Crypto analysts are pointing out the possibility of an impending correction after the strong performance of the leading cryptocurrency Bitcoin (BTC) in recent weeks.

A popular trader named Justin Bennett stated in his new blog post that Bitcoin’s recent rally was impressive, gaining around 25% in the last two weeks. However, Bennett claims that with this rally, some of the gains made by Bitcoin may be lost.

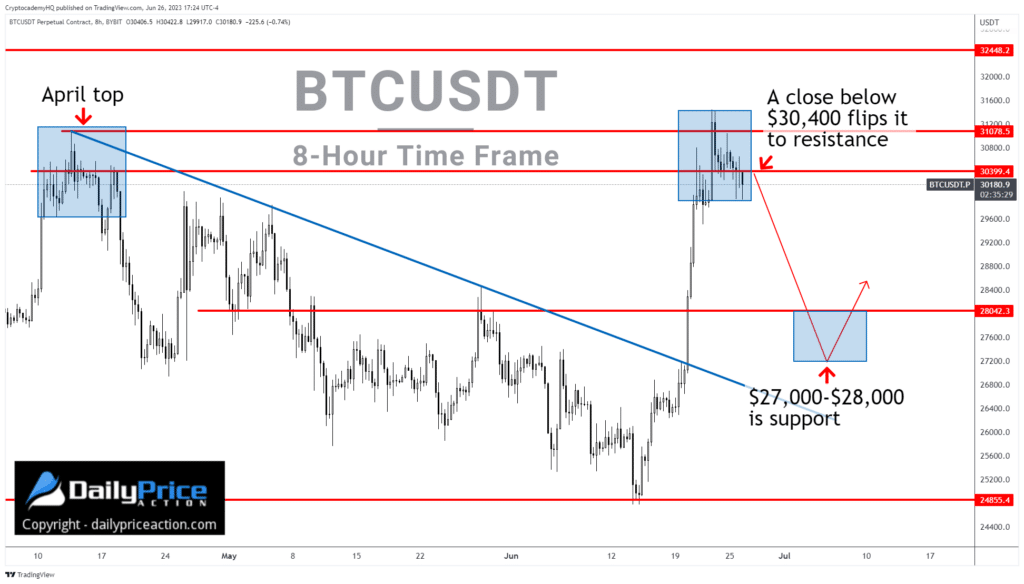

“A pullback towards the $28,000 area seems likely to clear up the late BTC long positions. If such a test takes place, the movement of the Bitcoin price at the level of $ 27,000-28,000 will determine what direction BTC will trend in July.”

Although the analyst has warned of a bearish trend, he does not completely rule out the possibility of an uptrend. According to the strategist, if Bitcoin manages to break the critical resistance at the $31,000 level, the short-term downside prediction will be invalidated.

“Alternatively, a sustained break above $31,000 indicates the bulls are in control and a breakout to $32,500 will occur.”

At press time, Bitcoin is trading at $30,259.

Bennett also tracks the USDT.D chart as it shows how much of the crypto market cap is made up of stablecoin USDT. The USDT.D chart is bearish, indicating that investors are giving up stablecoins to take risks. This data is generally a bullish signal. On the contrary, a rising USDT.D chart is considered a bearish signal for BTC. Bennett said that a move above the 8% level for USDT.D could put BTC at risk of a significant correction.

Tether dominance might confirm a reclaim of the 7.3% level today. 👀 2.5 hours to go.

If so, watch for a move to the 8% handle, equaling an approximate 10% pullback for #Bitcoin$USDT.D pic.twitter.com/Bv5GlmsMAD

— Justin Bennett (@JustinBennettFX) June 26, 2023

You can follow the current price action here.