Stuttgart, Munich With world market leader STMicroelectronics (ST), ZF has secured a second supplier for silicon carbide chips. According to the company, the multi-year contract provides for ST to supply tens of millions of silicon carbide modules. From 2025, ZF wants to mass produce a new inverter, an important component for battery storage.

The first customer should be a European manufacturer in 2025. The so-called inverters are considered the brains of the electric drive. They control the flow of energy from the battery to the electric motor and vice versa.

“Our order book in electromobility up to 2030 now amounts to more than 30 billion euros,” says Stephan von Schuckmann, ZF board member responsible for electromobility and materials management. “For this volume we need several reliable suppliers for silicon carbide chips.” It was only at the beginning of February that ZF entered into a close partnership with Wolfspeed, which also includes a minority stake in the construction of the new chip factory in Saarland.

The Franco-Italian company STMicroelectronics is the largest European chip manufacturer and has recently grown rapidly. Last year sales increased by a quarter to almost 15 billion euros. The profit has almost doubled to around 3.7 billion euros.

“The key to success in electric mobility is greater scalability and modularity with higher efficiency and performance as well as better affordability,” says Marco Monti, ST board member responsible for the automotive division.

The combination of silicon (Si) and carbon (C) is energy efficient and takes up little space. On average, the components are ten times smaller than conventional silicon chips and lose up to 50 percent less heat. SiC allows vehicle manufacturers to either use smaller batteries or offer a range that is a good 15 percent longer. However, SiC chips are also significantly more expensive.

ZF relies on chip specialists

ZF is the second largest German automotive supplier. With the second SiC partnership, the foundation company from Lake Constance is increasing the pressure on the industry leader Bosch considerably within a short period of time. Bosch is the only automotive supplier that manufactures silicon carbide chips entirely in-house in order to control the process and ultimately have the higher added value in-house. On the other hand, ZF relies on the experience of the chip specialists.

The business with components for electric cars is growing.

ST is the world’s largest supplier of silicon carbide chips. Industry observers from Yole put the French-Italian group’s market share for these semiconductors at 37 percent. The number two is the German competitor Infineon with 19 percent. The US group Wolfspeed has a market share of 16 percent.

>> Read also: Wolfspeed boss about partner ZF: “Cooperation is designed for decades”

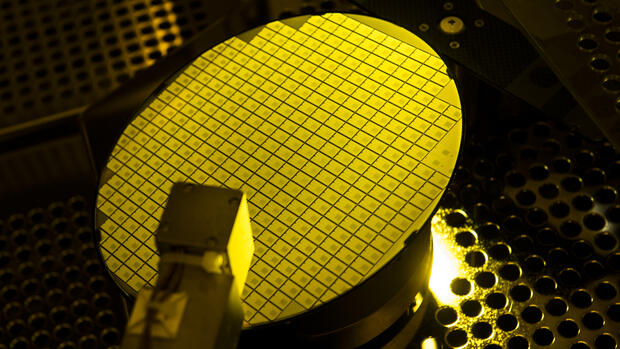

When it comes to the starting material, i.e. the silicon carbide discs on which the chips are made, Wolfspeed is the leader with a market share of 53 percent. According to Yole, ZF partner Wolfspeed is the only manufacturer that can currently produce SiC chips on disks with a diameter of 200 millimeters. However, STMicroelectronics will catch up in two or three years.

“Silicon carbide is very light and the hardest ceramic material with very good thermal conductivity and very good resistance,” states the electronics industry association ZVEI. In addition, silicon carbide enables a shorter charging time.

Silicon Carbide Chips: Market triples to $6 billion

Market researchers at Yole expect the five largest suppliers of SiC chips to triple their capacities by 2027. At the same time, the market will grow to six billion dollars, more than three times as much as in 2022. At the beginning of the next decade it should be ten billion. The new Wolfspeed factory in Saarland alone will cost between 2.5 and three billion euros.

Yole also assumes that the automotive industry will buy 70 to 80 percent of all SiC chips worldwide this year – and this is unlikely to change in the next ten years. The chips are also used in charging stations.

The world’s leading manufacturers of SiC chips are STMicroelectronics, Infineon, Wolfspeed, Onsemi and Rohm. All major car manufacturers have now concluded supply contracts with one or more SiC producers. Mercedes has secured Wolfspeed supplies and is working in parallel with Onsemi. The Opel parent company Stellantis buys from Infineon for its 14 brands. VW and Kia purchase SiC chips from Onsemi. And STMicroelectronics has been the chosen core supplier of electric car pioneer Tesla for years.

>> Read also: VW versus Tesla: The fight for affordable electromobility begins – with a problem

Disadvantage: Silicon carbide triples chip costs

However, SiC has one disadvantage: “With silicon carbide, the chip costs of the power semiconductors triple compared to classic silicon technology,” says Peter Fintl, semiconductor expert at the consulting firm Capgemini. “In the foreseeable future, semiconductors made from silicon carbide will always be more expensive than those made from silicon,” says Fintl. “The production is simply too complex for that.”

However, the chip companies will change their production in the coming years. So far they have been producing on discs with a diameter of 150 millimeters, in a few years 200 millimeters will be the standard. Fintl estimates that the costs per component should fall by around half. “This makes SiC technology affordable for more applications.” In the next few years, however, the use of SiC is likely to be largely limited to sedans and SUVs in the premium and luxury classes.

ST is currently heavily expanding its SiC capacities in Catania, Italy, and in Singapore. ZF will also be supplied from there. Munich-based rival Infineon started building a two-billion-euro SiC plant in Malaysia last year.

More: Why Tesla is suddenly shying away from silicon carbide