Small investors were literally shocked in December when millions of people queued up for public offerings hoping that they would go through the roof. The price of 5 of the 7 stocks offered to the public this month was below the public offering price.

Recently, it has spread from word to mouth exceeding the population of some countries Our number of investors in the stock market does not seem to produce a very good result.

So much so that 5 million new investors entered our stock exchange in the last year. So the total number of investors Reaching 8.5 million He renewed his historical record.

Although the targeted number of 8 million investors was reached in 2008, such unconscious new investors Taking part in the stock market brought with it dangers.

What happened to TAB Gıda, which broke the public offering record?

TAB Gıda’s public offering, which broke a historical record with the participation of 5,185,061 investors in October, was realized with a valuation of 130 TL and subsequently 207 TL levels He had tested it.

After a few months, the stock fell well below the public offering price of 130 TL. The bottom point was around 95 TL. saw.

The market value of the company in periods when TAB Gıda shares exceed 200 TL 50 billion TLIt exceeded . Today, while the value of the share is around 110 TL, the market value of the company has lost almost half of its value. Up to 29 billion TL It’s down.

TAB Gıda’s public offering size largest public offering We would like to point out that it broke a record in terms of the number of participants.

Most of the recent public offerings broke the ceiling and fell to the offering price!

Of the 7 different companies that went public in December, Avrupakent Real Estate Investment Trust with (AVPGY) Sur Tatil Evleri Real Estate Investment Trust (SURGY) broke the roof from the first day and dashed the enthusiasm of small investors.

In this environment where all public offerings entered since the beginning of the year have somehow brought profit to their investors and generally gone through the roof. ceiling disruptions from day one It literally shocked the small investor.

This decline in public offerings, starting with TAB Gıda, seems to have subsequently damaged small investors’ confidence in public offerings. The current situation can easily be easily overlooked by unconscious investors. to panic selling It allowed.

Since public offerings are made through various pages on social media, by only looking at companies’ ceiling and ceiling tables, and without examining any prospectus, public offerings are not accepted. There was an unconscious accumulation.

So much so that many companies went public because they could not get loans from banks. in the past too similar public offering trends In the end, balloon explosions took place, just like today.

However, the most important point here is that these public offering crazes are only solid and visionary companies In other words, companies that were promising and whose financial situations were well examined and revealed were somehow able to continue on their way.

So in the past 2010-2014 Dozens of companies went bankrupt during the public offering frenzy between However, we should also point out that 85% of 117 companies continue their business. Very few of these provided returns above the index and inflation.

RELATED NEWS

Failed Companies That Lost People’s Money in the Stock Exchange After the “IPO” Fury of 2010-2014 – Part 3

So, it would not be wrong to say that today’s public offering craze is experiencing a similar situation. With these declines the importance of being selective It seems like it will become more clear in the coming days.

Çates Elektrik, which went public recently, used its public offering proceeds to pay off its debt, as stated in its prospectus.

According to the KAP statement, existing loan debts Debts amounting to 1,299,723,679 TL in total were repaid. In addition, the statement said that it has repaid its foreign currency debt totaling 5,468,805 USD with its own internal resources.

Although it was reacted by some people on social media, companies in approved prospectuses They clearly state these situations in advance. If the prospectus is not complied with, they may face various sanctions from the CMB. However, judging by the reactions on social media, new investors did not read the prospectus of the companies, that is, they entered the public offering. They do not research companies appears clearly.

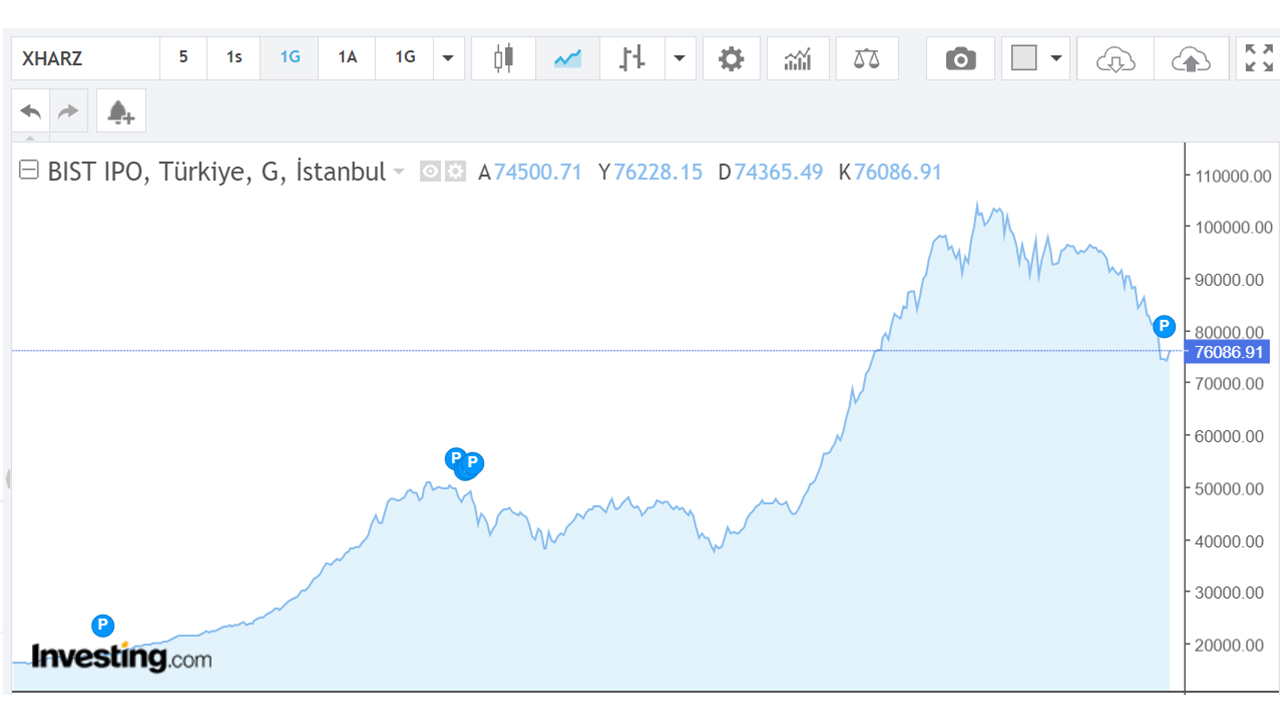

“While the high performance of public offerings increased investor demand, this increased demand further increased the performance of public offerings, turning the process into a pyramid scheme. However, the recent upward momentum in the BIST100 index has slowing down with rising interest rateswith the decrease in the inflow of new buyers and fresh money and the significant decrease in transaction volumes. in the public offering index We see (XHARZ) performance starting to weaken.” said.

Dükkancık pointed out that, especially with the recent increase in foreign investor inflows, interest and momentum have started to turn towards large companies with high index weights. “Investors started to question IPOs. After the public offerings announced, on many social media platforms, What does the company do?Fundamental questions and answers such as its balance sheet, investments and where it will use the IPO proceeds. instead of focusing on investment pointsFocusing on issues such as , how many lots can be purchased from the offering, how many caps will the shares go to, was one of the most important signs that the process was already heading towards an unhealthy point. Companies where investors can now ask the right questions and find satisfactory answers A period in which the company moves towards public offerings awaits us.. It is worth noting that in this regard, both sector employees and supervisory and regulatory organizations have great roles to play in preventing investors and companies from becoming victims of public offerings in the future. At this point, when participating in public offerings, investors should examine the public offering reports more closely and be careful to make their decisions accordingly.” he said.

Our other economy-themed content:

RELATED NEWS

Does Credit Card Usage Really Cause Inflation to Rise?

RELATED NEWS

Failed Companies That Lost People’s Money in the Stock Exchange After Going “IPO” – Part 4

RELATED NEWS