Dusseldorf At the beginning of February, the world’s second-largest personnel consultancy, Heidrick & Struggles, made a strategic investment in Germany. The takeover of Atreus, the German market leader for so-called interim management, is not only the largest acquisition to date for the listed US group outside of the home market.

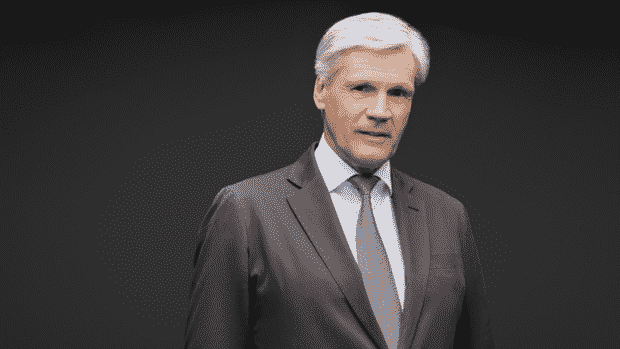

Heidrick & Struggles has also rearranged the order of the largest headhunters in the German market. As a result of the takeover, the US company has moved up to second place behind market leader Egon Zehnder in terms of its balance sheet for the current year. “With Atreus, we are massively expanding our range of services in Germany and Europe,” explains Nicolas von Rosty, partner and Germany head of the personnel consultancy, in an interview with the Handelsblatt.

In addition to the previous core business, the search and finding of top managers and management consulting (“headhunting”), they are now also involved in so-called on-demand talent management. The aim is to be able to fill top positions on a short-term and temporary basis. This is more important than ever, especially in a time of great change and volatility.

More and more projects with interim CEOs and CFOs

Atreus, based in Munich, has been managed by the founders Rainer Nagel (58) and Harald Linné (60) for 20 years. The company has a database that, according to its own information, lists around 15,000 experienced managers who work in companies for periods of between six and 18 months. If required, Atreus employs these managers temporarily in a subsidiary specializing in temporary employment and hires them out to companies.

Around 200 projects are currently running at Atreus, for which more than 45 managers are temporarily employed at Atreus Interim Management GmbH. These include an interim CEO of a medium-sized company specializing in food products with sales of EUR 150 million, an interim CFO for an automotive supplier with sales of more than one billion and an HR manager for a company driven by financial investors.

The placement of managers by Atreus has been in increasing demand in recent years. The company now has 80 employees, including 27 directors who are responsible for the projects. According to Atreus, in 2021 it had a turnover of 52 million euros.

According to the company, sales increased again by around 30 percent last year. The business is “highly profitable”, according to Atreus co-founder and managing director Harald Linné. Heidrick & Struggles appeared to be “the ideal partner” for further, primarily international, expansion.

Heidrick & Struggles, Korn Ferry, Russell Reynolds, Kienbaum are fighting for places

In the future, the current 21 advisors from Heidrick & Struggles and the 27 directors from Atreus will work together. They are to provide companies with comprehensive support in filling management positions: the Atreus directors are to cover the need for interim solutions, while the Heidrick consultants are looking for long-term candidates for the management position at the same time.

The reorganization is not enough to attack Egon Zehnder’s position as market leader. The Zurich-based company already generated sales of around 110 million euros in Germany in 2021. And in 2022 it should have been between ten and 20 percent more. But on the following places it is getting increasingly tight.

>> Read also: Ten questions from headhunters – and the best answers

Four competitors are now fighting for places two to five: With the consolidated turnover of Atreus with around 72 million euros in 2021 and currently 48 consultants, Heidrick & Struggles has the best prerequisites to become the new number two. This is followed by Korn Ferry with a turnover of 70 million euros (2022) and 39 consultants and Russell Reynolds with 40 consultants.

Kienbaum is also back in attack mode. After several years of transformation, the German personnel and management consultancy has been growing again since 2021 and has now been able to hire new top people from the competition. And Spencer Stuart is also keeping up. The new head of Germany, Lars Gollenia, has hired a new McKinsey consultant in Anna Hocker. Another new addition is the number of Spencer Stuart consultants as of March 1st. increase to 24.

With Atreus, Heidrick & Struggles not only gains quantitative influence, but also positions itself strategically in a growth segment. Because: Interim management is now also in high demand at the top level of management bodies. More and more companies need short-term support.

Long periods of notice in Germany require transitional solutions

The industry association DDIM expects an increase of ten percent to a fee volume of 2.75 billion euros for 2023. “We are seeing more assignments from interim managers as well as increased daily rates,” says association leader Marei Strack. In addition to Atreus as the larger intermediaries, the drivers of the business are EIM and Taskforce as well as personnel service providers such as Hays, Michael Page and Robert Half. There are also a few boutiques and interim managers who market themselves.

On the one hand, the increased demand for interim managers is due to ongoing transformation processes and increasing restructuring cases in the German economy, where experienced and independent managers are in demand.

>> Read also: How do you become a headhunter? Professionals explain how to start a career and give career tips

On the other hand, it is structurally justified: The notice periods in Germany were and are long in international comparison, and non-competition clauses are increasingly being pronounced when changing jobs. As a result, it takes up to a year and a half before a new board can start. And this time has to be bridged.

The most recent acquisition by Roland Berger shows how relevant the use of these interim solutions has become. On February 1, the largest German management consultancy acquired Candidus, a consultancy specializing in interim management, and thus repositioned itself in the restructuring business.

Clear commitment to the German market

According to Sascha Haghani, Roland Berger’s Managing Director for Germany, Austria and Switzerland, “in the future, our consultants should take on more entrepreneurial responsibility in special and crisis situations” and thus “take on board positions”.

With Atreus, Heidrick & Struggles has secured a significantly larger competitor. The Group has the necessary financial resources for this. The listed company, headquartered in Chicago, has recently grown strongly: by 61 percent from $621 million in 2020 to $1.003 billion in fiscal year 2021. The Ebitda margin was 14 percent.

The group’s growth and profitability also drove an equally small but strategic takeover: that of BTG in the USA, a consultancy specializing in interim management. According to the annual report, the company already contributed 67 million dollars to the increase in sales in 2021 – the takeover was only completed in April 2021.

With Atreus and BTG, Heidrick now has two pillars in the interim management. For Rosty’s Germany boss, the takeover of Atreus is “a clear commitment from Heidrick & Struggles to the German market”. Germany is now the second largest location of the group after the USA.

More: Headhunter competition