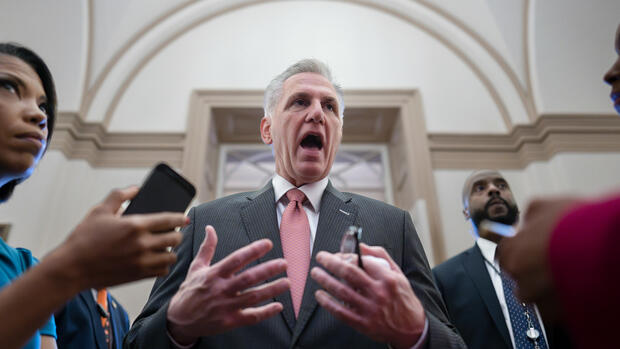

The leader of the House of Representatives addressed the press on Saturday.

(Photo: dpa)

Washington The leading Republican in the US Congress, Kevin McCarthy, sees good chances for an agreement in the debt dispute by the beginning of June. Negotiations with US President Joe Biden are making progress, McCarthy told the press on Saturday. There is no agreement yet. “We haven’t reached our goal yet.” However, an agreement is within reach than it has been for a long time.

Talks would continue. On Saturday evening (local time), insiders told CNN and the Reuters news agency that Biden and McCarthy were planning another phone call shortly. Biden said on Friday: “We’re close and I’m optimistic.”

Both sides are working toward a two-year deal that would limit federal spending and raise the debt ceiling. If the two sides do not reach an agreement before the debt ceiling of currently around $31 trillion is reached, the US is threatened with default, which could have serious consequences for the global economy.

This could happen as early as June. Treasury Secretary Janet Yellen wrote to Congress on Friday that the federal government could default by June 5 without an agreement on a higher debt ceiling. So far she had given June 1st as the earliest date for this.

The new date gives the two negotiating parties a short breathing space. It could also just prolong the argument. Yellen made it clear that the situation for the world’s largest economy was serious and that the treasury was almost empty.

The US President was recently hopeful about an end to the debt dispute: “It’s very close and I’m optimistic.”

(Photo: AP)

The debt ceiling is currently $31.4 trillion. This cap has already been reached for months, the USA can only stay afloat with financial policy tricks – called “extraordinary measures” in technical jargon. Yellen said that if the US waited until the last minute to raise the cap, the consequences could already be serious.

Fitch threatens demotion

As early as 2011, a Republican majority in the US Parliament had delayed raising the debt ceiling for so long that the US credit rating was downgraded for the only time in history. The rating agency Standard & Poor’s dropped the top rating “AAA” at the time and since then has only rated the USA with “AA+” – i.e. one rating lower.

The rating agency Fitch also threatened this week with a possible downgrading of the top credit rating. It is believed that the risk has increased that the debt ceiling will not be raised in time and that the US government will no longer meet its payment obligations, it said.

In the US, Parliament decides the maximum amount of money the state can borrow. This repeatedly leads to arguments about raising the upper limit if the governing party does not have a majority in both chambers of Congress.

Biden’s Democrats need the support of Republicans to reach an agreement.

(Photo: dpa)

The Republicans again emphasized on Friday that there was progress in the talks. But they also made it clear that there were always new points of contention that delayed an agreement. The Republicans, with their majority in the US House of Representatives, want to use the negotiations to cut spending on certain social programs.

They are also calling for recipients of certain benefits to be required to work. The Democrats are opposed to this, arguing that this would hit the weakest in society even harder.

Uncertainty in financial markets

The head of the International Monetary Fund, Kristalina Georgiewa, also sharply criticized the United States on Friday. The stability of the global financial system is at stake, she warned. It is “frustrating” that an agreement on raising the debt ceiling is being waited until the last minute.

In the financial markets, every day without a compromise brings more uncertainty. “As long as the agreement is not reached, the situation in the USA is like riding on a razor blade,” said Jürgen Molnar, capital markets strategist at RoboMarkets. On Friday, however, the hope of an early agreement apparently prevailed. The German leading index Dax flipped the switch at its daily low. In the further course of trading, it continued to rise with the strong US stock exchanges and closed 1.20 percent more firmly at 15,984 points.

More: ‘Time is running out’ – Yellen scrutinizes Congress over debt ceiling