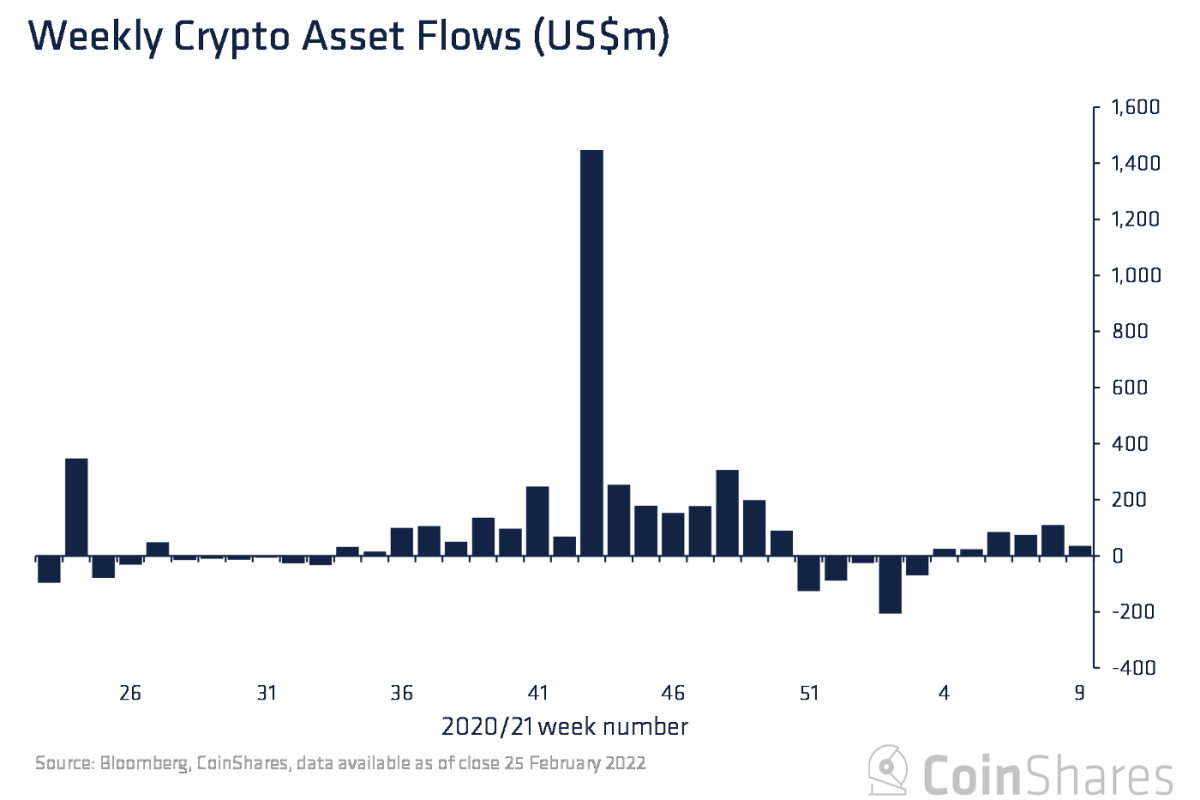

Digital asset manager CoinShares reported that institutional investment in crypto assets reached $36 million last week, following the Russian invasion of Ukraine shaking up global markets.

Institutional inflows from the United States offset the outflows experienced in Europe last week, according to Coinshares’ latest Digital Asset Fund Flows Weekly report.

“Despite the ongoing turmoil and anticipated negative sentiment in Eastern Europe, digital asset investment products saw a total inflow of US$36 million last week. Interestingly, volumes on Bitcoin crypto exchanges trading the RUB/USD pair increased by 121% on a weekly basis.

Regionally, funds flows were one-sided; In the Americas (especially Canada and Brazil), a total of 95 million USD was seen, while a total of 59 million USD outflow was seen in European investment products last week.”

According to CoinShares, this marks the sixth week of fund inflows for investments in digital asset products.

As usual, the leading cryptocurrency by market cap Bitcoin (BTC), received the lion’s share of entries. After BTC, the most invested cryptocurrency is the second largest cryptocurrency by market value. Ethereum (ETH) it happened.

“Bitcoin saw a total of US$17 million in fund inflows last week and entered its 5th consecutive week in fund flows, with total inflows of $239 million. Ethereum has seen relatively smaller inflows totaling $4.2 million.”

Breaking recent fund inflow trends Left (LEFT) and Litecoin (LTC), This week, along with the majority of the altcoin market, it has experienced exits. According to CoinShares, the emerging smart contract platform Tezos (XTZ)became the only market-challenging digital investment product among emerging altcoins.

“Extraordinarily, most altcoins have had minor outages over the past week. Solana and Litecoin were the main focus of negative investor sentiment, with exits of $2.6 million and $0.5 million respectively.

Tezos was the only altcoin investment product to see inflows, with a total fund inflow of $4.4 million…”

You can read the full CoinShares report here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.