Dusseldorf, London It could be the largest transaction since the outbreak of the pandemic: the British group Unilever wants to take over the consumer goods division of the pharmaceutical giant Glaxo-Smithkline (GSK). Unilever had offered around 50 billion pounds (equivalent to around 60 billion euros) for this, GSK had rejected the offer at the weekend as too low.

The takeover gamble continued on Monday: Unilever, whose range of brands with food (Knorr, Pfanni), cosmetics (Axe, Dove) and cleaning products (Coral, Domestos) covers the entire spectrum in the consumer goods market, signaled that it would improve its offer. The company is said to be in talks with banks about further financing. GSK’s consumer goods division “would be a very good strategic fit” and could “create a growth platform,” Unilever said.

The purchase attempt shows how much pressure both groups are under. Growth is weakening, CEOs are controversial, share prices are lagging behind the competition. Through the takeover, Unilever could strengthen the higher-margin cosmetics business and take on corporations such as Estée Lauder or L’Oréal.

With the sale, GSK would give in to pressure from its investors, who have been pushing for a spin-off of the consumer goods industry for some time. GSK is known for the toothpaste Sensodyne, the pain ointment Voltaren and the nasal spray Otriven. The US pharmaceutical company Pfizer has a 32 percent stake in the consumer goods division. He also rejected Unilever’s previous offer.

Top jobs of the day

Find the best jobs now and

be notified by email.

“Please don’t” – Analysts advise Unilever against acquisition

At first glance, a deal would be in the interest of both parties. But analysts advise against it with unusually sharp words. “We can’t think of many things that would unnerve us more than Unilever acquiring GSK’s consumer products division,” writes James Edwardes-Jones of investment bank RBC Capital Markets in a note captioned “Please don’t.” .

According to the expert, GSK mainly offers medical products that entail completely different regulatory hurdles than the Unilever portfolio. In addition, Unilever has no overlaps with two-thirds of the products in the relevant division. The plan to simply roll out these brands in new markets is not working. Unilever is “not a management powerhouse” that improves the performance of acquired companies. In addition, Unilever would be “heavily indebted” after such a takeover.

According to the Bloomberg news agency, analysts value GSK’s consumer goods division at around 48 billion pounds (57 billion euros). To convince the GSK board of a deal, Unilever would have to pay significantly more. GSK boss Emma Walmsley is reportedly planning £60 billion (€72 billion).

On average, eleven financial experts surveyed by Bloomberg assume that the consumer goods group will have to offer at least 57.3 billion pounds (68.5 billion euros). That would be £10m more than Unilever was expected to pay for expected growth, said Bernstein analyst Bruno Monteyne. “It’s a very bad deal.” The marketers rate it similarly: Unilever’s share price fell on Monday by up to 8.5 percent to a two-year low.

Unilever wants to strategically realign itself

Unilever CEO Alan Jope announced Monday that he would unveil a new direction later this month. As the attempted takeover of the GSK division shows, Unilever wants to increasingly focus on health, beauty and hygiene. These areas would allow for higher and more sustainable growth.

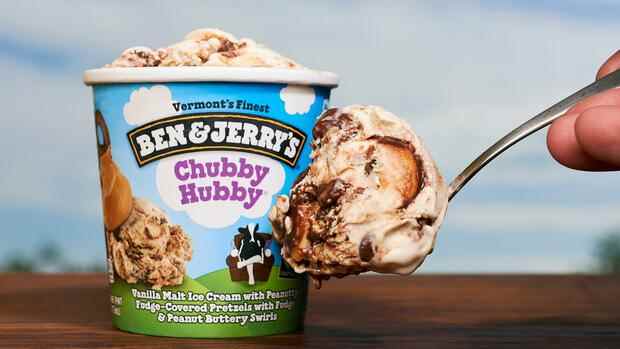

Unilever also plans to divest areas of slower growth. This could affect the food sector. For example, Unilever sells ice cream under the brands Ben & Jerry’s and Langnese or Hellmann’s mayonnaise. However, there are currently no plans to sell the entire food division, said Jope. The reorganization should aim at new growth and not at cost reductions.

An industry observer from Germany rates a realignment as the right step in principle. “Focusing on the area of consumer health, which is as fragmented as it is growing faster, makes perfect sense simply because of the aging society.” The magnitude of the deal that has now been initiated and the insufficient synergy potential, however, raised doubts as to “whether the envisaged target is a good choice”. .

In the first nine months of last year, Unilever generated 41 percent of total group sales of 39.3 billion pounds (47 billion euros) with cosmetics. A little less comes from the food sector. A fifth made Unilever with detergents.

Manager Jope is now planning the biggest reorganization since he took office three years ago. Since then, the share price has fallen, although the consumer goods industry is traditionally considered to be crisis-proof. While Nestlé boss Mark Schneider successfully sells poorly performing parts of the Swiss rival’s business, Jope is accused of inactivity. Therefore, he is now suspected of wanting to compensate for his previous shortcomings with the GSK deal.

Most recently, one of Unilever’s largest investors, British star fund manager Terry Smith, criticized Jope’s course. Management does not focus enough on the fundamentals, Smith wrote in a letter to investors, but rather on marketing strategies: “A company that feels it has to define the purpose of Hellmann’s mayonnaise has clearly lost its mind.” one the meaning of a company. More and more companies are dedicating themselves to their own purpose, but this is controversial.

GSK boss Walmsley is under pressure

Market observers had expected offers for the GSK division – but rather from Unilever’s competitors Procter & Gamble (Ariel, Pampers, Gillette) or Reckitt Benckiser (Calgon, Durex, Sagrotan). GSK boss Walmsley has been pressured into selling the consumer goods division by her activist investor Elliott Management since last year. The New York-based hedge fund expects a sale could send GSK’s share price up 45 percent.

Walmsley’s plan so far has been to take the division public in the summer and keep a stake. But the company would probably agree to a sale if the price was right. Whether selling or going public: Walmsley wants to invest the expected billions in proceeds in the development of its own pharmaceutical pipeline. Here the group has been lagging behind its British rival Astra-Zeneca for years, which is also reflected in the share price. The Unilever offer had a positive effect on those, however: the GSK share rose by up to six percent in the meantime.

More: More expensive, greener, more digital: This is how the business with everyday goods is developing