As the Webtekno team, we continue to examine the pocket-friendly prices of the iPhone 13 family. This time we will take you to a Turkey where there is no SCT. Let’s see if we subtract the SCT from the tax items applied to the iPhone 13, how much money can we have for these devices?

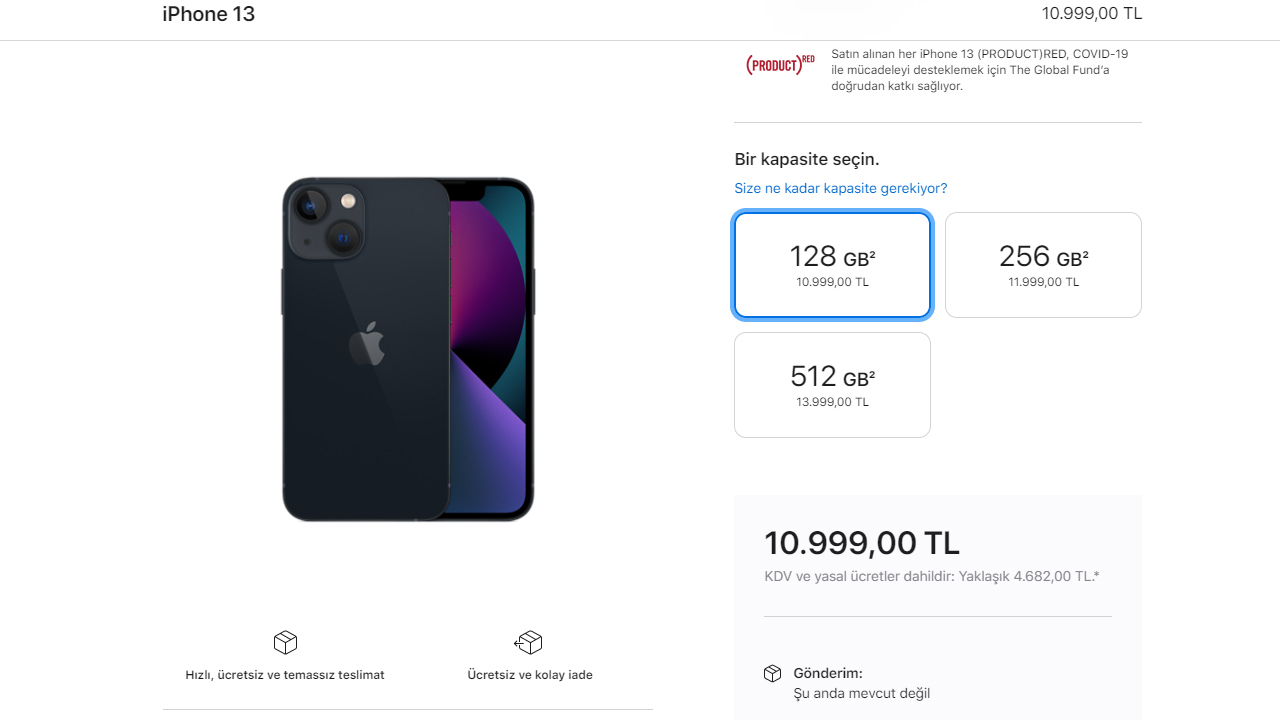

US-based technology giant Apple, at an event it held recently iPhone 13 announced its new products with its family. Apple Turkey After the company’s statement, it updated its website and announced the prices of smartphones in Turkey, which will be opened for pre-order in the coming days. Accordingly, a consumer in our country, 10 thousand 999 TL to 22 thousand 999 TL He will be able to buy himself an iPhone 13, with prices varying in the range.

We can say that it has become a tradition to look at the price before buying a technological product in Turkey. In this context, in one of our content we have prepared for you recently, for the prices of the iPhone 13 family, how much tax is taken and how much money the devices make to Apple Turkey we calculated. Now we’re going to make a new account, the results of which you will be even more surprised. If there is no excise dutyHow much will it cost to own an iPhone 13 under current conditions?

If we reduce the SCT to 0 percent, what will the iPhone 13 prices be like?

In our previous calculations, we explained the tax items on the iPhone 13 family one by one. Accordingly, 18 percent VAT for an iPhone 13 arriving in Turkey, 50 percent SCT, 10 percent TRT share and 1 percent tax belonging to the Ministry of Culture and Tourism were paid. As you can see, the item with the highest rate is Turkey’s seen as luxury was the excise duty applied to the products. Come now, going to parallel universe Suppose this tax does not exist. In this case, what price tag would the iPhone 13 models have?

RELATED NEWS

Countries with the Most and Least Work Required to Buy iPhone 13 Pro Announced: Turkey First But…

Since we pay tax on tax when calculating taxes multiplication we are implementing. So the tax paid for a smartphone, 96.6 percentIt goes up to . When we remove the SCT from this account, the SCT tax is removed along with the SCT. 31 percent We are faced with a tax. In addition, let us state that the values we consider as ‘Apple Turkey’s profit share’ are the values we calculate based on the current pricing. In other words, in a world where there is no SCT, Apple Turkey can reduce its profit share even more by a percentage, even lowering the prices below the values below.

iPhone 13 mini

For the 128GB version:

- Customs entry price: 4,846 TL

- Tax without excise duty: 1,502 TL

- Apple Turkey’s profit: 1,471 TL

- Sales price without SCT: 7,819 TL

- The difference is: 3,180 TL

For the 256GB version:

- Customs entry price: 5.084 TL

- Tax without excise duty: 1,576 TL

- Apple Turkey’s profit: 2,003 TL

- Sales price without SCT: 8,663 TL

- The difference is: 3,336 TL

For the 512GB version:

- Customs entry price: 5,560 TL

- Tax without excise duty: 1,723 TL

- Apple Turkey’s profit: 3,068 TL

- Sales price without SCT: 10,351 TL

- The difference is: 3,648 TL

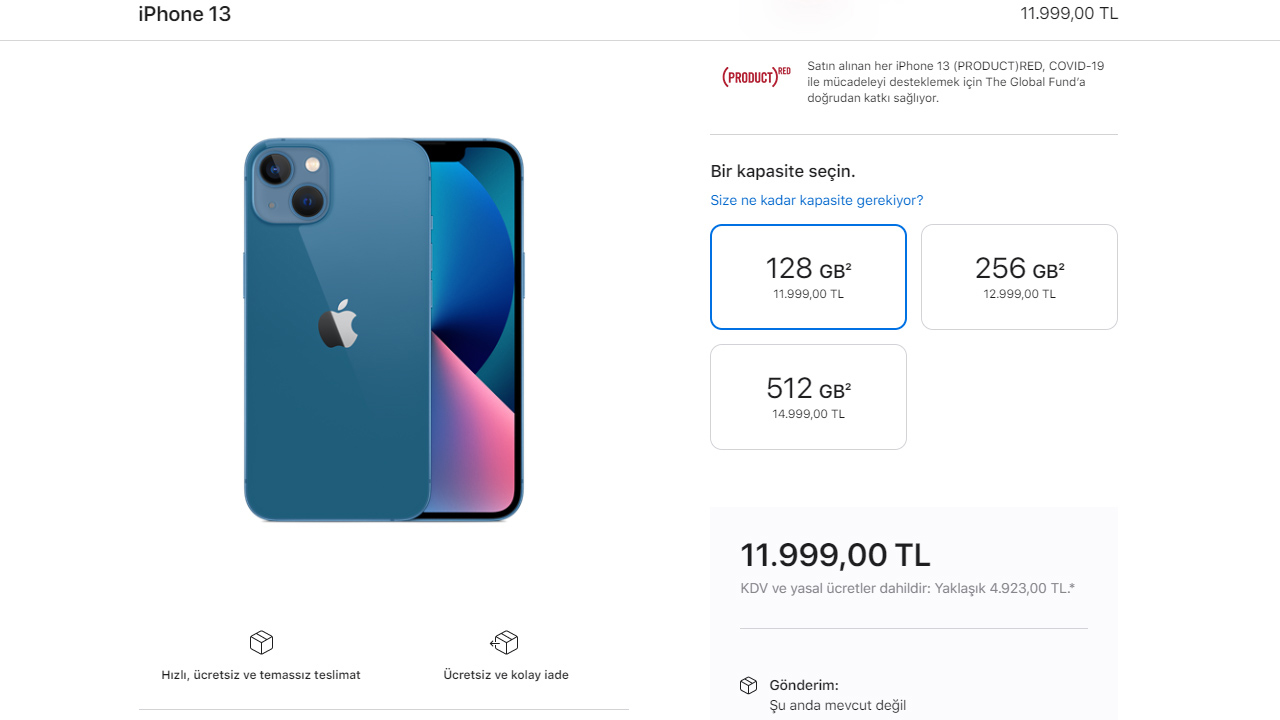

iPhone 13

For the 128GB version:

- Customs entry price: 5,096 TL

- Tax without excise duty: 1,579 TL

- Apple Turkey’s profit: 1,980 TL

- Sales price without SCT: 8,655 TL

- The difference is: 3.344 TL

For the 256GB version:

- Customs entry price: 5,334 TL

- Tax without excise duty: 1.653 TL

- Apple Turkey’s profit: 2,512 TL

- Sales price without SCT: 9,499 TL

- The difference is: 3.500 TL

For the 512GB version:

- Customs entry price: 5,810 TL

- Tax without excise duty: 1,801 TL

- Apple Turkey’s profit: 3,576 TL

- Sales price without SCT: 11,187 TL

- The difference is: 3.812 TL

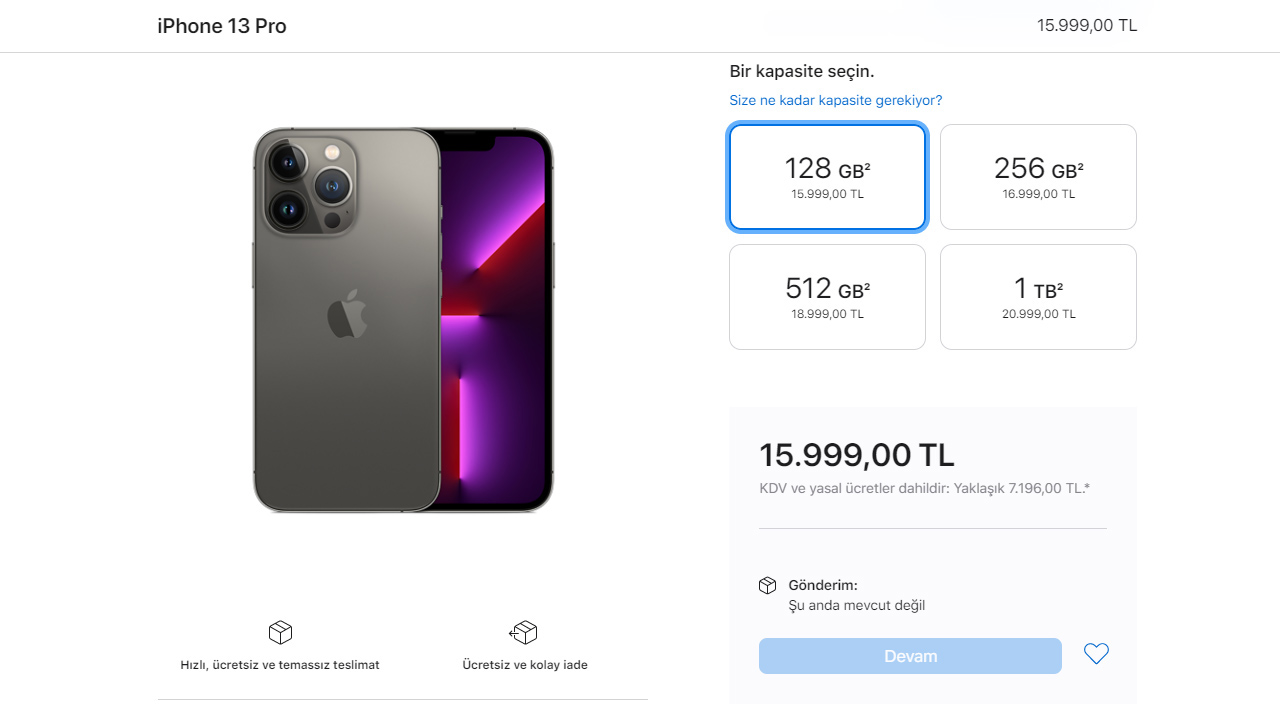

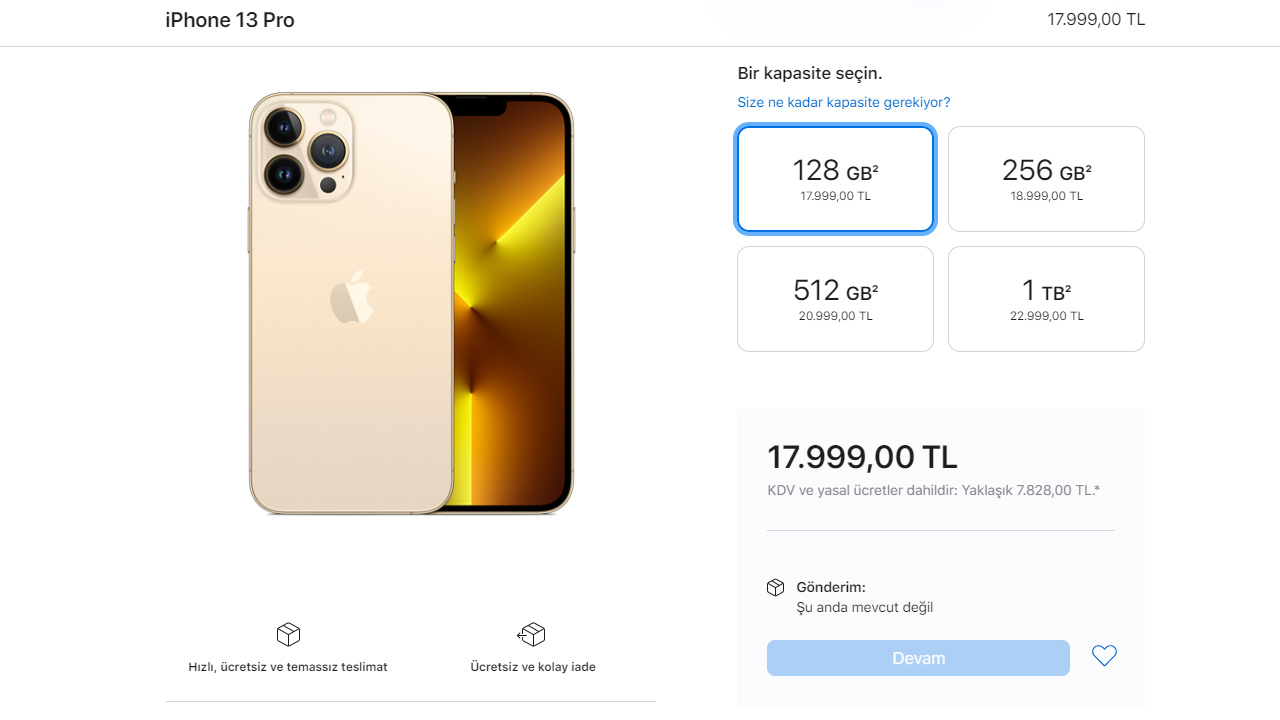

iPhone 13 Pro

For the 128GB version:

- Customs entry price: 7,449 TL

- Tax without excise duty: 2,309 TL

- Apple Turkey’s profit: 1,354 TL

- Sales price without SCT: 11.112 TL

- The difference is: 4,887 TL

For the 256GB version:

- Customs entry price: 7,706 TL

- Tax without excise duty: 2,388 TL

- Apple Turkey’s profit: 1,849 TL

- Sales price without SCT: 11,943 TL

- The difference is: 5,056 TL

For the 512GB version:

- Customs entry price: 8,218 TL

- Tax without excise duty: 2,547 TL

- Apple Turkey’s profit: 2,842 TL

- Sales Price without SCT: 13,607 TL

- The difference is: 5,392 TL

For 1TB version:

- Customs entry price: 8,928 TL

- Tax without excise duty: 2,767 TL

- Apple Turkey’s profit: 3,446 TL

- Sales price without SCT: 15,141 TL

- The difference is: 5,858 TL

iPhone 13 Pro Max

For the 128GB version:

- Customs entry price: 8.103 TL

- Tax without excise duty: 2,511 TL

- Apple Turkey’s profit: 2,068 TL

- Sales price without SCT: 12,682 TL

- The difference is: 5,317 TL

For the 256GB version:

- Customs entry price: 8,363 TL

- Tax without excise duty: 2,592 TL

- Apple Turkey’s profit: 2,557 TL

- Sales price without SCT: 13.512 TL

- The difference is: 5,487 TL

For the 512GB version:

- Customs entry price: 8,883 TL

- Tax without excise duty: 2,753 TL

- Apple Turkey’s profit: 3,535 TL

- Sales price without SCT: 15,171 TL

- The difference is: 5,828 TL

For 1TB version:

- Customs entry price: 9,605 TL

- tax without excise duty: 2,977 TL

- Apple Turkey’s profit: 4.115 TL

- Sales price without excise duty: 16,697 TL

- The difference is: 6,302 TL

Do not buy iPhone 13 without watching this video: