Mike Belshe, CEO of digital asset custodian BitGo, gave critical information about Alameda Research. CEO, 3000 before FTX filed for bankruptcy on Nov. Wrapped Bitcoin (wBTC) confirmed that it is trying to use it.

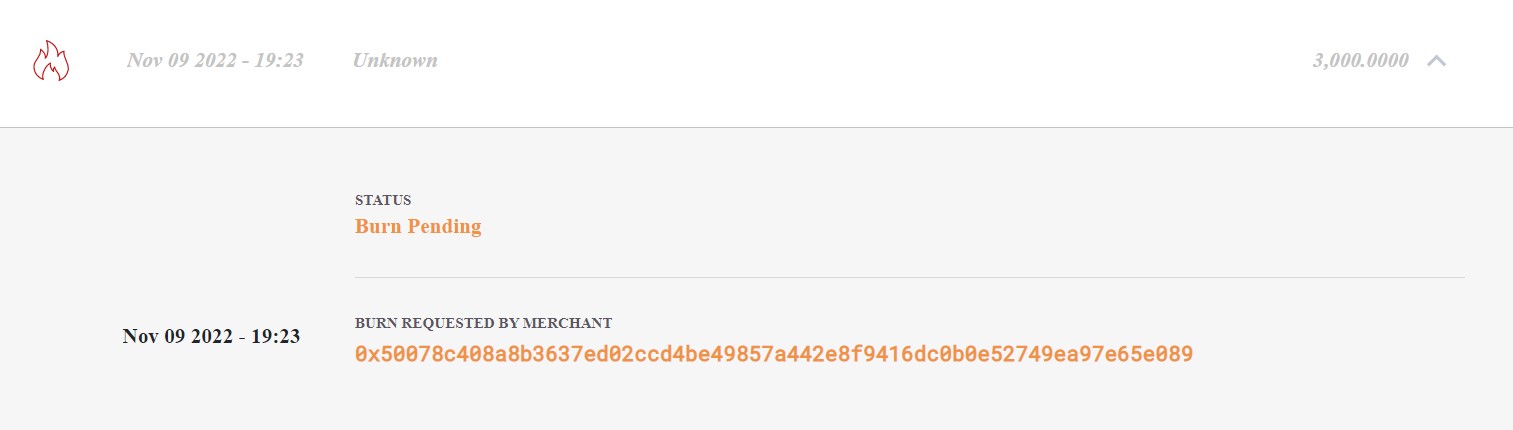

DeFi researcher Chris Blec brought up the claim on December 14. According to Blec’s statement, Alameda Research wanted wBTCs to use the assets, but the transaction was rejected because they could not pass the security process. According to BitGo’s statement, the transaction in question wanted to be carried out for the purpose of ‘burning’. As a matter of fact, the person who opened the transaction, wBTC He didn’t seem to know much about the burning process.

Interesting nuggets from today’s $WBTC Twitter Space w/ @BitGo and @KyberNetwork:

During FTX turmoil, someone from Alameda tried to redeem 3k WBTC for BTC.

BitGo refused to honor.

Tokens were burned anyway.

BitGo isn’t sure what to do w/ the 3k BTC.https://t.co/A1wYY72skb

— Chris Blec (@ChrisBlec) December 14, 2022

“The security details were not aligned with the entire process. We declined the transaction and decided to keep the assets in our wallets. This is how the burning process works. You need to know the parties well for the burning process, but this information was missing.”

CEO Belshe stated that they did not process the request due to such details. As we have reported as Koinfinans.com Alameda Research It went bankrupt a few days later. BitGo, on the other hand, suspended the transaction completely and continued to hide the assets.

Alameda’s attempt to use 3,000 wBTC also appears on Etherscan.

Although Alameda Research tried to dump thousands of wBTC tokens to the market, it got stuck in BitGo’s security phase. The reason for the attempted redemption of the $50 million worth of wBTC is unclear. However, it seems that FTX executives are trying to raise funds from various sources to get out of bankruptcy until the last minute.

Analysis by Arkham Intelligence on November 25 found that Alameda had withdrawn $204 million from eight different addresses from FTX.US five days before FTX filed for bankruptcy.

wBTC is a tokenized version of BTC and can be used for BTC when sent to a burn address, triggering the release of BTC. The conversion is done in a 1:1 ratio.

The tokenization of Wrapped Bitcoin allows Bitcoin holders to interact with Ethereum-based smart contracts and decentralized applications.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.