Zilliqa (ZIL) The price has shown an impressive performance in the last two weeks, registering an exponential rise. Despite this rise, Zilliqa turns 180 degrees and looks pretty close to a collapse. This exponential rise seems to be reversing as investors are making profits and increasing correlation with Bitcoin.

This correction is currently testing a crucial support level and breaking this level could trigger a major collapse.

Zilliqa Price at a Critical Threshold

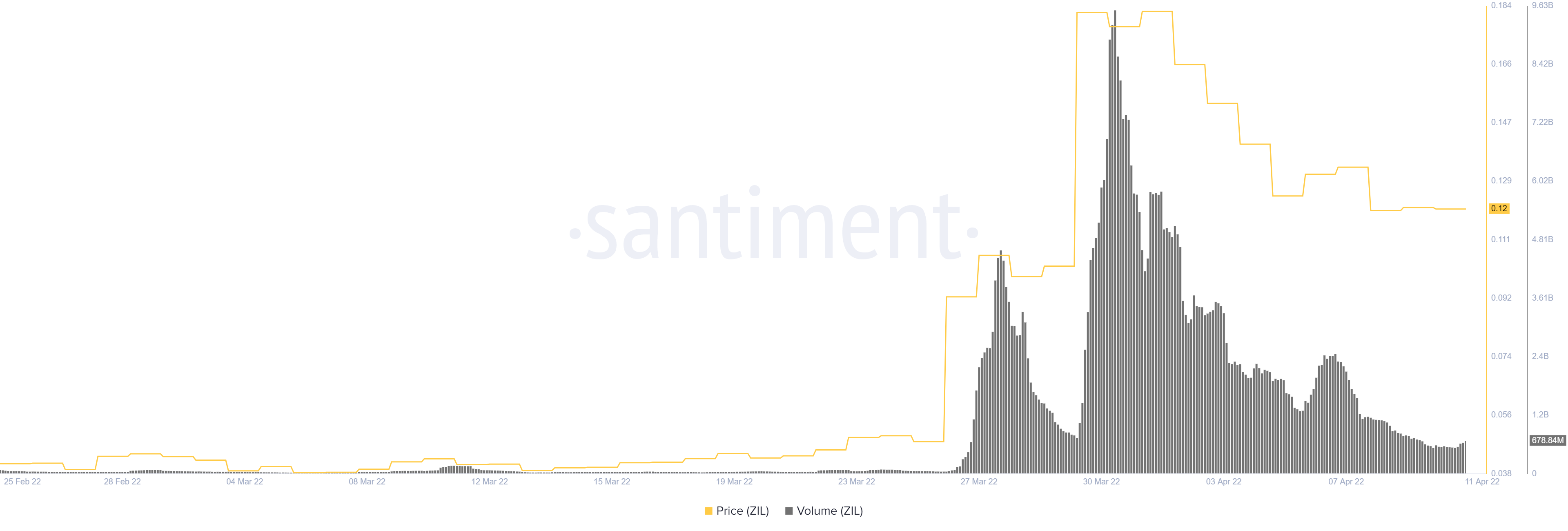

Zilliqa price jumped from $0.038 to $0.230 from March 15 to April 1, showing a massive 503% increase. The uptrend formed a swing high at $0.230 and has been declining ever since. ZIL got to where it is now, depreciating roughly 48%.

Fortunately for buyers, the demand zone between $0.097 and $0.122, i.e. the support area, seems to be providing buying pressure. As the chart shows, retests of this resistance have recorded an increase. However, the increasing selling pressure in Bitcoin may be floating towards the Zilliqa price, causing it to crash as well.

Zilliqa priceIf it breaks below the $0.097 support level, it will invalidate the bullish argument and trigger a collapse towards $0.051. The existence of a fair value gap (FVG) stretching from $0.097 to $0.051 makes this decline more attractive.

An FVG represents a price inefficiency resulting from rapid movements in both directions. Markets often reverse, causing these gaps to be filled. Therefore, market participants need to be prepared for a 50% drop to $0.051.

ZIL priceSupporting this decline in the on-chain volume was the decrease from 17.6 billion to 10.42 billion in the last three days. This sudden collapse shows that investors are booking profits and leaving the ecosystem, which is in line with the technically detailed scenario.

Therefore, traders are advised to be cautious, at least until the Bitcoin price stabilizes and forms a directional bias.

While the bearish view is contingent on a breakout of the $0.122-$0.097 demand zone, a bounce from the same zone could likely trigger a rally. Also, a recovery in Bitcoin could limit the downside regardless of price inefficiency. Therefore, failing to break below the mentioned barrier would allow buyers to rally and trigger another rise towards $0.151.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.