As in traditional markets, there is a funding rate in the futures section in crypto money markets.

We often convey that an increase in the funding rate is a correction signal. So what is this funding rate? Why do we need a correction when this rate rises?

We will explain the answers to these questions below. However, in summary, we can say that the “funding rate” is a balancing mechanism. At a point where the price balloons with excessive leverage and diverges from its true value, the bubble bursts and we are faced with a correction.

The “funding rate” we encounter in the crypto money markets are generally ongoing contracts that do not expire on a certain date.

Binance recently published an article on the funding rate and its effects on the market.

The following descriptions are translated from this article by Binance.

What is the Funding Rate?

Funding rates are periodic payments to traders holding long or short positions, depending on the difference between futures markets and spot market prices. Therefore, depending on open positions, traders will either make payments or receive funds.

Crypto funding rates prevent a permanent divergence in the prices of both markets. It is recalculated several times a day – Binance Futures does this every eight hours.

What determines the financing rate?

The funding rate consists of two components: the interest rate and the premium.

In Binance Futures, the interest rate is fixed at 0.03% (0.01% per financing window) on a daily basis, with the exception of contracts such as BNBUSDT and BNBBUSD, where interest rates are 0%. Meanwhile, the premium varies according to the difference between the futures contract price and the instant price.

During periods of high volatility, the price differential may increase. In such cases, the premium is increased or decreased accordingly.

When the funding rate is positive, the futures price is usually higher than the instantaneous price. Thus, long position traders pay for short positions. Conversely, a negative funding rate means that short positions pay for long positions.

How does it affect traders?

Because funding calculations take into account the amount of leverage used, funding rates can have a huge impact on an individual’s profits and losses.

With high leverage, a trader paying for funding can take losses and get liquidated even in low volatility markets.

Thus, traders can develop trading strategies to take advantage of funding rates and profit even in low volatility markets.

Essentially, funding rates are designed to encourage traders to take positions that keep futures prices in line with the spot markets.

Market sentiment and correlation

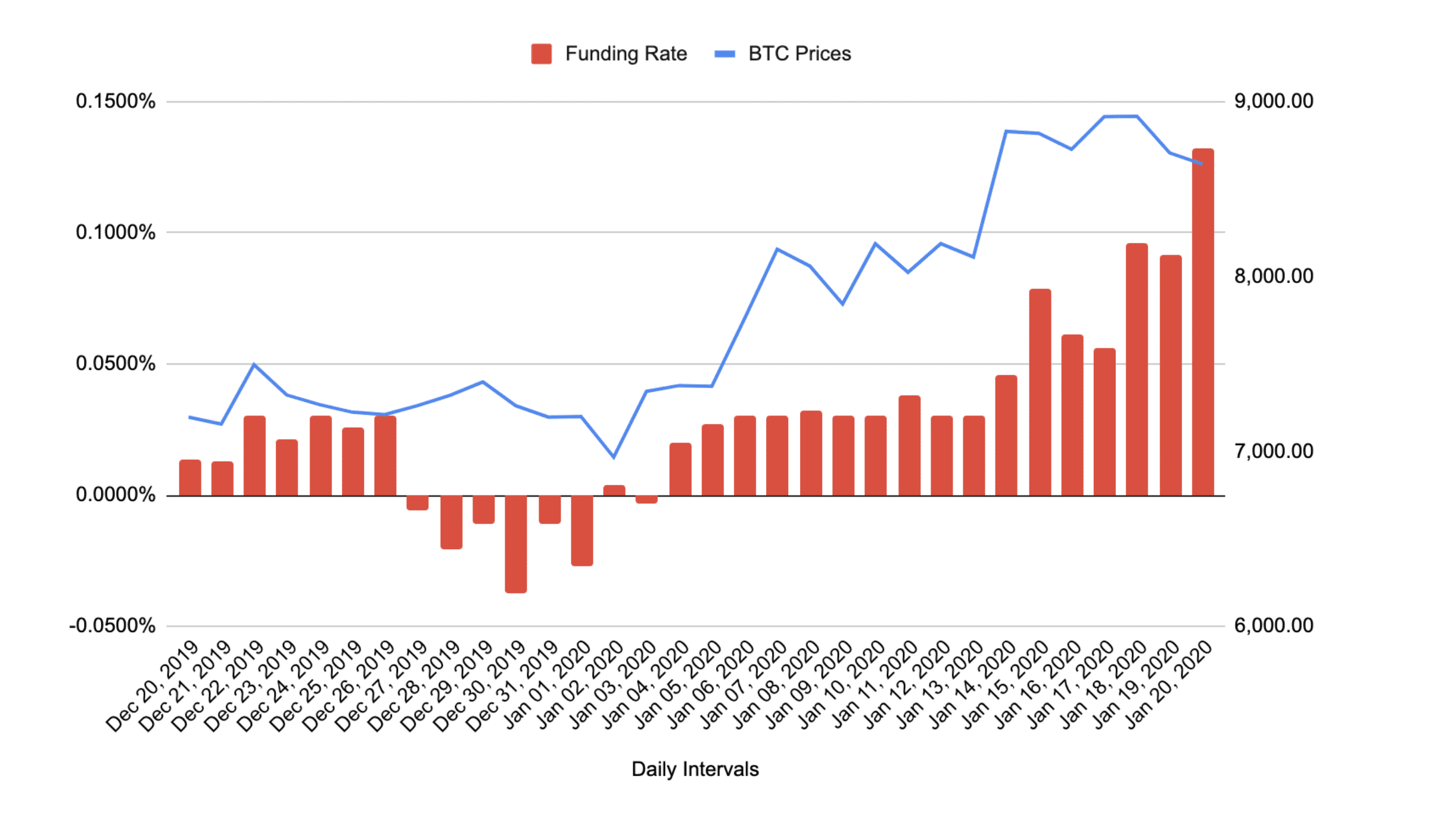

The chart below shows the relationship between funding rates and spot BTC prices over a 30-day period:

As the chart shows, funding rates have doubled as BTC prices have rallied since the beginning of the year.

Rising funding rates were a sign of confidence in more upside potential in the market. Still, many traders have noticed increased funding fees, helping futures prices align with the spot.

Conclusion

Crypto funding rates play an important role in the futures market. Most crypto derivatives exchanges use a funding rate mechanism to keep their contract prices in line with the index at all times. These rates change as asset prices rise or fall and are determined by market forces.