According to crypto analyst Lawrence Lewitinn, complaints can be heard about Bitcoin (BTC) in much the same way as Ethereum (ETH). Ultimately, the analyst states that while Ethereum has increased by about 500% since January 1, Bitcoin has only doubled in that time. Still, it was Bitcoin that became the fiat currency in one country and owned several futures-based exchange-traded funds (ETFs). cryptocoin.com We have compiled Lawrence Lewitinn’s analysis of Bitcoin and Ethereum in terms of spot and options markets for you.

“Both Ethereum and Bitcoin have shown surprising growth”

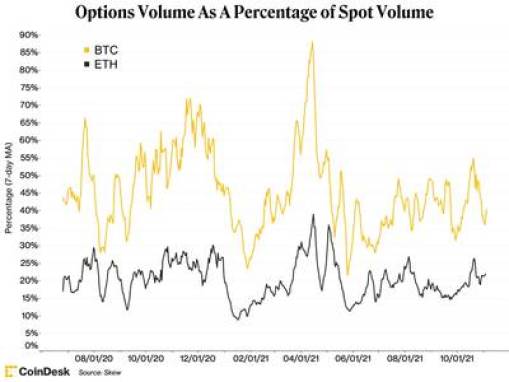

According to the analyst, comparing Bitcoin to Ethereum, even though they are in the same asset class, is equivalent to comparing apples to oranges for those with more than a cursory understanding of crypto. The analyst notes that the derivatives markets agree with at least one subtlety on the difference, which is the relative volume of Ethereum options relative to the spot market compared to Bitcoin:

This is important because higher option volume relative to spot is a sign of a mature market and can aid in price discovery. To be sure, both Ethereum and Bitcoin have shown surprising growth in both the spot and options markets over the past year.

According to figures compiled by provider Skew, the analyst says that in October 2020, Ethereum spot trade averaged $93 million per day for seven major exchanges, and a year later that averaged $1.6 billion per day. Meanwhile, the analyst recalls that options daily volumes rose to $335 million from just $23 million the previous year.

The seven Bitcoin and Ether spot exchanges tracked in this piece were Bitstamp, Coinbase, FTX, Gemini, ItBit, Kraken and LMAX Digital. Although exchanges like Binance are not included, one can get an idea of the relative size of each spot market.

According to the analyst, the Bitcoin market was even larger to begin with, with the October daily spot volume averaging $395 million in 2020, while the options market was $206 million. Fast-forwarding 12 months later, the analyst states that it was $2.2 billion and $989 million, respectively, and makes the following comment:

Still, when it comes to growth, Ethereum was the more impressive of the two. The spot market grew approximately 16 times and the options market approximately 15 times in one year. Bitcoin’s numbers gained “only” 5.7x and 4.8x, respectively. This is a dream for any market other than small potatoes compared to Ethereum.

According to the analyst, we are still in the early stages of the crypto derivatives market

However, the analyst states that looking at these figures, the relative size of the options market of each currency to its own spot market stands out. Again, the spot data reviewed are just a handful of exchanges where assets are traded. But these are some of the world’s largest exchanges, and their data is generally reliable. Therefore, the analyst says it helps in giving an idea of what is going on in the markets. The analyst shares that from mid-June 2020 to date, Bitcoin options volumes averaged 45% of the spot, while for Ether it was only 20%.

Just skimming, the analyst says that Bitcoin (BTC) options volumes by spot have remained in the range of 30% and 50% since June, and the market experienced a huge spike in options in April, almost competing with the spot market, even on April 8th. He states that he passed it. He also says that Ether’s options market appears to have more modest ranges, typically staying between 15% and 25% over the past five months. For those who care, the analyst adds that the standard deviation for the Bitcoin rate is 17%, while it has been 5% tighter for Ether since June 2020. Lawrence Lewitinn comments:

Of course, we are still in the early stages of the crypto derivatives market.

Deribit, an exchange, has the lion’s share of options trading for both Bitcoin and Ether. “We are still evolving,” said Luuk Strijers, chief commercial officer of the exchange, and predicts growth will be rapid as the market is still maturing. Stephen Ehrlich, CEO of brokerage firm Voyager Digital, agrees, saying that crypto options are similar to stock options two decades ago but will eventually catch up. Stephen Ehrlich shares his view:

I think it’s just a matter of time. As these products become easier to obtain and trade, you will see the volume grow. But we’re still a few years away from that happening.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.