XRP price nearly doubled after Ripple’s legal victory over the US SEC. But can its rally continue after it reaches almost $1? We are looking for an answer to this question.

XRP price rises sharply

The XRP price skyrocketed following a federal court ruling that said its sales on crypto exchanges were in compliance with US securities laws. On July 14, the XRP price dropped by about 10% to $0.76. However, it is still up about 65% compared to its lowest price the previous day.

At its highest level in the last 24 hours, XRP/USD reached its best level since December 2021 at $0.93. Accordingly, it approached the 1 dollar limit.

A whale-backed XRP rally

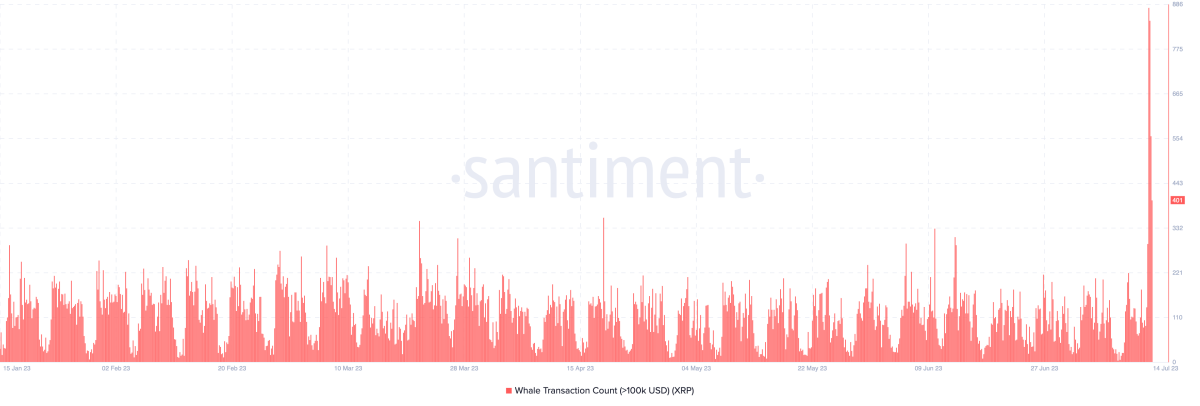

Some indications are that XRP’s continued price increase may not be just a short-term reaction to positive news for Ripple. For example, the duration of XRP’s major price action is simultaneous. It coincides with trading volumes reaching a 10-month high. Meanwhile, the number of XRP whale transactions climbed to its best level in 2023. This shows that the richest investors are supporting the XRP rally.

Brian Q, an analyst at data analytics platform Santiment, makes an important statement. He said, “If major whale addresses are increasing their supply as they enter this price action, it is a harbinger that the increase may be just getting started. It is also a sign of good things to come.” he says.

Also, the increase in XRP prices is in line with the increase in supply held by organizations holding 100,000-10 million token balances.

In other words, the whales didn’t sell the rally. But they actually accumulated XRP. This suggests that most of them want to position themselves for more earnings.

Altcoin going to $1 and beyond?

From a technical perspective, XRP will test the $1 level in the coming days. However, its potential to continue its rally seems weak for now. Specifically, the July 14 pullback occurred near a combination of resistance consisting of a multi-year horizontal trendline (purple) and a giant descending trendline ceiling (black). Additionally, XRP’s weekly relative strength index (RSI) has turned overbought, raising correction expectations.

XRP price will be risky if there is a pullback. cryptocoin.com On the sidelines, it risks falling towards the multi-year ascending trendline support of around $0.45 by September, down about 55% from the current price level. Other price targets include the token’s 50-week exponential moving average (50-week EMA; red wave) near $0.48. There is also the 200-week EMA (blue wave) near $0.50.

On the other hand, an overbought RSI will cause a situation. It will also cause the XRP price to consolidate horizontally in the $0.75-1 range. If the XRP price rises steadily above $1, then the situation will change. The next price target until September is probably up. It will be near the $1.35 resistance level in the August-December 2021 session.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow on. Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.