The Shanghai upgrade of Ethereum, scheduled to take place in eight days, will allow the withdrawal of ETH staked in 2020. Reports show that recent movements in ETH price are similar to those seen before Merge.

What does the Shanghai upgrade portend?

The upgrade, scheduled for April 12, is causing concern among investors as a large amount of ETH will be released, in addition to the fear and uncertainty in the market. In his research report on Wednesday, Bernstein said that Ethereum has underperformed Bitcoin by 14% this year, but is currently breaking out before the Shanghai upgrade.

Bernstein said that the momentum is reminiscent of when Ethereum rose on Merge, its most recent upgrade, which took place in September.

However, as the upgrade approaches, there will be “increasing awareness” that around 70% of staked ETH is through liquid staking protocols like Lido and that traders are allowed to sell their stETH for whatever reason, “therefore, the staked ETH For 70%, liquidity is new right now, but they can still do it.”

Shanghai upgrade could bring $2.4 billion selling pressure to Ethereum

The remaining staked ETHs were staked directly on the Beacon Chain and thus, they are unlikely to be short-term investors considering they invested their ETH in December 2020, during a time of significant uncertainty as to whether the transition to PoS will be successful.

According to the report, the ability to easily deposit and withdraw ETH gives holders more confidence in staking, and those on the sidelines are now more likely to stake. However, as about 1 million ETH will be released, some experts do not rule out the possibility of selling pressure…

The increase in selling pressure could be worth several billion dollars, according to some observers.

Analysts at K33 Research wrote in a note to clients on Tuesday, “While 1.1 million ETH may face the market on partial reward withdrawals, Celsius Network will likely sell 158k staked balances as part of the bankruptcy process. “These two numbers represent around 1.3 million ETH, or about $2.4 billion worth of potential sell-side pressure to face the market.”

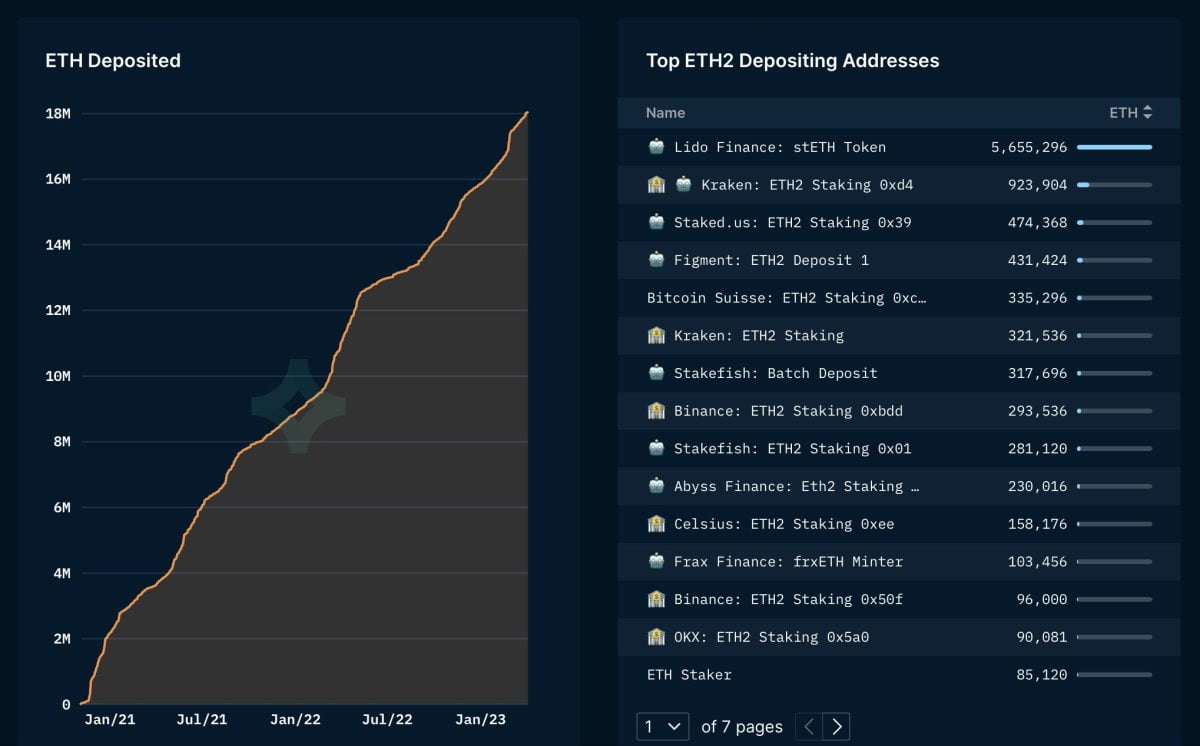

More than 18 million ETH has been staked on the network since Beacon Chain went live in December 2020.

Celsius may cause additional selling pressure

Selling pressure is likely to rise as bankrupt crypto lending platform Celsius liquidates its 158,176 ETH staking balance to recover at least some of its creditors’ funds.

According to K33, cryptocurrency exchange Kraken, which has recently come under the regulatory hammer for failing to register the offering and sale of its crypto staking-as-a-service program in the US, looks set to recapture all ETH staked by US investors. At the time of writing, the number of ETH staked through Kraken was 1.2 million. cryptocoin.com As we have reported, Kraken is among the exchanges that have been on the radar of US regulators recently.

“Kraken will receive back all ETH staked by US investors as a result of the SEC Wells Notice, this may persuade some of Kraken’s ETH stakers to sell,” the analysts said.

“Big sale unlikely”

According to data from CoinGecko, the expected supply increase of over $2 billion is only 20% of Ethereum’s average daily trading volume. According to an analysis by 21Shares, partial withdrawals will likely take five to six days to process, while full withdrawals will take three weeks and four months.

In other words, the selling pressure will likely spread over several days, allowing buyers to keep up with the selling pressure. “Thanks to the modest daily limit on the original 16.27 million ETH, this potential selling pressure is evenly distributed over a long period of time,” said Max Eberhardt, a crypto analyst at Saxo Bank.

Eberhardt added that the majority of ETH staking investors are long-term investors and are unlikely to liquidate their holdings after the upgrade.

Just over 46% of staked ETHs are in profit, as the current market price of Ethereum is higher than when these cryptocurrencies are locked on the network:

Who has the biggest lion’s share ahead of the Shanghai upgrade?

K33’s chart above shows that 46.3% of staked ETHs are in profit, as the market trend of ETH is higher than when these coins are locked in the network. Meanwhile, 28.04% of staked ETHs sit at a profit of more than 20%.

If we exclude coins staked through liquid staking services offered by Lido and Coinbase, this number drops to 24.2%. According to K33, 66% of this 24.2%, i.e. 16% of all ETH deposited, were invested by long-term investors before February 2021.

K33 analysts said, “As ETH is trading 63% below the ATH level, the lion’s share of this group is unlikely to recapture any significant amount. “Tokens associated with liquid staking derivatives are unlikely to be unlocked for sale.”

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.