Based on 6 different on-chain data, popular analyst Game of Trades suggested that the Bitcoin (BTC) price is in a unique position to invest long-term.

A social media recently shared by Game of Trades in your post, 6 different important metrics were analyzed. The Bitcoin price of these metrics in a historic location for purchase Stating that this is the case, the analyst said that these data were also available in the last three bear market. point shot works reminded. The analyst says these six metrics based on on-chain data are exceptional in Bitcoin. risk-reward while emphasizing the level of in 2015, 2018 and 2020 pointed to the market cycle.

Accumulation trend score

The first metric presented by the analyst is one that highlights areas of heavy accumulation in terms of asset size and number of coins purchased. accumulation trend got score. This metric is added/sold It shows a combination of the size of the assets relative to the number of new cryptocurrencies.

Values close to 1 in the chart, i.e. darker colors occur represent the accumulation is doing. The analyst pointing to the point we are in on the chart, After the collapse of FTX, investors became strongly hoarding. stressed.

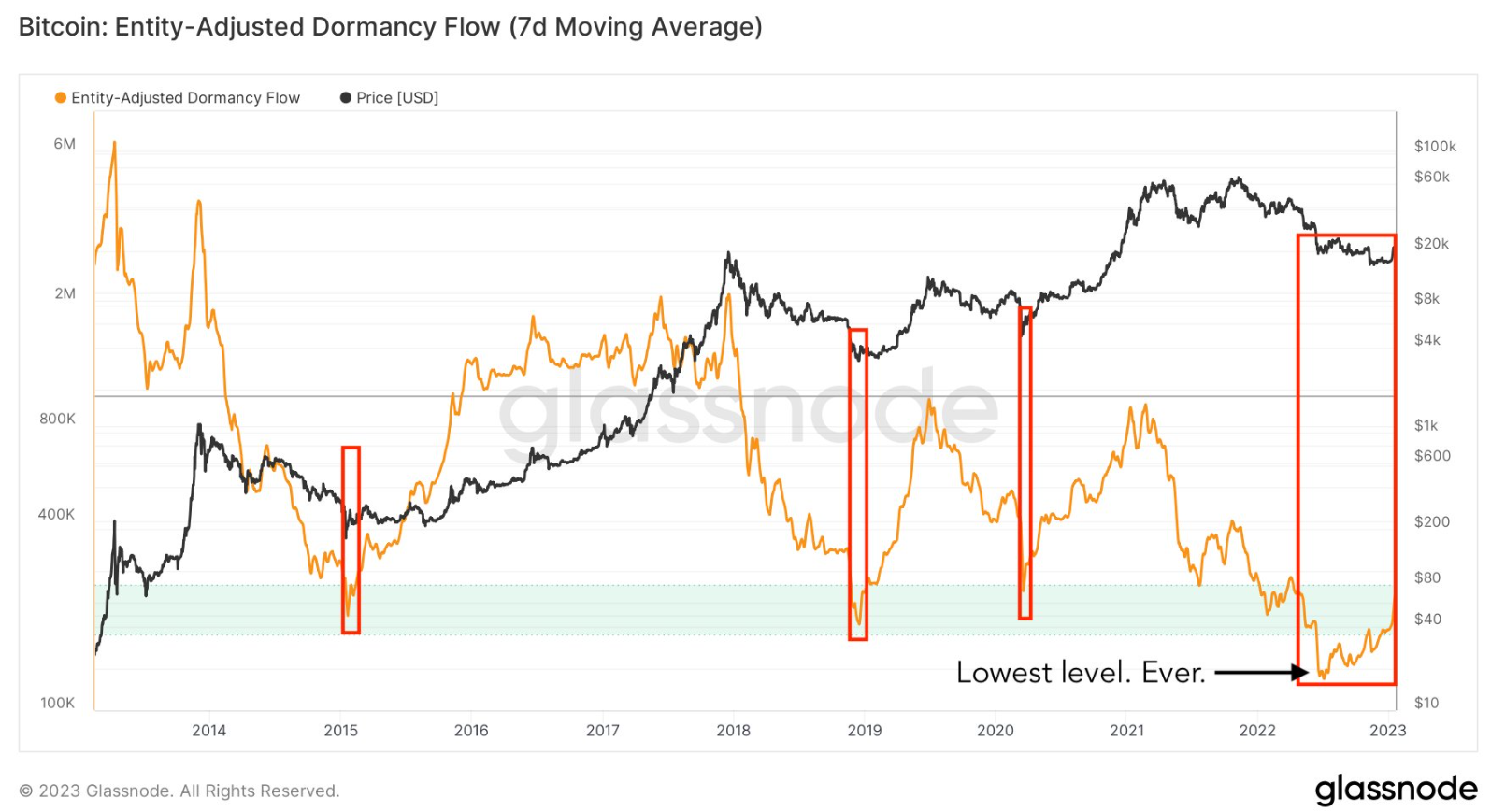

Entity-adjusted dormancy flow

The second buying opportunity signal put forward by the analyst is the ratio of the current market capitalization to the annual idle value. “asset-adjusted dormancy flow”. The lower the value presented in this data, the longer the cryptocurrencies will be held by investors. a similar situation past two months was confirmed throughout.

of dormancy flow lowest level ever seen The analyst, who specifically pointed out that the market was down, said that speculative players were withdrawn from the scene and only long-term investors remained in the market.

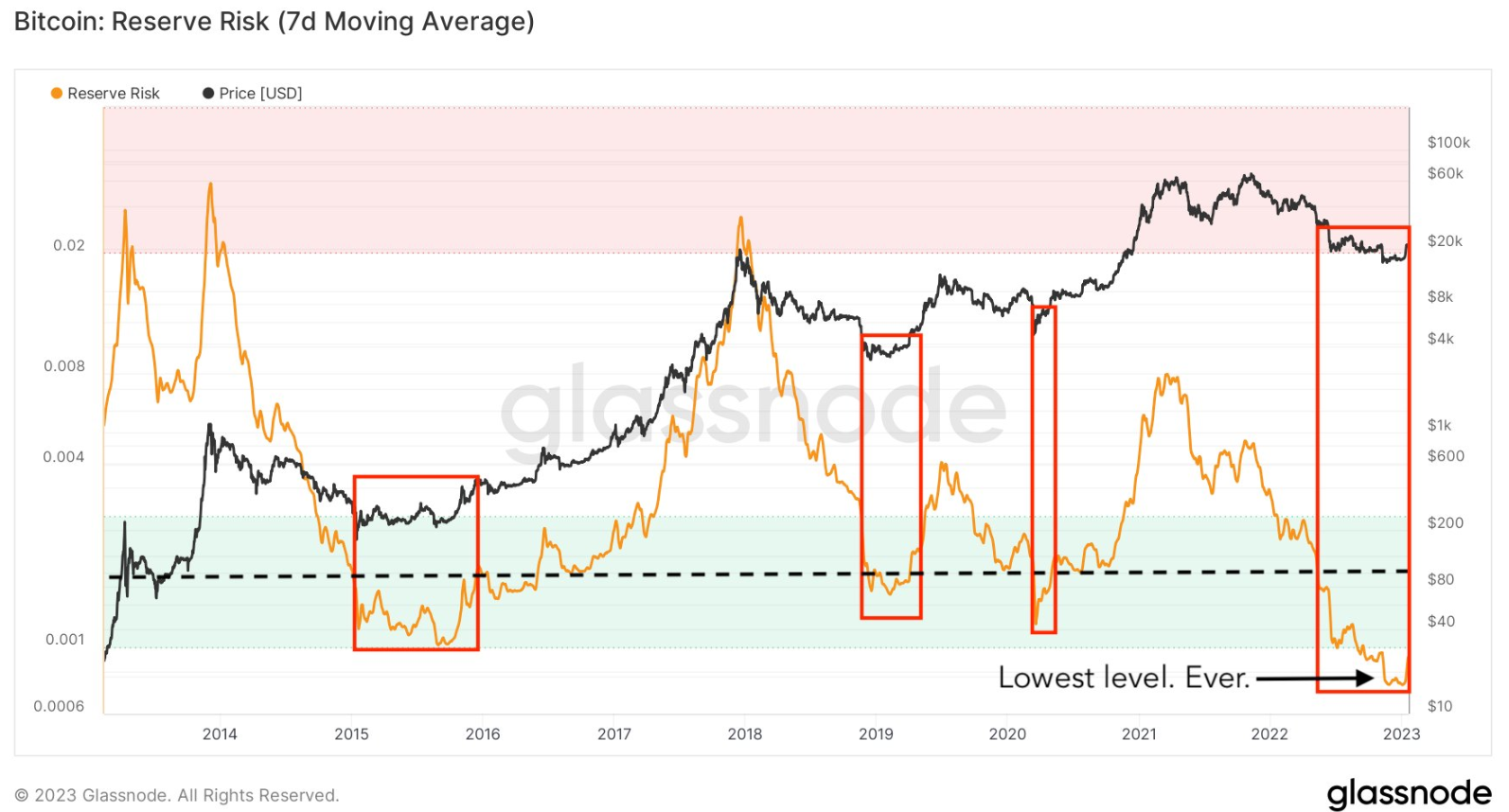

Bitcoin reserve risk

The analyst also noted that the Bitcoin reserve risk parameter, which is used to assess the confidence of long-term holders relative to the Bitcoin price, giving more positive signals than ever suggested. Reminding that the low values on this parity indicate high confidence and cheap prices, the analyst said that the reserve risk in the history of Bitcoin. at levels never seen before proved to be positioned. According to Glassnode data, the position of the metric is above all time in 2022. to its lowest level (ATL) declined.

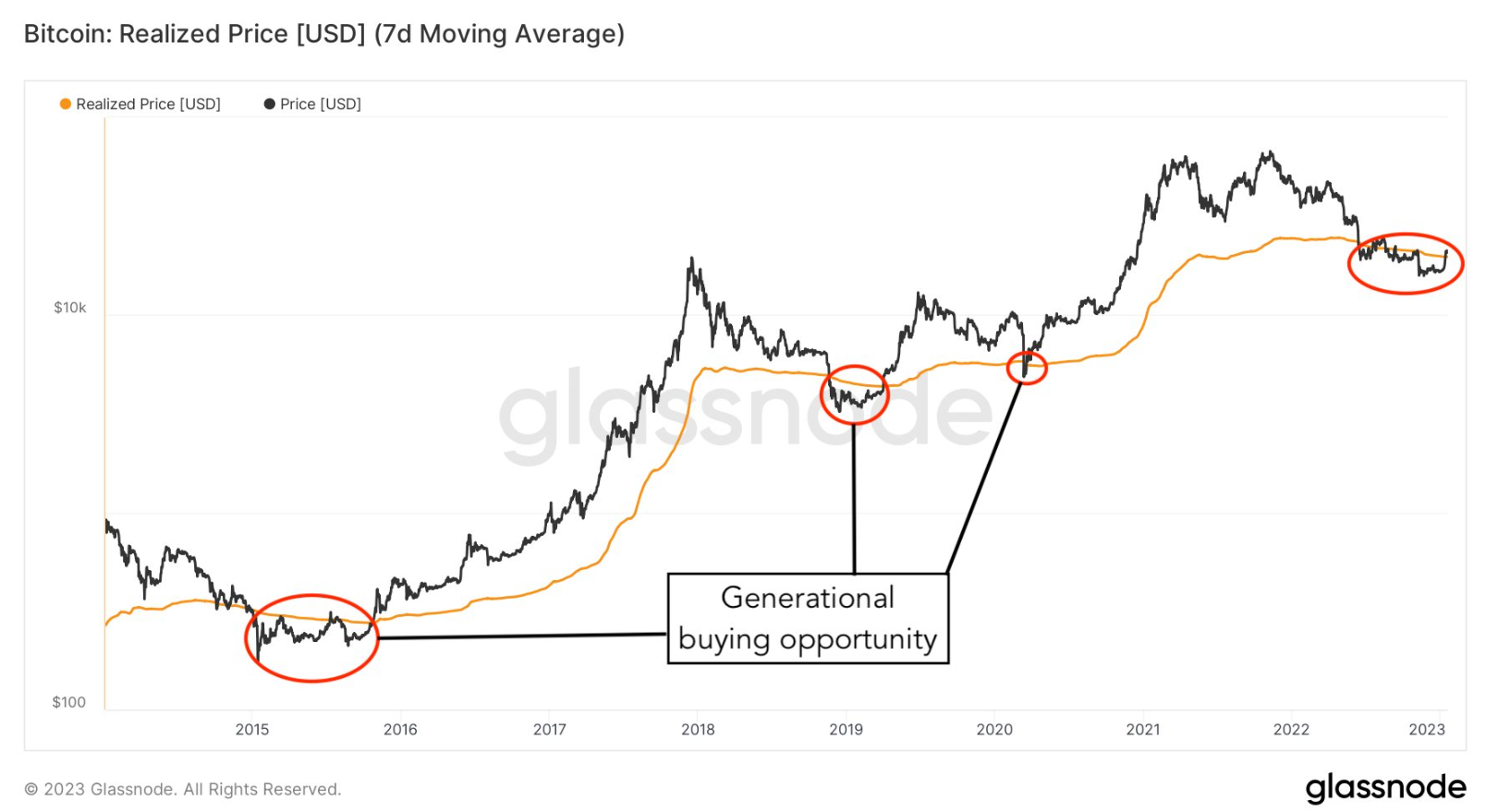

Realized Bitcoin price

Focusing on the realized Bitcoin price, which shows the average cost at which all Bitcoins were purchased in the next step, the analyst said every time the price falls below this indicator. bottom level seen stated. Looking at this metric, Bitcoin’s FTXPointing out that .

Bitcoin MVRV Z-score

of bitcoin “fair value” or when it is significantly overvalued or undervalued relative to its actual price MVRV Z-score It represents another of the key buy signals, according to the analyst. Compared to historical data when is this metric if it leaves the specified green zone, after that point downtrend ends and with it a bull season starting.

Underlining that the MVRV Z-score is currently trying to get out of the green zone once again, the analyst still says something that happened last August. “fake” could not help but warn against the risk of recycling.

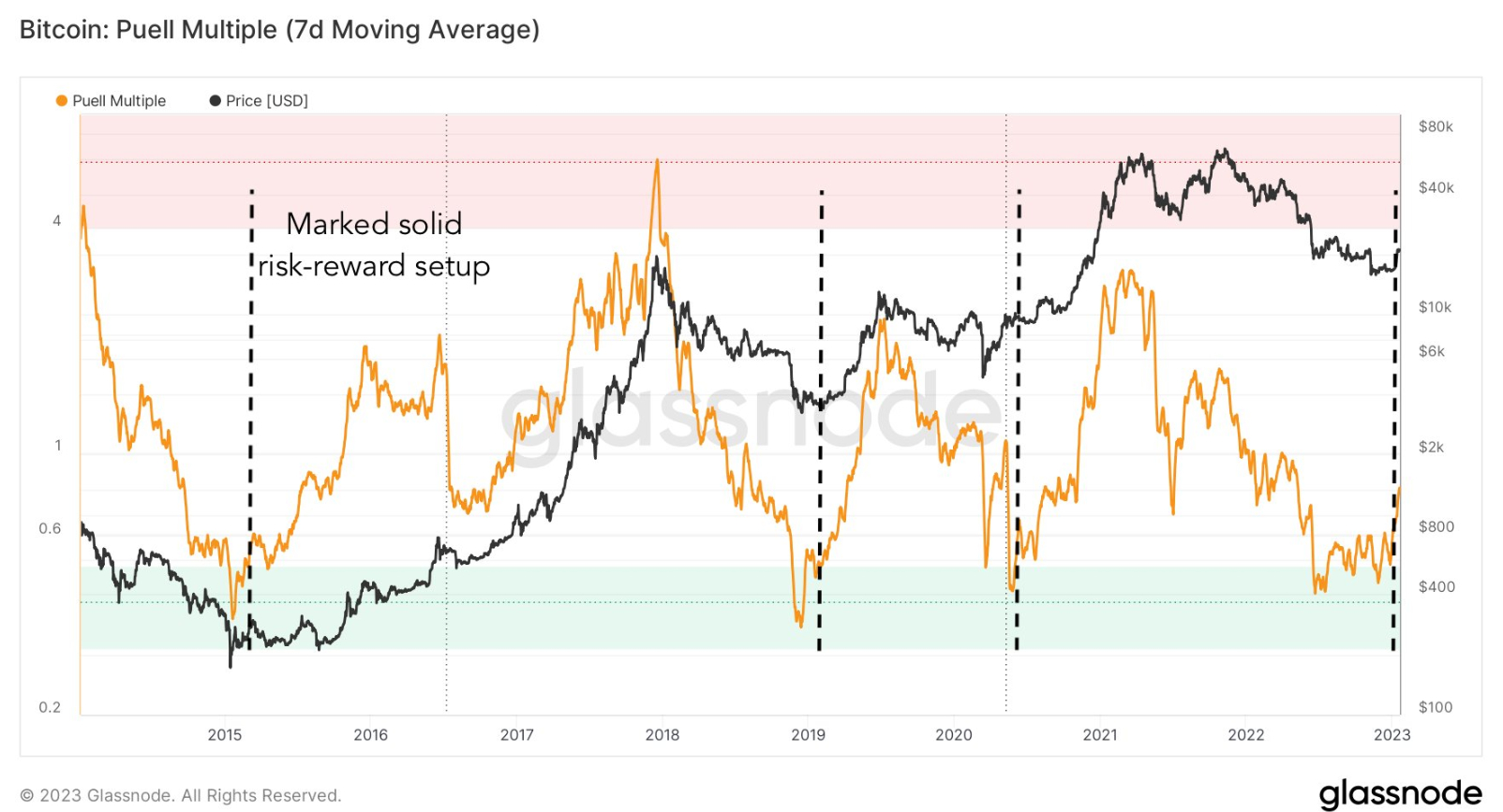

Bitcoin miners profit status

The lower the value, the more miner stress there is. in another sense extremely unhealthy and high leverage According to the analyst, this data, which shows that the miners who turn the industry into a casino with their rates, are about to be deleted from the market, means another buy signal.

Low values, as at the moment, indicate that miners are under stress and represent long-term buying opportunities.

Sharing the data table, the analyst “from the most stressful area” He stated that the miners, who probably damaged the sector, either went bankrupt at this point or were mostly elephants. Stating that with this latest data, the market has reached the maximum pain value, completed the search for liquidity and is at the beginning of the return path, the analyst said that Bitcoin has “buying opportunity for a generation” defined as.