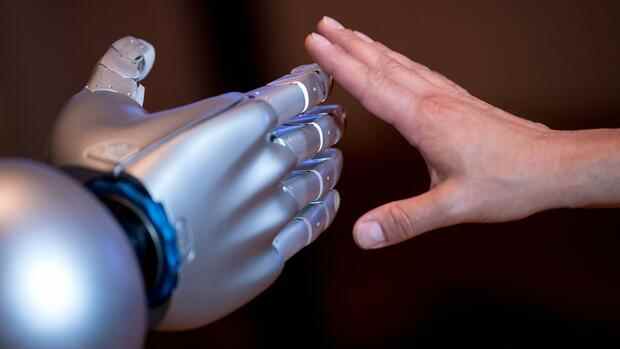

Investors can entrust their capital to a robo advisor. This automatically invests the customer’s capital, often with the help of algorithms.

(Photo: dpa)

Frankfurt Digital money managers have so far not been the focus of Germans. Robo-advisors are also vaguely known among people who use online banking, who have a certain amount of free investment capital at their disposal and who are definitely interested in the topic of investing. In order for such automated financial investment offers to come into question for them, they would have to cost little and be easy to use.

This is the result of an online survey by the company GapFish in Berlin on behalf of the robo-advisor Cominvest and Quirion among 1300 participants who have at least a net income of 1500 euros, at least 5000 euros of freely available investment capital and regularly use online banking.

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Continue

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Continue