Balance sheet, which is a financial statement showing a company’s liabilities, assets, and other financial values for a given period; It is issued in order to inform the shareholders and investors of the company. Let’s see what the balance sheet, which is one of the most necessary tables for fundamental analysis, is, what it does and how it is prepared.

Trading is often a high risk and therefore a high return area. If the company in which this trade is made consists of many investors and shareholders, specific reports should be prepared about what is going on in the company. One of them, the balance sheet, is the its capital, debts, assets in a certain period It is one of the most important financial statements that shows the financial and other financial values in detail.

The prepared balance sheet shows the financial activities of the company for a certain period. So it is not a general truth. For this reason, when an economic analysis is required about the company in question, comparisons should be made between different balance sheets. The process of preparing the balance sheet and its details can sometimes be a bit complicated. Bride balance what is it, what does it do, how to prepare Let’s see the most frequently asked questions in detail.

What is a balance sheet, what does it do, what does it consist of and how is it prepared?

First, what is a balance sheet?

Balance sheet with its most basic definition; of a company’s liabilities, assets and equity for a given period It is a financial statement in which it is reported. With the balance sheet, which allows the investors to see the rate of return and the shareholders to see the capital structure of the company, it is clearly seen what the company owns and owes for that period. In this way, basic analyzes are made about the company and financial ratios are calculated.

What does the balance sheet do?

As it can be understood from its definition, the status of a company in a certain period can be seen through the balance sheet. How much debt does the company have, what are its assets, All the economic values that determine the financial structure of the company, such as the equity, are determined on the balance sheet. However, it should not be forgotten that the balance sheet only shows the financial structure of the company for a certain period.

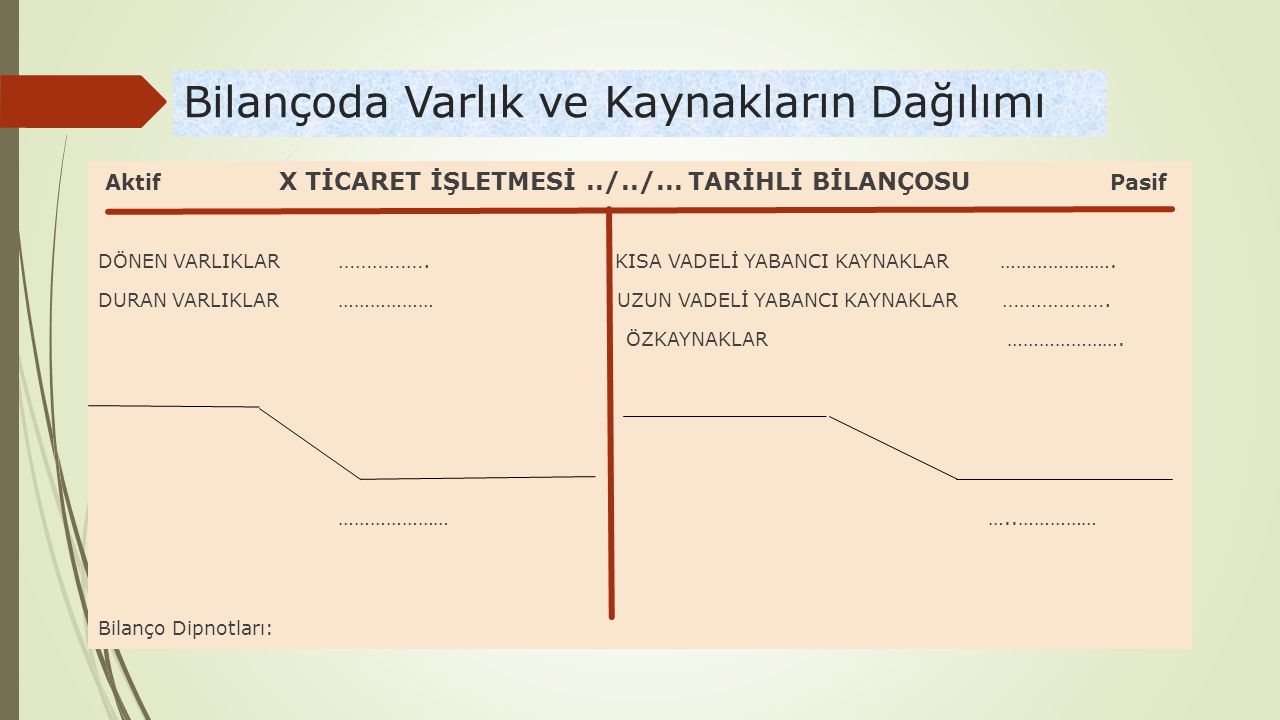

Not every company needs to have a lot of revenue to be considered successful. The important thing is that the assets, namely the debt-to-equity ratio, are healthy. Therefore, the balance sheet Assets = Capital + Liabilities It is prepared on the basis of a formula. The debt-to-equity ratio of the company in a certain period is clearly revealed through this financial statement. In this way, new investors and existing shareholders will be informed about the financial structure of the company.

What does the balance sheet consist of?

- assets

- debts

- equity

assets

One of the most important items of the balance sheet is the assets of the company. These assets are liquidity. They are ranked according to the ease of converting them into cash. assets; Current assets that will be converted into cash within a year or a short time are divided into non-current assets and long-term assets. Current assets are listed as follows;

- Treasury bills, short-term certificates of deposit, cash and similar most liquid assets.

- Securities such as stocks and debt securities that can be easily converted into cash.

- Accounts receivable, which refers to the money customers owe the company.

- Inventory denoting any commodity available for sale.

- Prepaid expenses expressing paid values such as insurance, rent, advertising contract.

Long-term assets are listed as follows;

- Investments that will not or cannot be converted into cash in the next year.

- Fixed assets denoting land, buildings, machinery, equipment and similar durable capital.

- Intangible assets that refer to property rights and similar intangible assets.

debts

Debts are money the company has to pay. Bond interest paid for bills, rents, public expenditures, salaries, foreign payments and the like; shown as a liability on the balance sheet. Debts; It is divided into short-term debts and long-term debts to be paid within one year.

Short-term debts are listed as follows;

- The current portion of long-term debt payable in that year.

- Interest payable, which expresses the interest on late paid taxes and similar payments.

- Prepayments received before service is provided or product delivered and will be refunded to the customer.

- Dividends payable for which payment has been authorized but not yet realized.

- Premiums reimbursable on incomplete deals.

- Invoices and similar debts to be paid within 30 days.

Long-term debts are listed as follows;

- Long-term debt that expresses the interest and principal on the bonds issued.

- Pension fund debts payable to employees’ retirement account.

- Deferred tax liabilities that have been accrued but will not be paid for one year.

equity

The money attributed to the owners and shareholders of the company forms the equity item of the balance sheet. They are net assets and are evaluated over total liabilities. Retained earnings considered in this context represent net earnings that the company reinvests or uses to settle debts.

A treasury share, which refers to a company’s repurchased share, is also equity. Can be resold for cash collection purposes or it can be used to prevent takeovers. Items such as common stock, preferred stock, and surplus capital are also items considered within the scope of equity in the balance sheet.

How and when is the balance sheet prepared?

The formula for preparing a balance sheet is simple; Assets = Capital + Liabilities

By applying this formula, the company balance sheet can be prepared in an easy way. Generally, balance sheets are prepared quarterly or annually. If requested by the board of directors or a similar audit structure, it can be prepared in different periods. The important thing is that this period is specified in the said financial report.

Many explanations and additional documents can be added to enlighten those who examine the prepared balance sheet. It is the decision of the preparing team to add explanations and documents. The more transparent the financial structure of the company is desired, the more detailed the items added to the balance sheet and the explanations added. Balance sheets are official documents for the company.

Why is balance sheet important for companies?

Just as we all get from time to time, what we give, do we need to take a loan? We calculate ourselves to see if we can pay off the debts; That’s exactly what companies do. Of course, the effects of this calculation are much wider in companies because company balance sheets are also shared with new investors.

Let’s consider a large company. The balance sheet is prepared so that the directors and shareholders of this company are aware of the financial situation. However The same balance sheet is also being reviewed by investors and analysts. In other words, the financial situation presented by the balance sheet may affect the company’s future loans, new investments and even its reliability in the market. Therefore, the balance sheet is extremely important.

Financial statement showing the financial structure of companies in a certain period What is a balance sheet, what does it do, how to prepare We talked about the details you need to know about the subject by answering frequently asked questions. The details of balance sheet preparation in our country are regulated in the Turkish Commercial Code.

RELATED NEWS