for the SOL.

If that’s the case, SOL price could soon start targeting $26, $38 or even $48. It is currently trading at $21 SOL.

XRP

XRP is also a promising altcoin for the new moon. The area around $0.31 is currently acting as a support base for the double bottom pattern forming on XRP’s weekly chart. This is a famous bullish reversal pattern that shows traders actively accumulating.

XRP price has also reached a local resistance of around $0.43 to $0.415. If the altcoin can break above this level, XRP price could rally 20% to challenge the next resistance around $0.55.

Chainlink (LINK)

LINK also shows some potential. The weekly chart of the crypto shows that it has been trading sideways between the buy peak of $9.5 and the sell peak of $5.5 for several weeks.

Despite this, LINK’s weekly RSI slope is rising and this could mean that the bullish momentum for LINK is increasing. This bullish divergence could indicate that a trend reversal is likely for LINK price to break past the $9.5 resistance.

What should be considered next as the 1st quarter ends in the altcoin market?

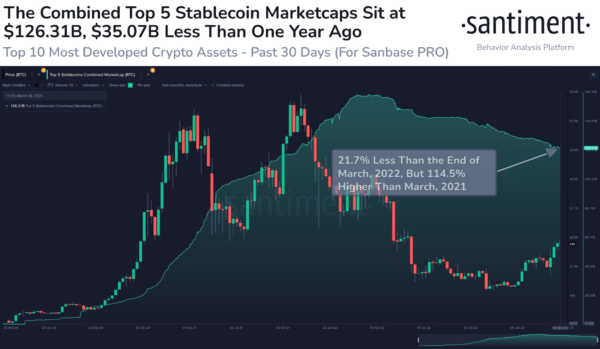

Blockchain analytics firm Santiment posted a new tweet this morning after the end of a hugely successful first quarter for the crypto market. According to the tweet, the total purchasing power for BUSD, USDT, USDC, USDP and DAI is approximately $126.3 billion.

The tweet also adds that the decline in purchasing power has subsided this week. However, he concludes that the increase in the purchasing power of the top 5 stablecoins will indicate that “the probability of Bitcoin going up is greatly increased.”

How about Bitcoin?

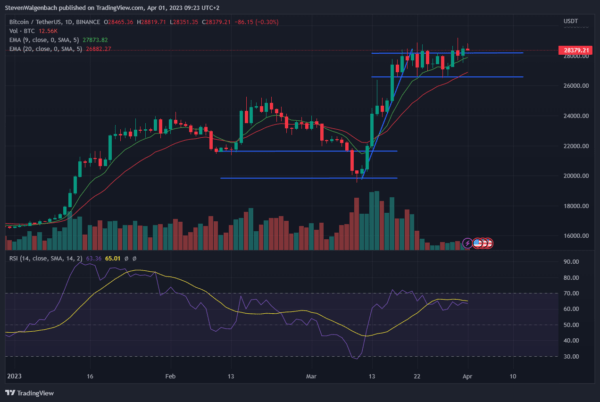

Bitcoin (BTC) price has increased by 1.19% in the last 24 hours, according to CoinMarketCap data. This 24-hour increase in the market leader’s price contributed to its positive weekly performance, bringing total weekly gains to 3.49%. As a result, the price of BTC is currently $28,412.42.

In related news, the global crypto market cap has increased by 1.03% in the last 24 hours, bringing the total total to approximately $1.19 trillion. The dominance of BTC in the market also increased by 0.30% in the last day, increasing the dominance of the leading crypto to 46.43%.

cryptocoin.com We have included current weekly Bitcoin analysis and critical technical levels in this article.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.