The cryptocurrency market has attracted increasing interest in recent years, and the opinions of analysts who develop various strategies in this field are gaining importance. In this context, Justin Bennett, known as a crypto strategist, presented a remarkable analysis by evaluating the potential of the altcoin market against Bitcoin.

One of Bennett’s notable views is that, based on historical data, Bitcoin’s movements may be decisive on altcoins. To analysis According to, an event in 2021 showed that altcoins could exceed the performance of Bitcoin. The analyst specifically points out that Ethereum and other altcoins performed stronger when Bitcoin investors made sudden sales over a two-month period.

According to Bennett, it is predicted that altcoins may experience a major rise in March-April if this historical pattern is repeated. It is suggested that leading altcoins such as Ethereum may emerge from Bitcoin’s shadow and shine more prominently. In particular, it is pointed out that Ethereum experienced a 182% increase in just 48 days at BTC’s peak during the April-May 2021 period.

Another point that stands out in Bennett’s analysis is the potential of the Ethereum/BTC pair. The analyst predicts that the ETH/BTC pair could make a major rise and move up to 0.15636 BTC. This means that Ethereum could reach $8,062 according to current data. However, Bennett adds that the market is not yet fully ready for this rise and investors should not rush.

Besides these, the analyst claims that if ETH/BTC only returns to the 2021-22 high of 0.08597 BTC, ETH can reach its all-time high of $4,878 as long as Bitcoin remains in the $50,000 range.

“The crazy thing is that even if ETH/BTC only reaches its 2021/2022 high, ETH can still record ATH (all-time high) as long as BTC can maintain these $50,000 levels. “There’s still a lot of speculation, but that’s what makes the market.”

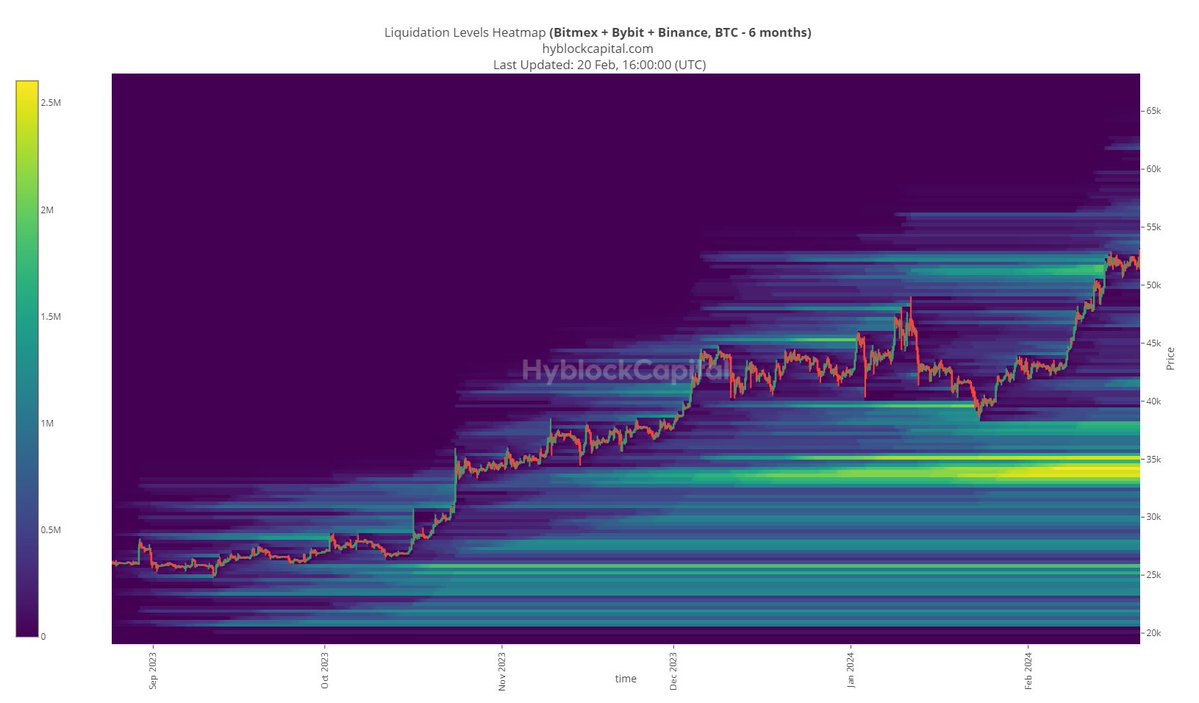

Bennett also thinks there remains a possibility that Bitcoin will fall into the $30,000 range, based on the liquidation heat map, which is used in technical analysis to predict price levels at which large-scale liquidations may occur and identify key support levels.

“Why might BTC target $30,000-35,000? So (graphic map below):”

You can follow the current price movement here.