Gold prices were on the verge of a deep correction on Wednesday last week. However, it managed to regain upward momentum in the second half of the week. In the process, the shiny metal surged to an all-time high above $2,400. There is no high-level data coming from the US this week. Therefore, the market will keep an eye on growth data from China and geopolitical developments. Meanwhile, market analyst Eren Şengezer says there may be more room upside for the yellow metal.

Gold prices are under the influence of headwinds, but remain strong!

cryptokoin.comAs you follow from , gold hovered around the peaks last week. After a slight pullback, the shiny metal started the week with a rise. However, transactions remained calm before the inflation data from the USA. The consumer price index in the USA increased by 3.5% in March, above market expectations. Following this data, the 10-year US Treasury bond yield increased and exceeded 4.5%. Additionally, the dollar index (DXY) rose above 105.00, reaching its highest level in the last five months.

Meanwhile, the latest CPI data has increased the possibility that the Federal Reserve will not change interest rates in June. These developments created downward pressure on gold prices. Thus, the shiny metal has slipped slightly from last week’s peak. In this process, gold prices lost approximately 1% in value on Wednesday. This was gold’s second daily loss in the last two weeks. On Thursday, while the dollar maintained its strength, the increase in geopolitical tensions caused gold to rise again.

WGC: These are the main drivers of the rise!

Meanwhile, the European Central Bank (ECB) kept key interest rates steady at its April policy meeting. Reuters, citing three sources, reported that ECB policymakers will cut interest rates in June. The sharp rise in the XAU/EUR parity showed that gold was catching up with capital outflows from the Euro.

Gold prices continued their rise, rising above $2,400 on the back of risk aversion and central bank purchases. According to the monthly report of the World Gold Council (WGC), rising geopolitical risks, stable central bank purchases and resilient jewelry and bullion demand are among the key drivers of the current rise.

Gold investors focus on geopolitics

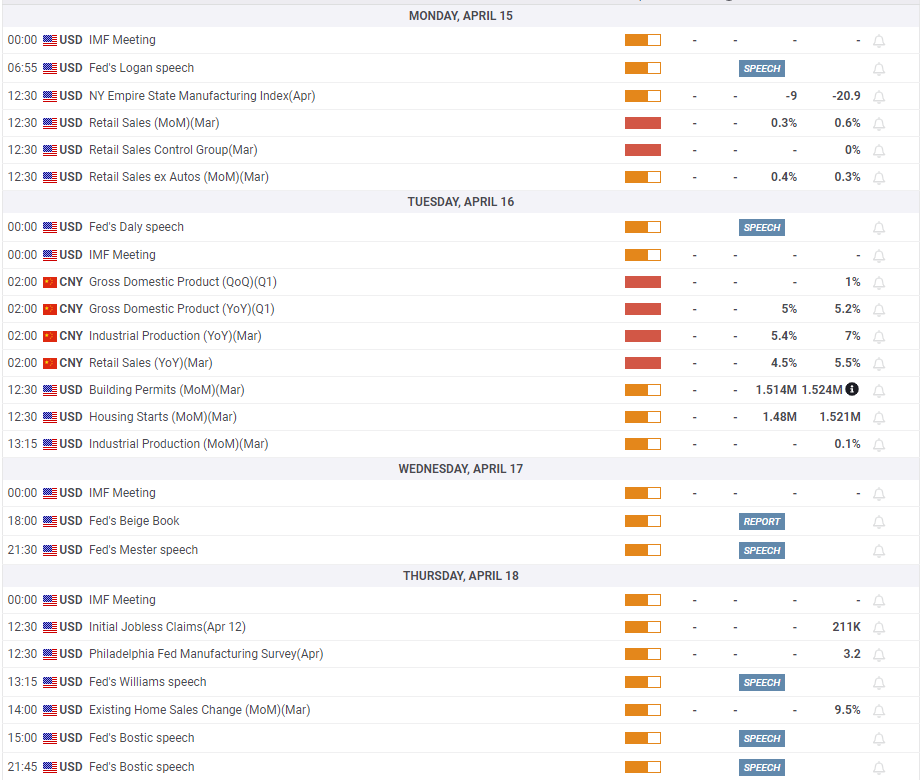

March will start with important data on the US economic calendar. Retail Sales, which increased by 0.6% in February, are expected to increase by 0.3% in March. According to experts, it is possible that negative data could cause a weakening in the dollar. Market participants will also closely monitor the first quarter GDP data from China. Expectations are that the Chinese economy will grow 5% annually, following an expansion of 5.2%. Market analyst Eren Şengezer interprets the impact of the data as follows:

It’s possible that a disappointing GDP data could raise concerns about gold’s demand outlook. It could also limit gold’s upward movement. Geopolitical developments are also among the issues that investors focus on. The easing of conflicts in the Middle East could trigger a deep correction in gold. Additionally, with expectations of a postponement of the Fed’s policy change, gold will continue to find support in a risk-averse market environment.

Gold prices technical view

The analyst evaluates the technical outlook of gold. The Relative Strength Index (RSI) indicator on the daily chart is trending well above 70. This shows that gold continues to be overbought. But this week’s action confirms that investors are paying little or no attention to technical developments. The yellow metal continues to trade in uncharted territory. Therefore, setting bullish targets for gold is not an easy task. If the precious metal stabilizes above $2,400 and confirms this level as support, buyers can have confidence in a move higher towards the next psychological level at $2,500.

On the downside, interim support is $2,320 (April 10 low). Moreover, there is support at $2,360 (static level, former resistance) ahead of $2,300 (psychological level, static level).

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!