a leading one cryptocurrency CryptoQuant, an analysis company, recently of Bitcoin He emphasized the importance of the Market Value – Realized Value (MVRV) ratio in understanding market behavior.

Comparing Bitcoin’s market value to its realized price, the MVRV ratio serves as a critical indicator of investor profitability and market valuation.

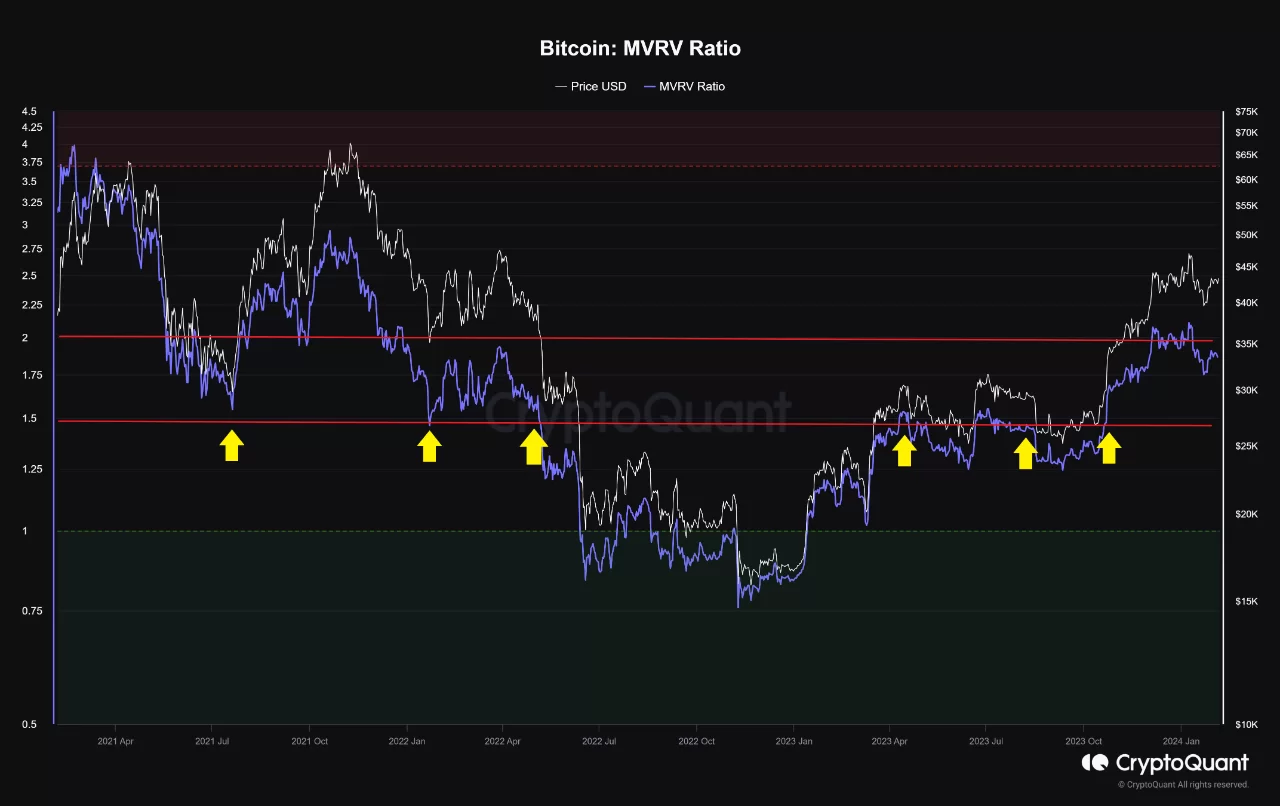

According to the analysis, the historical MVRV ratio levels of 1.50 and 2.00 played important roles in previous bull markets.

The 1.50 level in the MVRV ratio is often referred to as the “capitulation zone” for Bitcoin. According to the analytics company, this level indicates extreme fear and panic among investors and typically leads to selling.

According to analysts, the fact that the bull markets in 2015, 2018 and 2020 started near or below the MVRV 1.50 level indicates that bottom formations have occurred at this point and investors have started to accumulate again.

In contrast, the 2.00 level in the MVRV ratio is known as the “bull market trigger” for Bitcoin. This level indicates that investors’ confidence is increasing and buying pressure is accelerating. According to analysts, in 2013, 2017 and 2021, bull markets gained momentum after the MVRV ratio exceeded the 2.00 level, showing that investors believed in Bitcoin’s upward trend and were willing to invest more.

As of February 5, 2024, the MVRV rate is around 1.80. According to analysts, this shows that Bitcoin is still near the bottom zone and a bull market trigger has not yet occurred. CryptoQuant suggests that a bull rally could be triggered if the 2.00 level is breached.

*This is not investment advice.

For exclusive news, analysis and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price monitoring now by downloading our applications!