In the cryptocurrency markets, the recent narrowing of the difference between the Term Representative Fund (VTF) funding rates between Bitcoin and Ether shows that investors’ risk appetite has increased. This development suggests that alternative cryptocurrencies may attract more investments in the coming period. Cryptocurrency supporters, who have recently questioned the sustainability of the appreciation of alternative cryptocurrencies (altcoins), including meme coins, are examining the latest trend in the difference between Bitcoin and Ether VTF funding rates. Here are the details…

Data shows VTF difference between Bitcoin and ETH

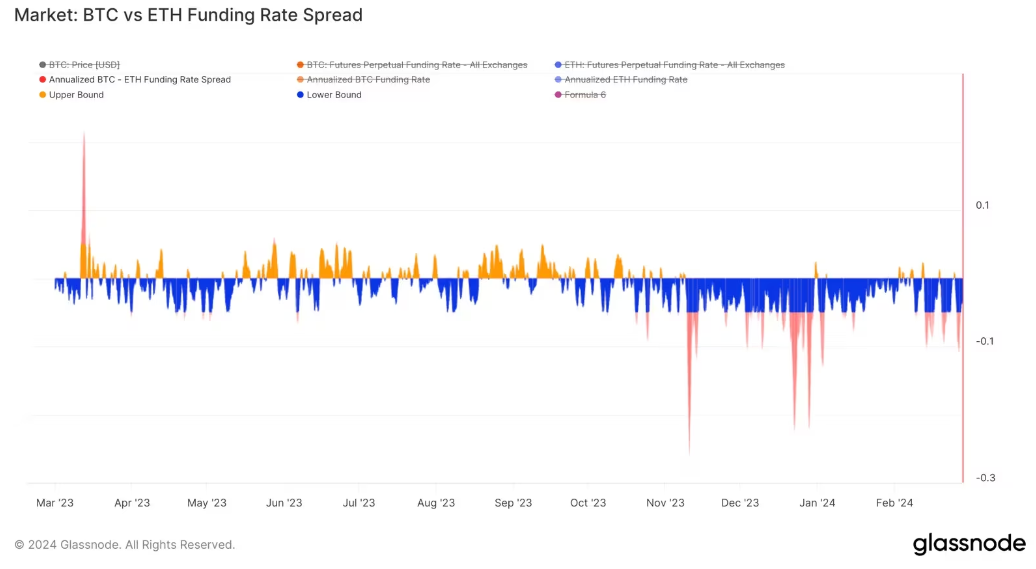

Data tracked by Glassnode shows that the spread has recently narrowed to -9% annually. This suggests that investors are willing to pay more to place leveraged bets on long or bullish positions in the Ether VTF futures market relative to Bitcoin (BTC). In other words, risk appetite is increasing – investors are looking to put money into smaller, riskier altcoins and hope to make big profits. Glassnode included the following statement in its weekly newsletter:

The gap between BTC and ETH funding rates is widening. Before October 2023, a relatively neutral regime could be observed, with the spread oscillating between positive and negative range. However, since the October rally, ETH funding rates have been consistently higher than BTC. This suggests traders have a greater appetite to speculate further up the risk curve.

Bitcoin adoption is on the rise

Bitcoin is the world’s largest and most liquid cryptocurrency in terms of market capitalization. Its adoption is increasing. On the other hand, Ether is considered relatively high beta and is the altcoin leader. Therefore, the price or funding rate difference in the Bitcoin and Ether markets reflects broader risk perception, just like the AUD/JPY pair does in traditional markets.

Futures proxy funds, or forwards, without an expiration date, include a funding rate mechanism so that futures representative funds’ prices closely track spot markets. A positive funding rate means leverage has shifted to the bullish side and longs are willing to pay shorts to keep their bets open. A negative ratio indicates a trend in the opposite direction.

Traces of rise in the altcoin market

In the first nine months of 2023, the Bitcoin-Ether funding rate difference fluctuated between -3% (lower bound) and +3% (upper bound). Since October, the spread has fallen below -3% several times, signaling a preference for Ether and the broader altcoin market.

The latest decline comes as Ether and other altcoins are pushing up the overall crypto market valuation. Bitcoin’s total market share, often referred to as its dominance ratio, has remained between 51% and 54% since early January, according to charting platform TradingView. The total crypto market value increased from roughly 1.7 trillion dollars to 2.2 trillion dollars during this period.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.