There are two key events to consider when looking at what’s likely to happen this week. The first is the end of the first quarter of 2023 and the expectations for the next quarter. The second is the US Non-Farm Payrolls (NFP) data, which will be released this week. Crypto analyst Akash Girimath explains why these are important for a bull rally for cryptocurrencies.

We welcome the second quarter of 2023

cryptocoin.comAs you follow, the first quarter of 2023 has been extremely bullish for crypto participants. However, it has not been so for traders in traditional financial markets. The chart below shows the performance of Bitcoin (BTC), Ethereum (ETH), S&P500, NASDAQ100 and gold. Clearly, BTC and ETH are in the club of winners in terms of returns amid the ongoing global banking crisis.

Given the historical performance of the leading cryptocurrency Bitcoin, the following article examines BTC’s key levels across weekly, daily and four-hour timeframes. While the outlook for the leading crypto remains bullish, a minor pullback is likely, which will be a boon for investors looking to accumulate BTC.

Also, Bitcoin Dominance, the percentage share of BTC’s market cap relative to the total crypto market cap, is in a critical hurdle. A drop in Bitcoin dominance could lead to profits returning to altcoins, which could lead to an alt season. The concept of capital rotation for cryptocurrencies, alt season and it is important to watch which altcoin category will be pumped.

Why is NFP data important to cryptocurrencies?

Unemployment Rate and NFP data are scheduled to be released on Friday, March 7. That will set the tone for the US Federal Reserve’s next move, such as raising or pausing interest rates. In early March, the positive correlation between BTC and the stock market fell due to growing concerns about the state of banks. As a result of this turmoil, cryptocurrencies have seen a massive inflow of capital. This catalyzed the continuation of the bull run that started in January 2023.

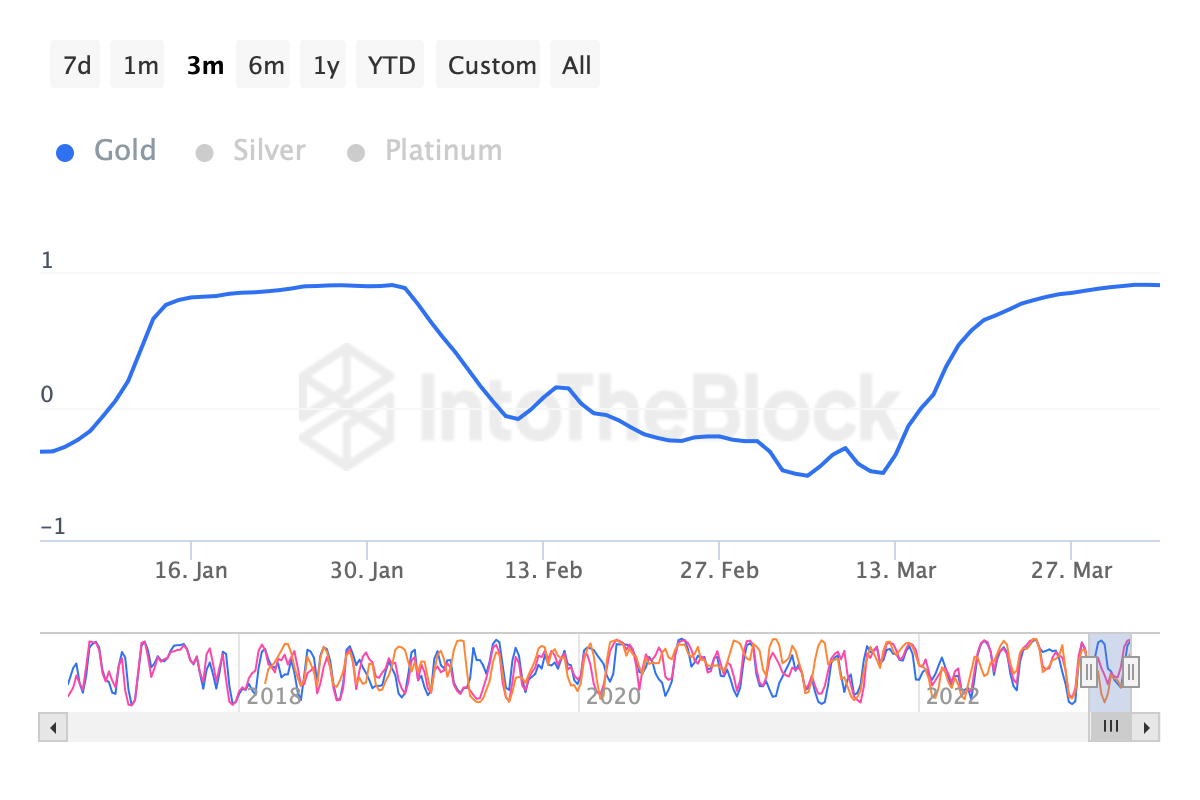

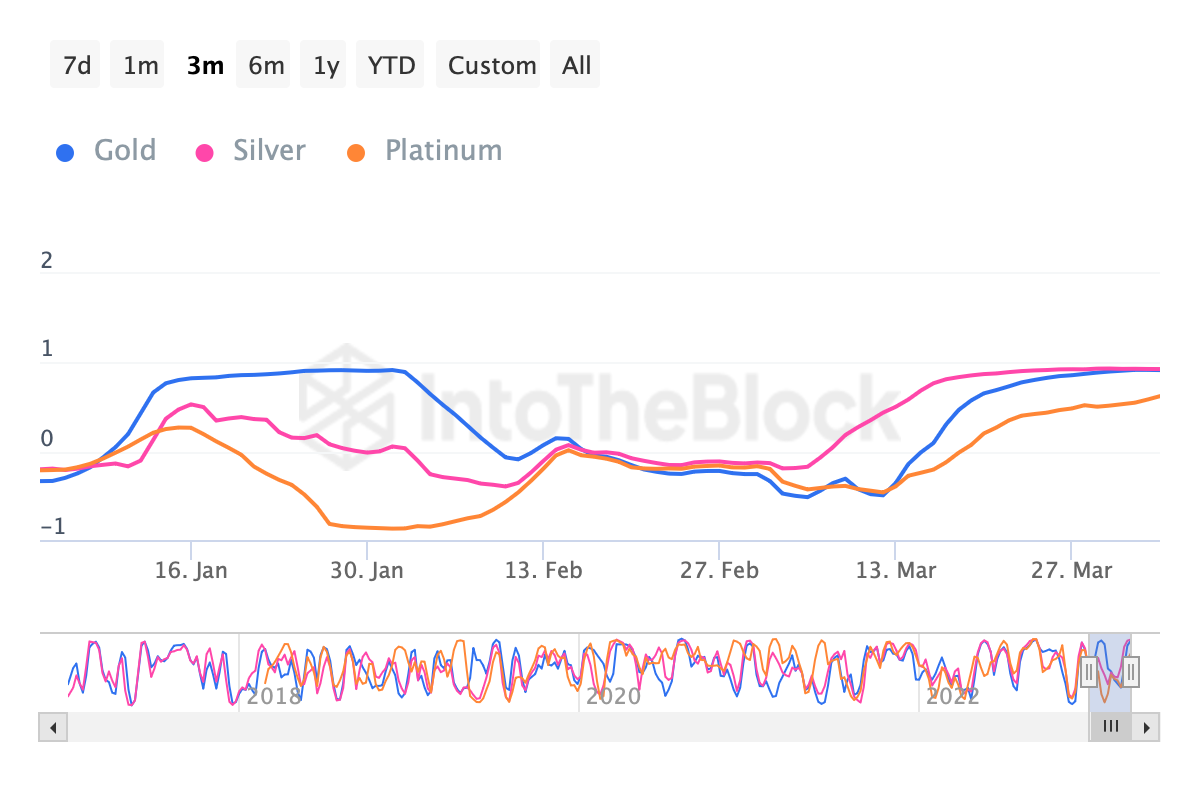

In parallel, the correlation between BTC and gold has been on the rise, going from -0.5 to 0.92 between March 12 and April 3. This strengthened the situation for both assets to regain their safe harbor status. However, as the bullish momentum wore off, Bitcoin’s rally came to a halt. Therefore, this caused the above-mentioned correlation to plateau.

Recently, the correlation between Bitcoin price and the S&P500 has returned, increasing from -0.25 on March 6 to 0.49 as of April 3.

Therefore, it will be interesting to see how the Bitcoin price reacts to upcoming macroeconomic events such as the unemployment rate and NFP figures. The consensus for NFP is 240k, much lower than the previous report of 311k. Depending on how much and in which direction the divergence is, Bitcoin price can either fall or find an opportunity to continue its rise from there.

A positive surprise of a larger size could be interpreted by the market as bullish for the US Dollar. This can start a quick sale, too. On the contrary, a large enough negative surprise can catalyze an upward move.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.