Credit cards are so ingrained in our daily financial lives that it’s hard to imagine they don’t exist. So, who invented the credit card, which almost everyone has at least one in their pocket, and since when has it been in our lives? Rest assured, the credit card story is older than you think.

According to 2023 data, it is used by 1.25 billion people worldwide and 117.7 million people in Turkey. The story of the credit card Have you ever wondered who came up with this bright idea?

If your answer is no, credit card From clay tablets to metal cards Let’s make a contactless touch to the transition.

What is the story of the credit card? It has been in our lives since earlier times than you think.

The term loan actually dates back to ancient Mesopotamia, at least 5 thousand years ago. What was written on clay tablets at that time is also available to us. credit system It gives information about. The tablets, which contain records of transactions between neighboring merchants, include examples of agreements to buy first and pay later.

Thousands of years later, these old methods were replaced by merchants distributing goods to farmers who did not have money to buy materials. to store cards is turning. Merchants minted coins or small plates as credit receipts for this system. Farmers paid their debts to merchants as they harvested their crops.

The economic growth and change in consumption habits in the USA in the mid-20th century, The birth of the credit card idea laid the groundwork.

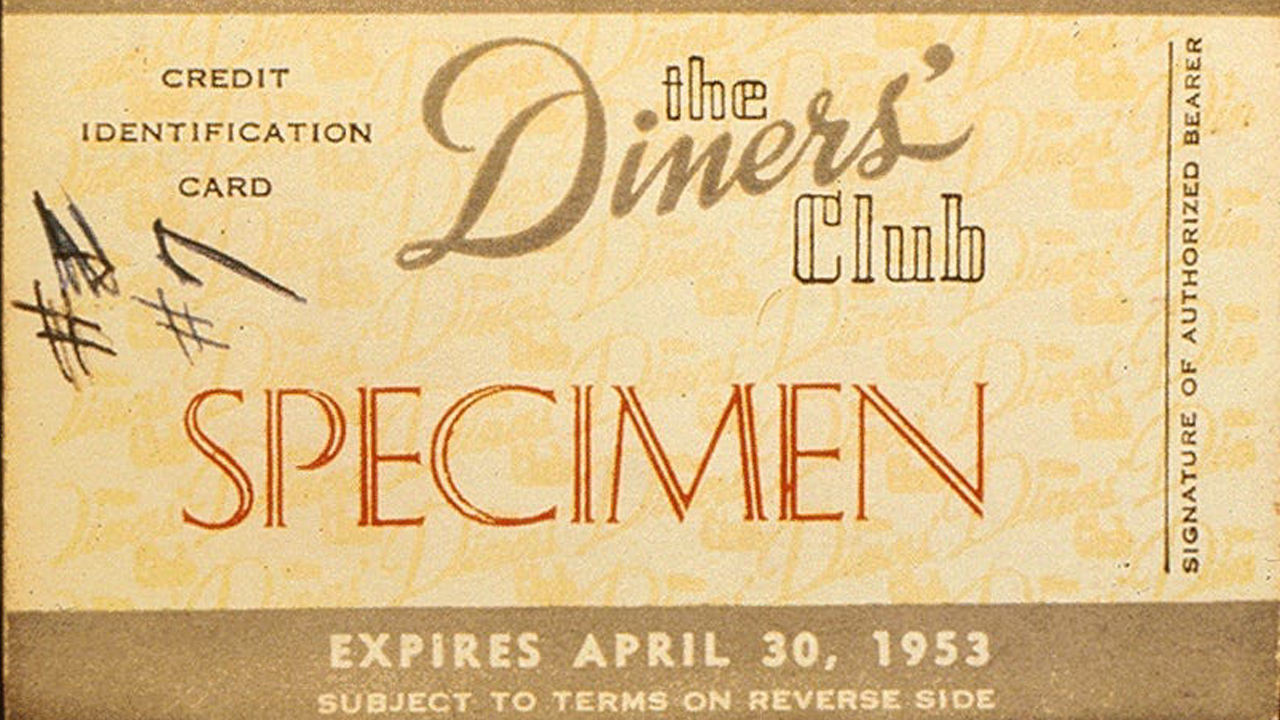

The first modern credit card: Diners Club

“Who found the credit card?” The question turns to Frank McNamara. The first incarnation of the credit card idea was introduced in 1950 by Diners Club, led by Frank McNamara. Legend has it that McNamara realized he wasn’t carrying cash at a business lunch and parlayed that experience into the idea of streamlining payment methods. “How was the credit card found?” Would you have thought that the answer to the question would be an experience from daily life?

This idea marked the birth of Diners Club. The Diners Club card was originally designed as a payment tool that could only be used in restaurants. Customers with a card would pay for meals using the card, and the restaurant would send the bill to Diners Club. Diners Club too for a small commission The payment was transferred directly to the restaurant’s account.

This application became popular in a short time and the number of card members increased in the first year. It exceeded 10 thousand.

Diners Club’s success encouraged other financial institutions to develop similar payment systems.

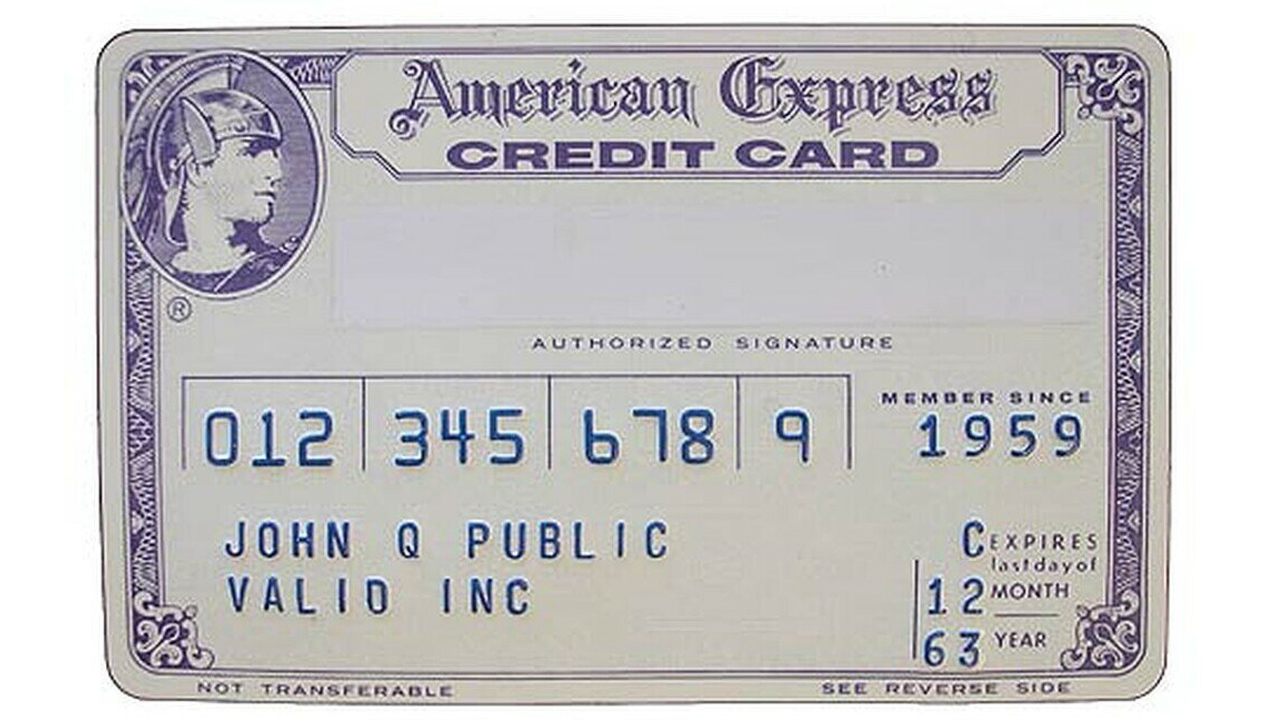

in 1958, American Express launched its own credit card, and this recharge card is designed to be used for travel and entertainment expenses. These cards offered their users a certain credit limit, allowing them to pay in a single bill at the end of the month. American Express was introduced for business travelers in 1966. issued a corporate card.

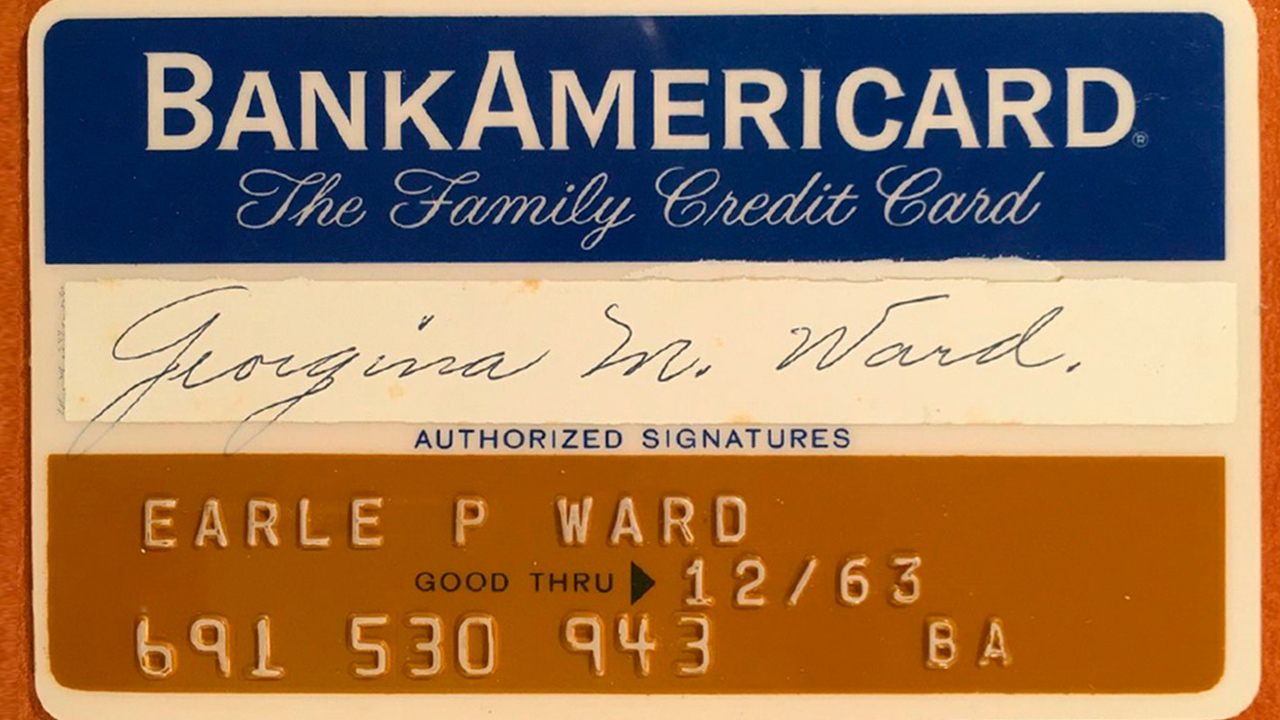

Again in 1958 Bank of Americathe forerunner of Visa Introduced BankAmericard. This step revolutionized the credit card industry and made credit cards popular. In 1966, it became available statewide. BankAmericard in 1976 changed its name to Visa and developed a system that makes credit card transactions easier and brings card use to the international arena.

During the 1970s and 1980s, credit cards began to proliferate on a global scale. MasterCard (formerly known as Master Charge) and other credit card companies also emerged during this period.

Many stages have been achieved in the development process of credit cards.

Scoring systems that make credit cards even more attractive

Points systems on credit cards have emerged as an innovation that offers consumers rewards based on spending. These systems, which began to become popular towards the end of the 1980s, were responsible for every purchase made by users’ credit cards. points or miles made them win.

These points can then be used for flight tickets, hotel accommodations, restaurant discounts or could be used for various rewards such as cash rebates. As you can imagine, the development of scoring systems has increased credit card usage by encouraging consumers to spend more and strengthened customer loyalty.

In the votes cast by those who participated in the 2021 Credit Card Shopping Survey, 22 percent voted for a certain When choosing a credit card, he was looking at rewards.

The expansion of the credit card industry has brought with it a number of regulations.

Since the 1970s, governments in the United States and around the world have enacted various laws to protect consumers and ensure fair competition. Released in the USA in 1974 Equal Credit Opportunity Act, It gave consumers the right to object to inaccurate or unfair billing.

Similarly, adopted in 2009 Credit Card Accountability Responsibility and Disclosure (CARD) Act, required credit card companies to be more transparent about interest rates and fees. Such regulations were intended to make credit card use safer and fairer.

Magnetic strip that increases credit card security and ease of use

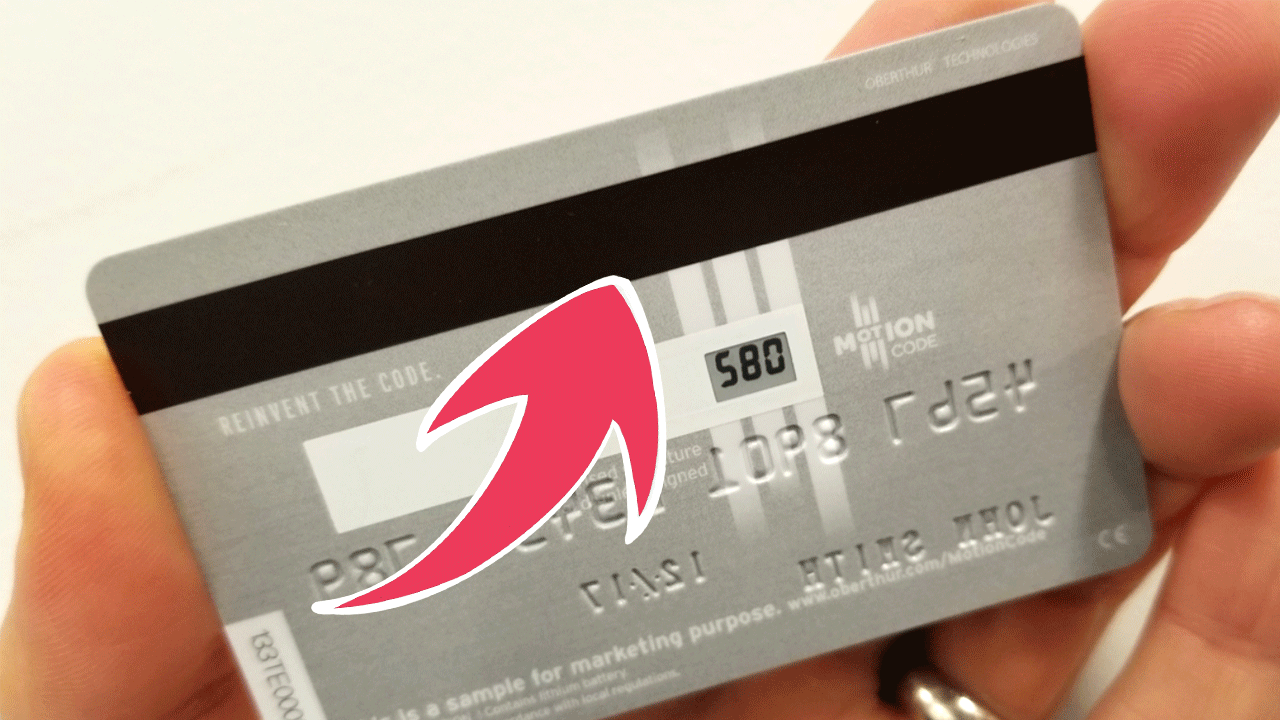

Placed on the back of the card in the 1960s magnetic stripBy storing the cardholder’s information in a digital format, this information is automatically read in every transaction. This technology also helped speed up transactions at the point of sale and reduce error rates.

One of the last big innovations is contactless cards

The contactless feature, which broke new ground in credit card technology in the early 2000s, Near Field Communication (NFC) technology It enabled the card to make transactions without physical contact with a payment terminal.

Consumers were able to make payments quickly and easily by bringing their contactless cards close to the terminal. Contactless paymentshas gained popularity as it saves time and offers ease of use, especially in small amount transactions. This technology Hygiene concerns during the pandemic period Due to this, it has become more widespread and contactless payment limits have been increased in many countries.

How do credit cards work?

A purchase made with a credit card is actually quite a complex chain of financial transactions it activates. When a consumer purchases a product or service with his card, a rapid flow of information and money begins between the bank that issues the card, the network that provides the payment infrastructure, and the seller’s bank.

This process works by making a payment to the seller on behalf of the consumer and then collecting this payment from the consumer, rather than instantly withdrawing money from the consumer’s bank account. The system provides consumers a flexible payment It also enables sellers to receive payments securely.

The future of credit cards is shaped by technological innovations and changing consumer expectations.

Increasing digitalization and the rise of mobile technologies are leading to the emergence of new payment methods in the credit card industry. In the coming years, biometric verification methods It seems that the use of more secure authentication technologies such as will increase. Finger print, face recognition and methods such as iris scanning will make credit card transactions more secure, which will reduce the risks of fraud.

Blockchain technology and rise of cryptocurrencies It has the potential to offer greater transparency and security in payment systems. These technologies can transform the credit card industry by providing alternative payment solutions outside of traditional banking systems.

Finally, artificial intelligence and machine learning, personalized payment experiences It can better adapt to consumers’ shopping habits by offering This will allow customer loyalty programs and payment preferences to be further customized.

Other topics you may wonder how to find:

RELATED NEWS

Who Thought of Fermenting Milk: How Was Yoghurt, an Original Turkish Food, Made for the First Time?

RELATED NEWS

How, When and By Who Was the ‘Condom’ Invented Against Epidemic Disease?

RELATED NEWS

Who and How Was the Air Conditioner Invented, the Value of which We Understand Even Better on Cold Winter Days? The original version wouldn’t even fit in your room!

RELATED NEWS

By Whom and How Was Zero, Banned for a Period Just Because It Was Thought to Be ‘From the Devil’, Appeared for the First Time?

RELATED NEWS

By Whom, When and How Was ‘Television’, Which We Cannot Even Imagine Existing Today, Invented?

RELATED NEWS

Who Thought of Looking into Space Through Lenses: Who and When Did Invent the Telescope?

RELATED NEWS