With the Securities and Exchange Commission (SEC) Ripple While the legal dispute between Labs continues, XRP has not received its expected share of the 2024 cryptocurrency rally and is struggling to grow due to regulatory pressure.

As of today XRP price It is trading around $0.494 and is up 0.47% in the last 24 hours. However, this slight increase has been offset by the altcoin’s market cap falling from over $33 billion to less than $28 billion in the last seven days, with its price falling by 19.01% in the past week. This latest decline caused the coin’s market value to drop to $27.270 billion.

As we reported as Koinfinans.com, cryptocurrency analyst CoinsKid expressed his bearish expectation about XRP on April 17. Analyst, altcoinHe argues that the recent price action of a failed bullish attempt indicates a potential significant downside. Additionally, the absence of a new price top during the bullish attempt and the apparent new price bottom during the recent decline are cited as evidence supporting the bearish trend.

The current situation of XRP is at a critical point because cryptocurrency The unit is facing important support and resistance levels. A quick analysis pinpoints the immediate support level at $0.438, while a more optimistic resistance level appears to be $0.550.

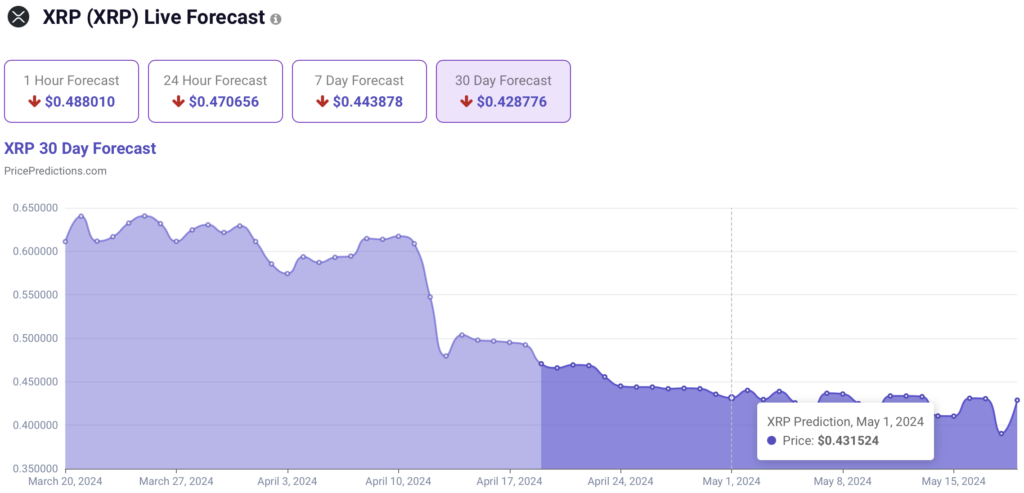

According to predictions from artificial intelligence (AI) machine algorithm models, the altcoin is expected to remain bearish in the long term, predicting a 12.55% decline by May 1 with a target price of $0.432. This data offers an important insight into the coin’s potential movements in the near future.

In the short term, machine learning algorithms detect a bearish trend by showing signs of a potential slight increase over the next few hours.

Technical analysis indicators include Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands (BB), Average True Range (ATR) and others.

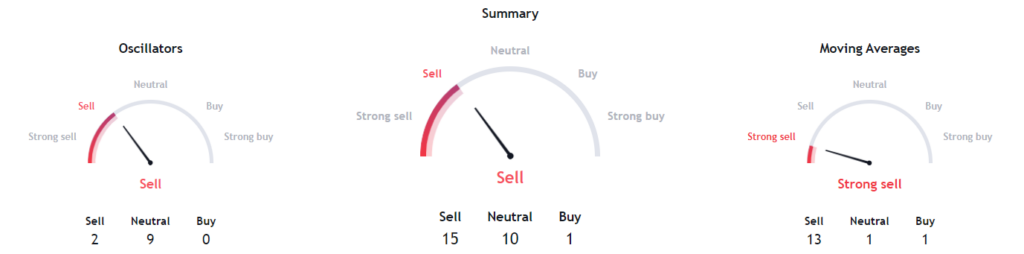

Similarly, when looking at technical indicators, there is a downward trend with a general ‘sell’ rating. The moving average (MA), together with the oscillators, gives a ‘strong buy’ signal. These technical analysis indicators offer important perspective on the short-term performance of XRP.

Moving averages rate XRP as a ‘strong sell’ based on three different time frames, while oscillators generally give a ‘sell’ signal. However, when the analysis is based on the last 4 hours of trading the oscillators indicate a ‘neutral’ situation. This shows that different signals about the short-term performance of XRP may emerge in various time frames.