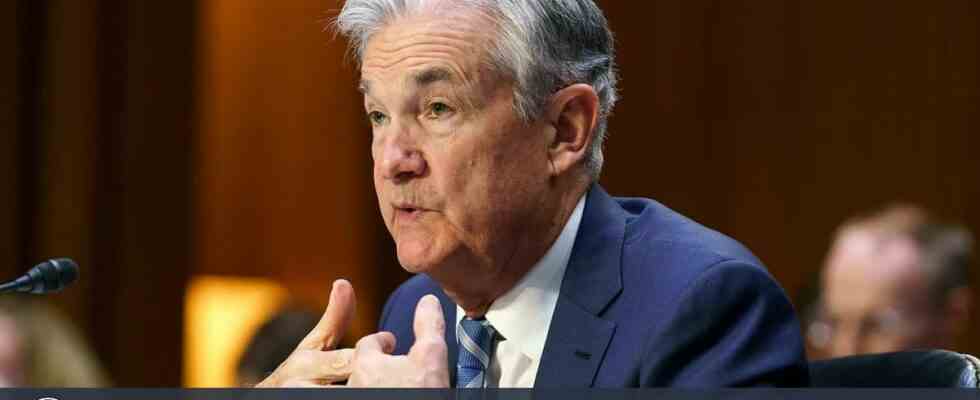

After the Fed’s 25 basis point interest rate hike, as expected, the eyes are now on Fed Chairman Jerome Powell.

Here are excerpts from Fed Chairman Jerome Powell’s speech:

- We are determined to reduce inflation to the 2 percent target.

- The effects of rapid tightening have not yet been felt.

- We find more rate hikes appropriate. We still have a lot of work to do.

- We need more evidence to be sure that inflation is on the downside.

- Monetary policy will have to remain restrictive for a while.

- Although inflation has slowed recently, it remains high.

- We will continue to evaluate the rate hike decisions by looking at the data from meeting to meeting.

With the speech of the Fed chairman of bitcoin Here’s his reaction:

FED Gave Many Hints In Its Announcement Announced Its Decision To Increase Interest Rates

The FED also gave many messages in its statement announcing its interest rate decision.

The Fed repeated that ‘continuing’ rate hikes would be appropriate. The Fed says inflation has decreased somewhat, but remains high. They still say that “continuing increases” in interest rates are appropriate.

The first comment seems a bit hawkish as “increases” is referred to as plural. There is not much change in their view of the economy. They emphasize that the work on inflation is not over yet:

“Inflation has eased a bit but remains high.”

Meanwhile, there is no change in their guidance on quantitative tightening:

“The committee will continue to reduce treasury and corporate debt and corporate mortgage-backed securities holdings, as outlined in its previously announced plans.”

Most of the other changes to the description are pretty neutral and just seem to reflect current reality. Between now and the next policy meeting, the Fed will have two monthly employment reports to consider.

The language of the Fed statement also sets the tone for Powell’s upcoming statements.

Ben Jeffery, BMO Capital Markets analyst, said:

“The key takeaway from the FOMC statement was that, alongside the widely anticipated 25bp rate hike, the Fed chose to continue using the word ‘ongoing’ in official language, indicating that there are more tightening moves to be made this cycle.”

*Not investment advice.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!