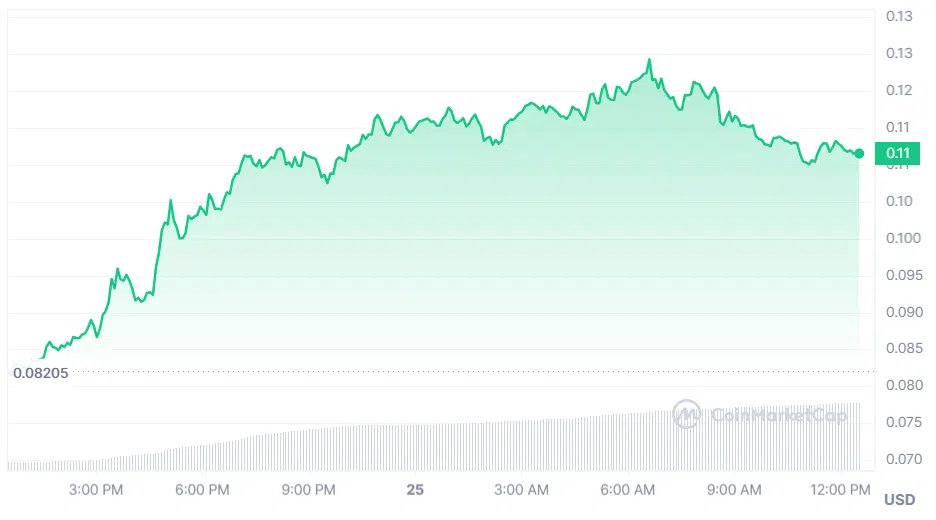

IDEX, stands out as both a hybrid decentralized exchange (DEX) and the native token of the market-making protocol of the same name. It has seen a significant increase in investor interest, with a 33% increase in the last 24 hours.

This is typically used for gas fees and providing liquidity on the Idex exchange. crypto- Its presence has generally trended downward over the past two weeks. Starting from $0.0920 on March 13, it fell to $0.0642 on March 20, a decline of 30%.

However, this price drop occurred just before a recovery move that saw the token reclaim its 10-month high. altcoinIt experienced positive momentum over the weekend and tested a strong resistance level before rising to $0.0904 on March 23.

The asset’s upward momentum extended into the next day, rising to $0.1191 on March 23, surpassing the $0.1 psychological price threshold for the first time since May 2023. This allowed IDEX to close March 23 with an impressive gain of 48.24%, marking its biggest intraday gain in the last 23 months.

Despite this morning’s 4.48% drop, the asset retained most of the gains recorded over the weekend. Market data shows that IDEX is up 33% in the last 24 hours, making it one of the best-performing crypto assets during this time.

In particular, although details are scant about the possible trigger of the latest surge, data suggest that increased demand following the increase in interest rates may be behind this movement. IDEX’s volume increased by 636% in the last 24 hours to $171.9 million, commanding 66% of Binance’s global volume.

Google Trends data also shows that searches for IDEX have increased rapidly since March 23, and interest increased from 23 to 92 as of March 24. Although interest has dropped since then, it remains fairly high compared to the seven-day average.

According to Coinglass data, IDEX’s derivatives volume also increased by 1,364% in the last 24 hours, reaching $784.53 million at reporting time, and Open Interest (OI) increased by 508% to $35.67 million. The asset is currently trading at $0.1111 and is struggling to hold above the $0.11 level despite the prevailing bearish move.