According to blockchain analytics platform Glassnode, data from specific Bitcoin investors suggests that Bitcoin (BTC) may be ready for a bullish market cycle.

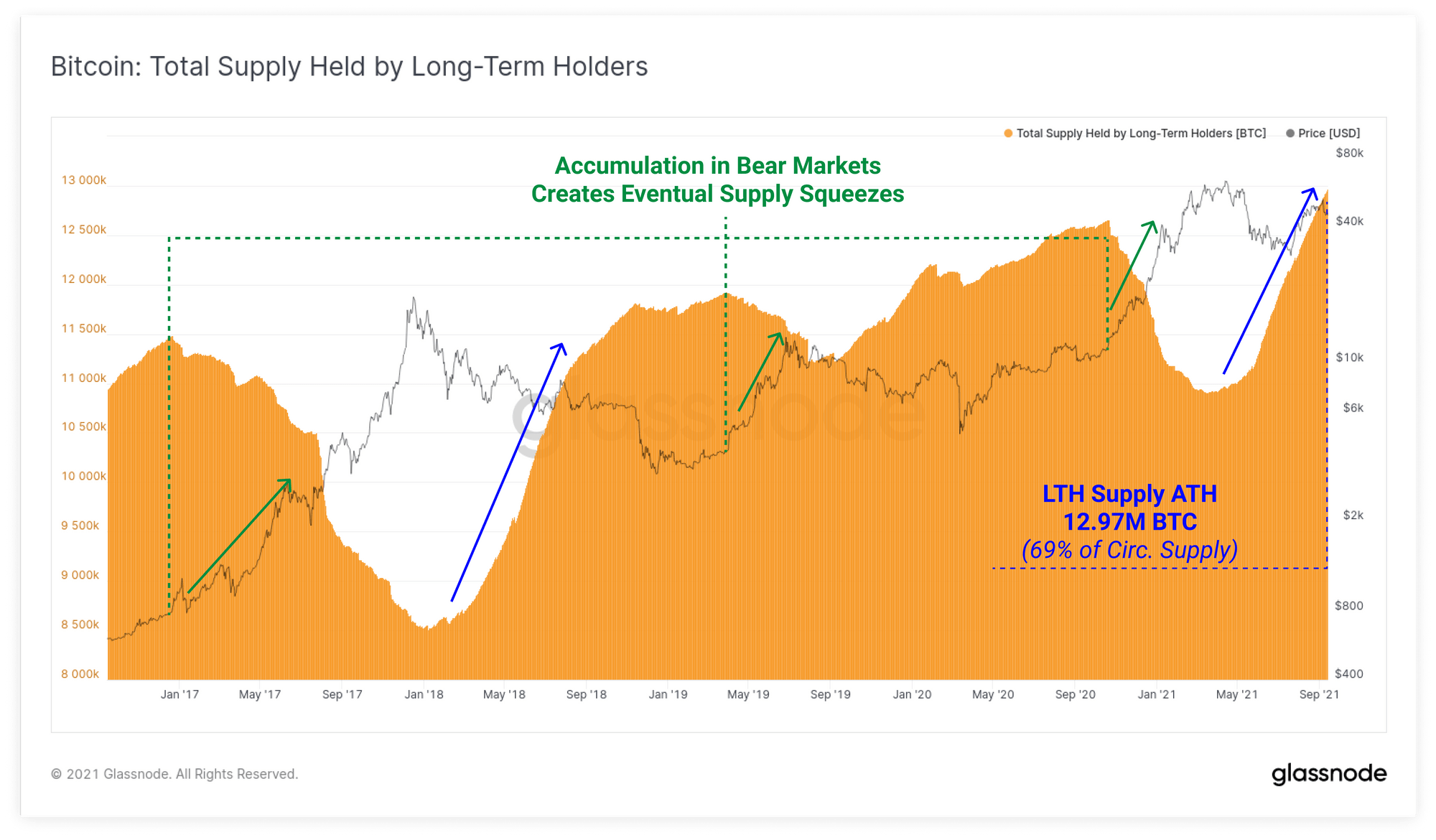

Glassnode states that long-term Bitcoin holders (LTHs) have accumulated 79.5% of all BTC, which is equivalent to the rate achieved last October before the bull market started. The analytics firm published the data in its weekly report titled “The Week On-chain.” On average, LTHs have held Bitcoin for more than 155 days. As the firm explains,

“LTH’s supply has reached 79.5 percent of all BTC coins this week, which is equivalent to the level reached in October before the bull market started. In fact, by volume, LTHs currently hold the most coins in history, reaching 12.97 million BTC this week.

The peak in LTH supply is usually; It marks the end of supply tightness and bear markets that start cyclical bull runs.”

Short-term investors (STH), on the other hand, had a larger share in the market before, but even the rally to $50,000 could not shake LTH’s determination.

Bitcoin is trading at $48,018.96 at the time of writing and has increased by over 4% in the last seven days after the volatile price action it experienced last week.

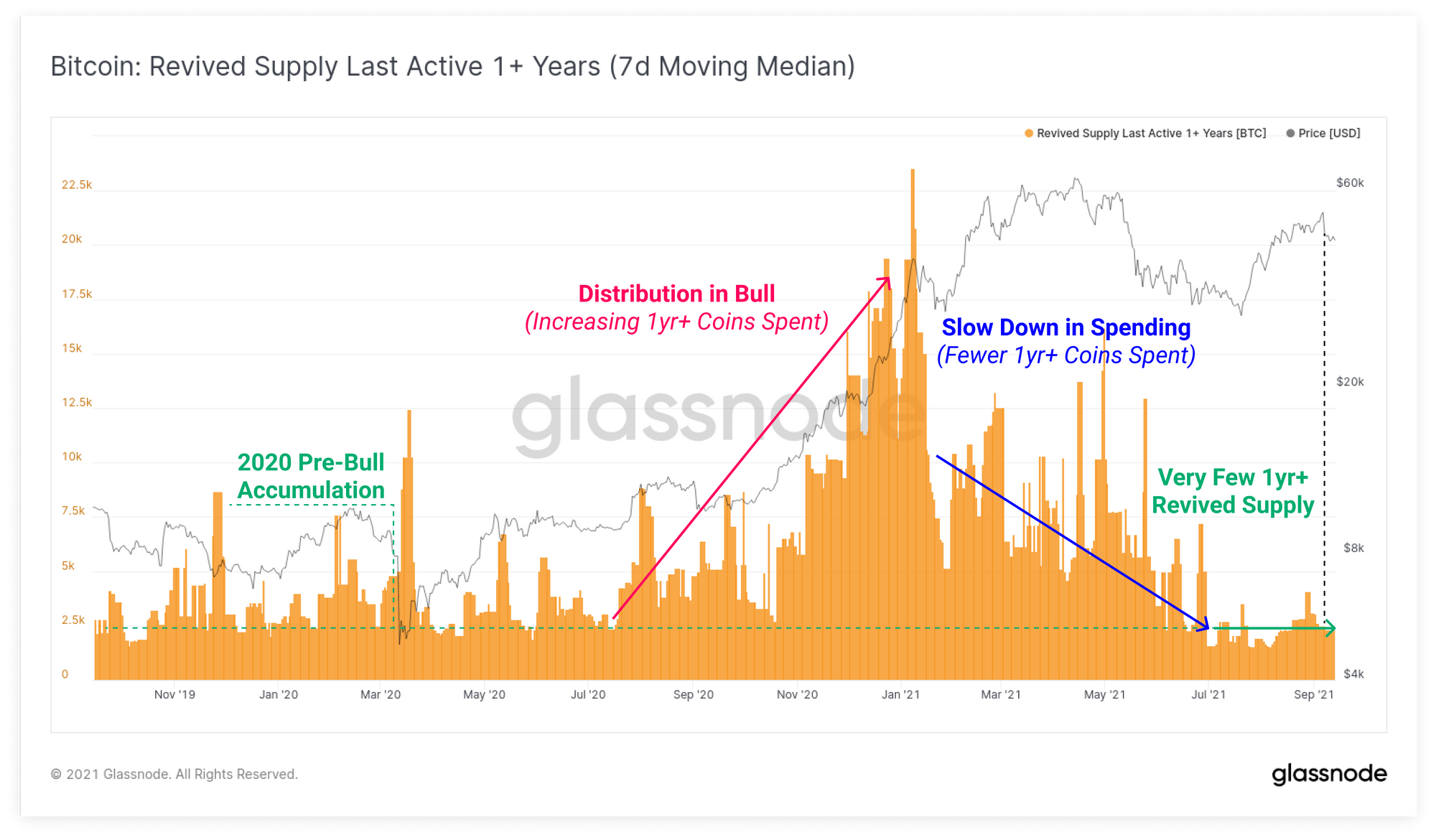

In addition, Glassnode measures the “age” of a Bitcoin by noting when it was last processed. This week, the firm observes that the amount of BTC, which is more than a year old, has reached “pretty low levels” compared to the period before the 2020 bull run.

“On a 7-day moving median basis, less than 2.5K BTC over 1 year old is spent per day.

This shows that as prices reached $42,000 for the first time, 9x less old money was spent compared to the 2021 bull market peak in January 2021, when 22.5k BTC was spent.”

In other words, we can say that the strong belief in Bitcoin this year contrasts with previous periods and the upward trend shows no signs of stopping.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.