Wow, what happened to Satoshi? We are in the thirty-ninth article of our series. The crypto money market, which opened this week above $ 3 trillion, fell below this level after the recent decline.

While Bitcoin is trading at just over $64,000 at the time of writing, this week’s post will talk about the Fed’s survey, Coinbase’s annual report, Discord, the US sanction, Huobi, and the operation in China.

Fed’s survey of representatives from the private sector

of the Federal Reserve Released on 8 November The Financial Stability Report included information on the surveys conducted with the participation of representatives from the private sector.

Fed, According to the report prepared by the Financial Markets Working Group total value referring to 130 billion dollars some of the stablecoin market “structural weaknesses” that these “may pose a risk in terms of payment and financial systems” stressed. In the report,

“Certain stablecoins, including the largest, are promised to be exchanged at any time for US dollars at a stable value, but this is not the case. [stablecoinler] it is actually backed by assets that could lose value or become illiquid.” expression was used.

One of the surveys in the Fed’s Financial Stability Report was held in the spring and the other in the fall, and these surveys were conducted with representatives from the private sector. Factors that pose a risk to financial stability asked.

In the survey conducted in the spring term; representatives from the private sector in terms of financial stability. the ninth thing he worries about the most cryptocurrencies/stablecoins. When it comes to the fall period, the demand for cryptocurrencies and stablecoins in terms of financial stability fifth biggest concern became and climatic concerns observed.

Top concerns for participants in the fall semester, respectively vaccine-resistant Covid-19 variants, sharp rise in real interest rates, rise in inflation and US-China tension it happened.

Coinbase’s third quarter overview

US-based cryptocurrency company Coinbase released its third-quarter annual report in the middle of this week. explained.

The company compared to the previous quarter in terms of transaction volume, revenue and monthly active users. a lower performance exhibited.

Trading volume of the iExchange quarter to quarter From $462 billion to $327 billion, number of users transacting per month 8.8 million to 7.4 million, total revenue From $2.27 billion to $1.31 billion fell.

The company’s trading volume $234 billion part corporate; $93 billion while individual investors constitute the part of the bitcoin in total transaction volume. 19%, if ether 22% shareholder it happened.

Institutional investors in the stock market in the previous quarter $317 billion volume was created. Coinbase reported this quarter-on-quarter decline in the market. “low volatility” tying.

Total value of assets held on Coinbase’s platform as of September 30 $255 billion declared as. $139 billion of this is corporate; $116 billion belongs to individual investors.

This 255 billion dollar cake Bitcoin 42%, Ethereum 22%, other cryptocurrencies 33%, and fiat coins 3% forming.

performance decline in the third quarter. Explaining with the conditions in the cryptocurrency market company, Both the number of monthly users and the total transaction volume increased in the fourth quarter. waiting.

Ethereum message from Discord CEO

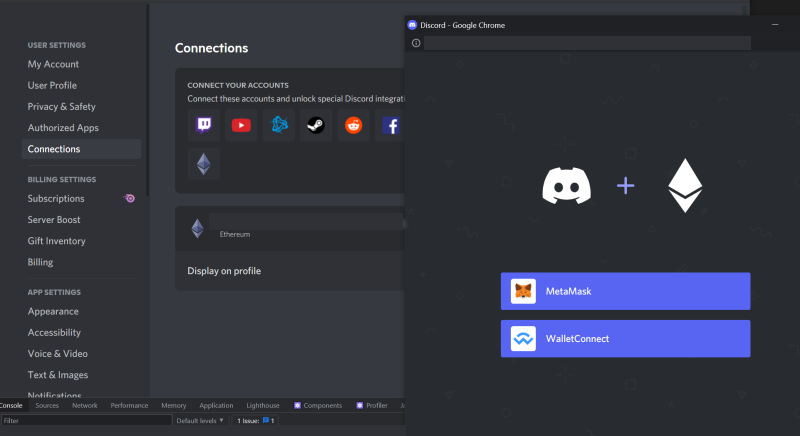

by Jason Citron, founder and CEO of Discord, on Tuesday a shared tweetIt was interpreted that the company may have a project for cryptocurrencies. However, Citron has announced that they have no such plans.

Citron responded to a tweet by Packy McCormick, founder of Not Boring Capital, A screenshot of Discord connecting to the Ethereum network shared.

Discord’s integration with the Ethereum blockchain means that the app 150 million monthly active users It can provide access to the blockchain ecosystem via Discord.

But the company has no plans to take a step in this direction, at least for the time being. Discord’s CEO made another statement on Thursday. used the following terms:

“We have no plans to implement this in-house concept for now. For now, we are focused on protecting our users from spam, scams and scams. Web3 has a lot of good aspects, but also a lot of downsides on our part that we need to focus on.”

Discord CEO, from Ethereum integration why Although he did not make a statement about giving up, some posts on social media show that To Discord’s plans that it may have been lost from the great backlash pointing out.

Many Discord users non-fungible token (NFT) if included in the ecosystem will cancel their membership. threatened him. Discord community, Due to the environmental effects of the Ethereum blockchain It is presumed that he had such a reaction.

Founded in 2015, Discord has received more than $980 million in funding since its founding, $500 million of which was in September. The company is assumed to have a valuation of $15 billion.

Another US stock market sanctioned

US Department of the Treasury; He launched a cryptocurrency exchange called Chatex into SDN because he suspects hackers are processing ransom payments. added to the sanctions list.

Office of Foreign Assets Control (OFAC) within the Ministry; It added IZIBITS OU, Chatextech SIA and Hightrade Finance Ltd to its sanctions list on the grounds that it provided infrastructure support to Chatex.

Chatex works with Suex in cryptocurrency transactions and directly linked was stated. Suex, a Russia-based over-the-counter (OTC) trading platform, was sanctioned on September 21 and The first crypto exchange to be sanctioned by the USA had happened.

Both Chatex and Suex; It was founded by a person named Egor Petukhovsky. Petukhovsky announced in a past statement that he was leaving Chatex.

The Treasury Department also in a different statement 30 different Bitcoin addresses associated with Chatex and two more persons, one Yaroslav Vasinskyi and the other Yevgeniy Igorevich Polyanin. sanctions list added that.

During the arrest of Vasinskyi, who was arrested in Poland, $6.1 million worth of bitcoin was seized. Authorities await Vasinskyi’s extradition to the United States.

Crypto exchange Huobi goes to address change

Huobi, one of the largest cryptocurrency exchanges in terms of trading volume, announced earlier this week that it was released from the financial authority of Gibraltar. received an operating license. announced.

Huobi, which was established in China but changed its headquarters due to regulations, operates as registered in Seychelles today.

Huobi acquired the distributed ledger technology license after stepping into Gibraltar in 2017. Huobi, which can only use this license to provide enterprise-grade brokerage and over-the-counter (OTC) transaction services, is licensed by the Gibraltar Financial Services Commission. required for spot trading also got the license.

The company, which started to transfer some of the infrastructure it uses to Gibraltar, will be able to move its spot operations completely to Gibraltar thanks to this license.

Affected by the bans imposed by the Chinese government on cryptocurrency transactions, Huobi is over the top of Gibraltar. serving at a global level it will be.

Du Jun, one of the founders of Huobi, told the Financial Times that the total revenue of the stock market 30% originates from China said that. The company will remove all user accounts registered in China by the end of this year. to have closed is planning.

Thanks to the license it obtained from Gibraltar, Huobi offers both individual and corporate customers. a legally regulated organization can serve as

400 million yuan operation in China

Chinese police conducted against a network suspected of defrauding Filecoin miners. operation As a result, he confiscated 400 million yuan (about 607 million lira) worth of cryptocurrencies.

While it was announced that the cryptocurrencies seized during the operation were in Ethereum (ETH), USDT and Filecoin (FIL), 31 suspects were detained from Shenzhen, Shanghai and Wuhan.

These individuals associated with IPFUnion, which produces the miner for Filecoin, are suspected of establishing a pyramid scheme.

According to The Block’s transmission, individual miners directly or via distributor IPFSUnion, which sells miner, in terms of the storage it provides of the ten largest FIL miners is among.

It is not known whether the suspects detained were IPFUnion employees or distributors.

Last week on this subject company that made the statementdevices of the suspects, which are the subject of the incident, seized illegally and to investigate as IPFUnion they are helping stated.

Filecoin’s developer, Protocol Labs, released its coin offering (ICO) in 2017. 200 million dollars valued funds. to the local press According to a group of scammers who want to mine Filecoin in China two years after that hundreds of citizens deceiving 2 billion yuan (about 3 billion lira) had collected.