Data on a recent crypto report by Bybit has revealed high transaction activity on Ethereum killer Solana. However, analysts argue that this could signal an impending decline in altcoin prices. XRP, Cardano, Solana, and Dogecoin could soon witness a 90% crash.

After the decline in US tech stocks and the S&P 500, the cryptocurrency market witnessed a correction. Bitcoin and Ethereum’s correlation with stocks has been at a high for the past two months, which has dragged cryptocurrency prices down.

Bitcoin price dropped below the key psychological level of $30,000 and altcoins followed suit. Among altcoins, the prices of Ethereum, BNB, XRP, Solana, Cardano, AVAX, Dogecoin and Polkadot fell sharply.

Sam Kopelman, UK manager of cryptocurrency exchange Luno, believes the crypto market has been affected by the Fed’s monetary policy tightening and falling stock prices. Kopelman told Forbes:

“Market, [Terra’nın çökmüş stablecoin’i] It remains in a state of fear, driven by the de-pegging of the UST as well as the fear radiating from the wider financial markets.”

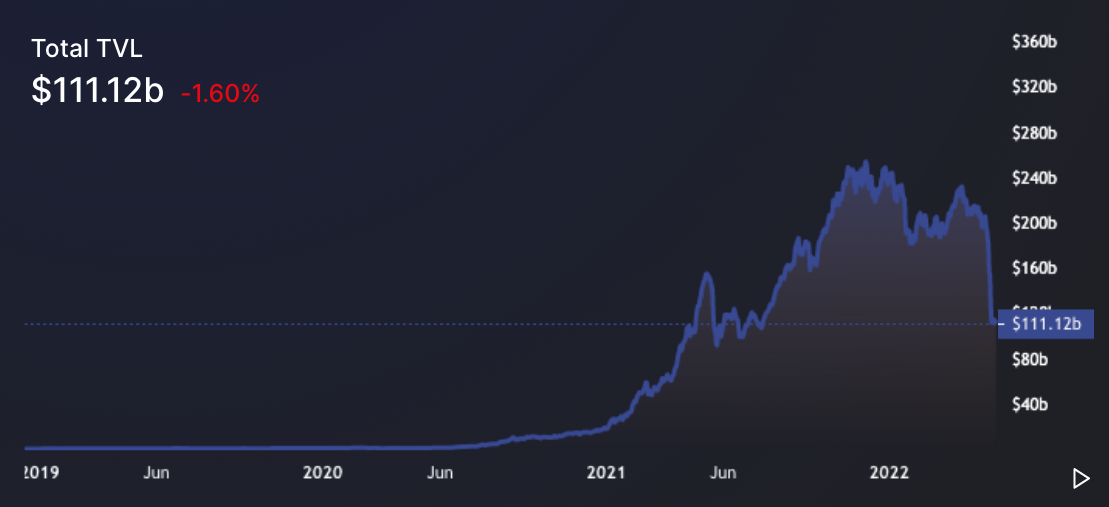

A recent report by cryptocurrency trading platform Bybit revealed a massive drop in total value in the DeFi ecosystem locked to Ethereum, Solana, Cardano, and Avalanche. There has been a 43% drop in the total value locked in DeFi as there has been a loss of $84.67 billion since the start of May 2022.

Fear and volatility in the crypto ecosystem has resulted in a consistent capital outflow in altcoins such as Solana, XRP, Cardano, Dogecoin, Ethereum, and Avalanche. Total value locked in altcoins has fallen faster than Bitcoin in terms of active users, activity and trading volume.

While Ethereum competitors like Solana are presenting themselves as high-yield cryptocurrency products, the lackluster price performance can be attributed to outdated accrual designs and misaligned incentives, according to the Bybit report.

The revenue generated by staking by token holders on the Solana network is below average. The report identifies the lack of innovation and incentives in token models in Solana and Ethereum alternatives as a critical trigger for the loss in protocol revenue.

FxPro senior market analyst Alex Kuptsikevich told Forbes:

“The panic selling in the markets and the continuation of investor anxiety are heralds that the peak of panic is approaching.”

Analysts believe that the price of Bitcoin could drop to $20,000 and altcoins could drop 90% in the ongoing bear market.

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.