Ethereum Locked for about 2 years with Shanghai update ETH filming resumed and multi-billion dollar of ETH The effect on the market scared investors.

The market again acted contrary to expectations and there was no fear. In its report published in February 2023, Coinbase stated that “if the risk appetite is high during the period of unlocking, the market unlocked Ethereums may face a demand far beyond balancing.” he said.

Coinbase’s It was just as the report said. ETH ETH rose above $2000 with the start of withdrawals. Within a week, we see that ETH maintains this strength and is traded at $2100 as of our news time.

Demand Outpaces Filming

According to the latest data, the number of withdrawals has decreased considerably and the staked ether number of drawn ether considerably exceeded the number.

According to data provided by Nansen, 94968 ETH has been staked and 27076 Ether has been withdrawn in the last 24 hours. This means that the net input is 67892.

When we look at the graph regarding the withdrawals, we see that the pressure of the unstacked ETHs on the price has decreased considerably.

The number of ETH waiting to be withdrawn has also decreased to 5% of the total locked value.

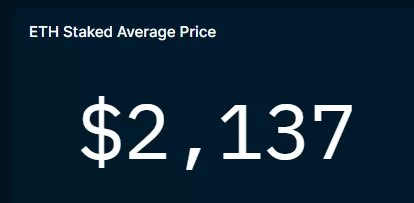

While the average price of ETH staked before Shanghai was around $3500, after Shanghai, this price dropped to $2137.

Is This More Bullish Signals For Ethereum?

Grayscale analysts Matt Maximo and Michael Zhao said that the outflows in Ethereum were less than expected and demand for ETH could increase as the risk of staking is reduced.

Stating that every ETH withdrawn does not mean that it will be sold, analysts said:

“The impact of the Shanghai upgrade on the price is related to the withdrawal of less ETH than expected. Initially it was expected that there might be more shots. Looking to the future, the demand for a reduced stake ETH may increase. That means bullish for Ethereum.”

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price tracking right now by downloading our apps!