The cryptocurrency market is showing tremendous strength in an impressive bull rally on the first day of this week. Bitcoin is leading the move with a remarkable year-to-date (YTD) performance. This raises concerns about profit-taking selling. Crypto analyst Vinicius Barbosa says CoinGlass data gives a sell signal for 2 cryptos.

It is possible for profit realization to trigger a sale!

Notably, crypto total market cap has increased by over $1 trillion since the beginning of the year, rising from $1.59 trillion to $2.63 by press time. Bitcoin alone is up 70% since January 1, 2024. Therefore, it is possible that investors will want to realize some of this profit.

In this context, we took a look at a Relative Strength Index (RSI) heat map on CoinGlass. This technical indicator is exhibiting strong momentum, with the daily average RSI value above 68 and the weekly RSI value above 65. Therefore, it is beneficial for investors to watch for potential sell signals for cryptos that are in the overbought zone. Especially for those that have a combination of multiple time periods that point to the same extreme situation.

Leading cryptocurrency Bitcoin is overbought!

Bitcoin is overbought on four of the five RSI timeframes. Additionally, there are higher values for higher ranges. It has values of 88.4, 79.5, 75.14 and 73.32 in the weekly, daily, 4-hour and hourly Relative Strength Indices, respectively. Currently, BTC is trading above the ATH level of the last cycle at $72,739. This indicates an increase of 9% in the last seven days. This combination of recent price movements and broken records indicates a sell signal for BTC.

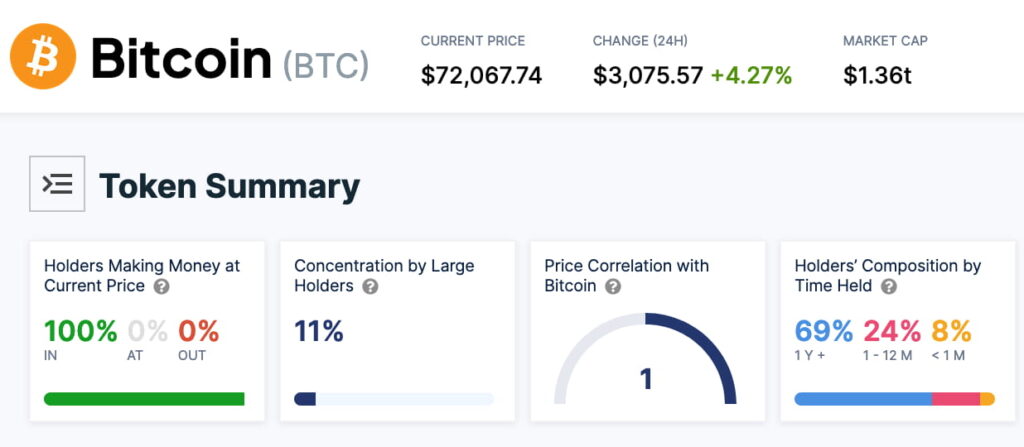

Interestingly, IntoTheBlock’s data shows that 100% of Bitcoin holders are currently in profit. This increases the possibility of sales for profit in the short term.

In second place is an artificial intelligence coin: Fetch.ai (FET)

Meanwhile, according to CoinGlass’ heat map, Fetch.ai (FET) is the second most overbought cryptocurrency across different time frames. FET is trading at $2.79, up 61% in one week. The weekly RSI value is at the overbought level of 89.32. Additionally, the token’s daily Relative Strength Index is 79.26. This threatens a correction for the token at any time. Essentially, this token benefited from the artificial intelligence (AI) narrative impacting different markets. For example, AI ranks alongside meme coins as one of the leading crypto narratives for this cycle.

However, having an overbought RSI does not guarantee a price decline or trend reversal. The cryptocurrency market is highly volatile. Therefore, it is possible for projects to continue to grow with favorable conditions and increased demand.

The opinions and predictions in the article belong to the analyst and are definitely not investment advice. cryptokoin.com We strongly recommend that you do your own research before investing.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!