There has been a low volume and a stagnant trend in the cryptocurrencies market lately. Many cryptocurrencies have continued their sideways movement over the past few weeks and the market has seen an overall low volume. This caused many investors to worry and created uncertainty about the future of the market. However, experts believe that the market will recover from this situation and will move again in the coming months. Crypto analytics firm Glassnode also reported that multiple on-chain metrics remain positive for Bitcoin (BTC).

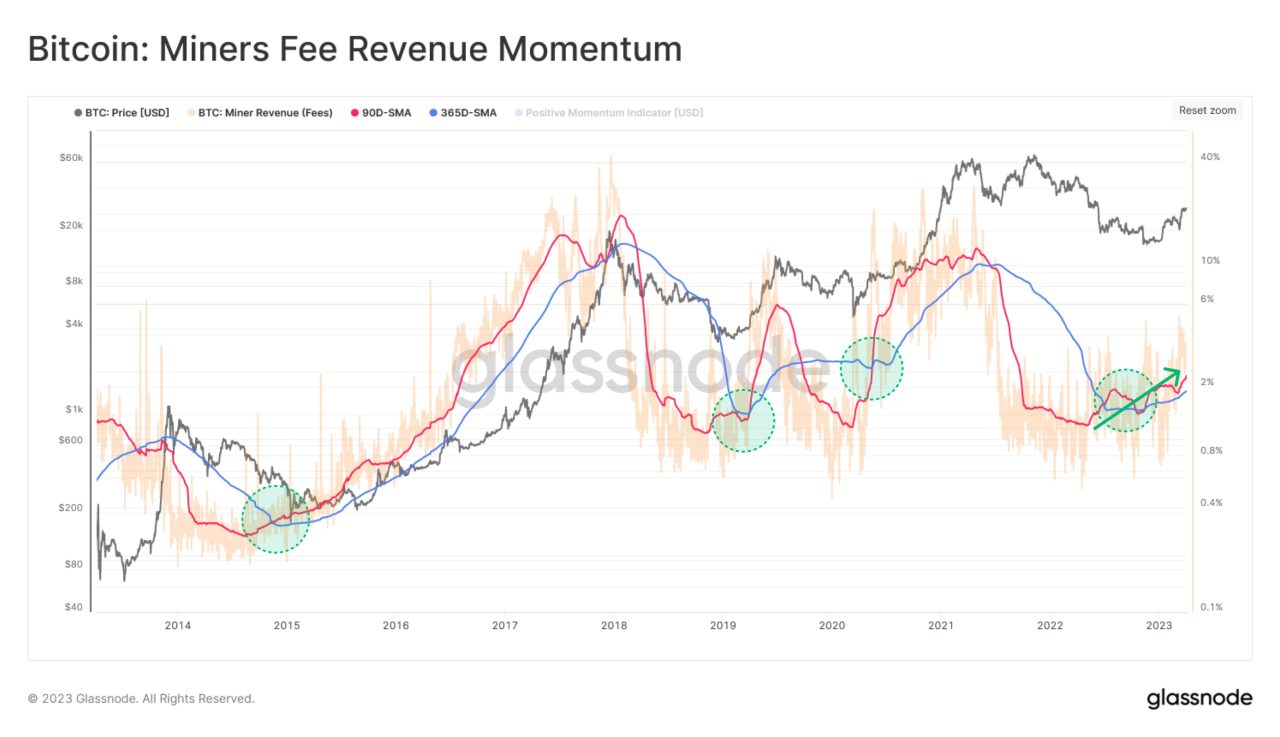

Glassnode’s data shed light on miners’ fee revenue momentum and its relevance to the emerging market. The metric reveals that the 90-day simple moving average (SMA) has crossed the annual SMA. took it out. According to the analytics firm, the metric is currently showing signs of increasing demand for Bitcoin.

“Currently, 90 days for fees [basit hareketli ortalama] exceeds the annual average, which indicates that new demand is entering the market.”

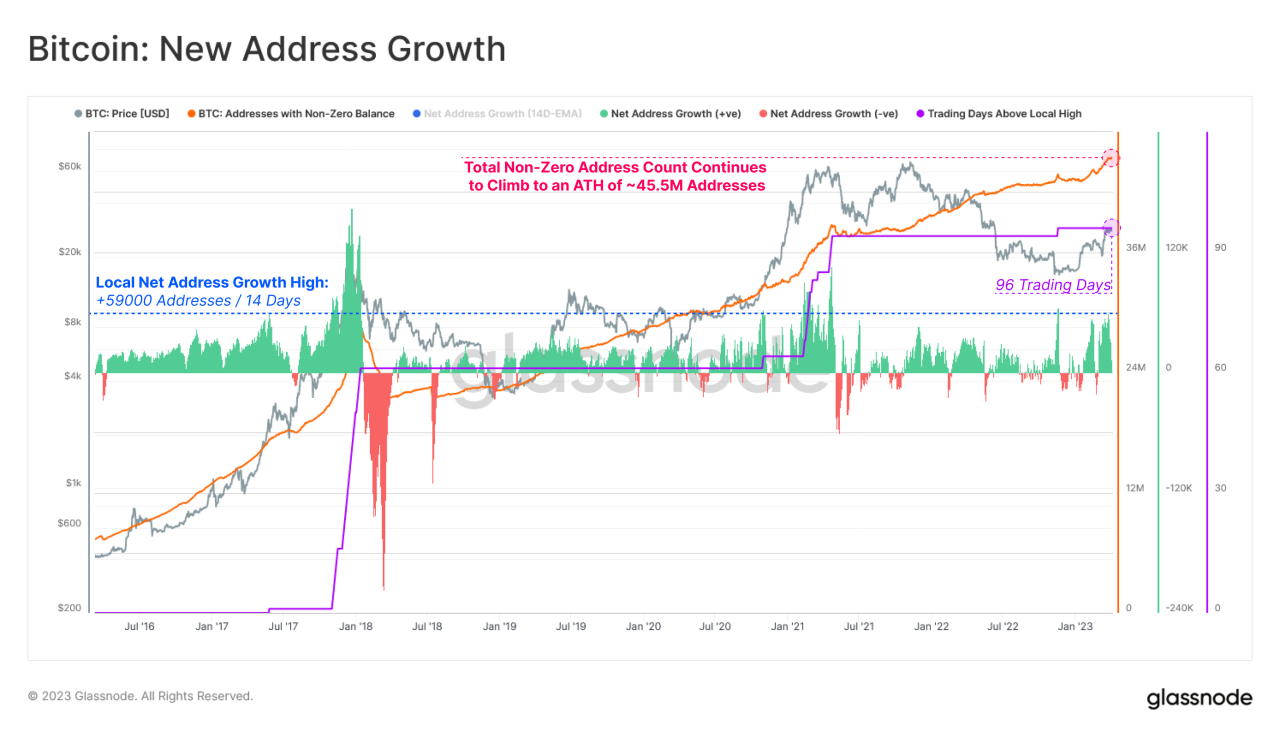

Glassnode also notes that the number of non-zero Bitcoin addresses has jumped to an all-time high of around 45.5 million.

“This indicates that the degree of on-chain activity is currently evolving.”

Koinfinans.com Additionally, as we reported, Santiment, a different analytics firm, says that Bitcoin traders are currently trading at a loss of twice the profit rate, which is actually an uptrend.

“This is the first time the ratio has been negative in five weeks and is actually a good sign that these FOMOs[fear of missing out]are giving up on the rally.”

Finally, at press time, Bitcoin is trading at $27,935. The top-ranked crypto-asset by market cap has dropped 0.46% in the last 24 hours and nearly 2% in the last week. BTC has risen more than 68% since the beginning of 2023.

You can follow the current price action here.