The popular meme coin Dogecoin recently exploded after DOGE fan Elon Musk’s official Twitter logo was changed to Doge. It seems that whales see this price increase as an opportunity. Meanwhile, crypto whales have been found to have 3 altcoins on their radar.

Dogecoin whales quickly cash out their holdings

cryptocoin.comAs you’ve been following, Dogecoin recently experienced a price spike of over 25% after the official Twitter logo was changed to Doge, as fans rushed to buy the meme cryptocurrency. The rapid price surge allowed Dogecoin whales to take advantage of their low-value assets. These clever investors bought the frenzy, sending Dogecoin back to previous levels on Feb.

Dogecoin is trading at $0.0958, which is the same as the price increase on February 4, driven by a tweet by Elon Musk. Dogecoin’s recent price surge allowed it to surpass key technical resistance levels, including the 50 and 200 exponential moving averages.

The current price action can be attributed to the power and influence of social media on the cryptocurrency market. Investors who respond quickly to news and developments, such as the change in the Twitter logo, can quickly reap big profits. However, this presents an opportunity for whales to capitalize on market sentiment and benefit from their investments.

Whales quickly transferred large quantities of DOGE in the past 24 hours before breaking news broke out. The purpose is cash out, OTC trading or something else.

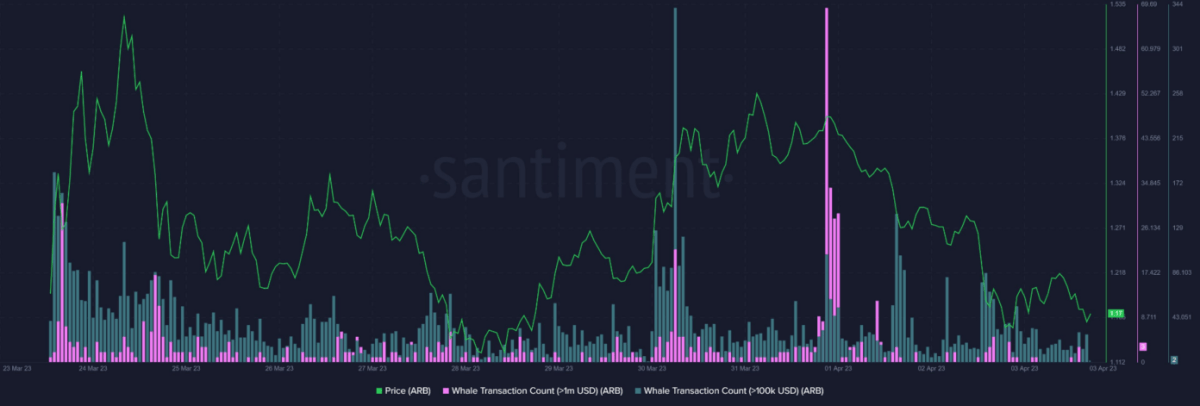

Arbitrum, whale activities escalate

In the midst of a volatile crypto market, Arbitrum has recorded a significant rise in the market cap rankings and currently ranks 39th. This is believed to be largely due to the platform’s ability to offer fast and inexpensive transactions.

Arbitrum’s climb in the market cap rankings has been impressive, but challenging. The whales caused significant fluctuations in the price of the platform’s native token, ARB, prompting the need for investors to be cautious and clarify the future of the project. However, despite these challenges, the Arbitrum community remains optimistic. By learning from the behavior of other tokens like APT and OP, the community made informed decisions and stayed ahead of the curve.

Arbitrum’s performance can also be attributed to the positive investor sentiment, which boosted Arbitrum ARB’s price and consolidated its position in the market. Its user-friendly interface, seamless integration with other Blockchain networks, and cost-effectiveness seem to have made it popular with developers and entrepreneurs creating decentralized applications. The platform’s popularity seems to be due to its ability to offer fast and affordable transactions, making it the preferred choice among traders and investors.

Whales bought millions of dollars of DYDX last month

Prominent crypto analyst Ali shared some information on the current buying habits of altcoin whales along with market sentiment on Twitter this morning. According to the post, whales have accumulated more than $24 million worth of DYDX over the past month.

The analyst believes this is worthy of consideration as the market sentiment surrounding DYDX is currently quite negative. Despite this, whales bought more than 10 million DYDX last month.

Looking at DYDX’s performance over the last 24 hours, CoinMarketCap shows that the altcoin is currently trading at $2.45 after a 4.35% price increase. The altcoin hit a high of $2.53 and a low of $2.36 in the same timeframe. Additionally, DYDX managed to strengthen by around 3.13% and 2.37% against Bitcoin (BTC) and Ethereum (ETH), respectively.

Whales bought 406 million LINK

Ali, a well-known crypto analyst at Twitter, has identified some key activities in the Chainlink ecosystem that can significantly affect price action. In a tweet, Ali detailed the on-chain data showing that approximately 406 million LINK tokens were purchased by 68,540 addresses.

Ali stated that addresses buy tokens at prices between $6.3 and $7. According to the analyst, this could have a technical impact on LINK’s future price behavior. Large buy orders around the indicated prices will represent a key support area that could prevent LINK’s price from falling lower.

LINK has rebounded from the local low of $5,900 after pulling back about 30% from the year’s high of $8,397, according to TradingView data. The price reached a new high on February 20, 2023, after a rally that started at the beginning of the new year and covered all the top cryptocurrencies in the crypto market. During the rally, LINK gained more than 51%, rising to a year high at $5,569. At the time of this writing, LINK was trading at $7,271, a few points above the upper limit of the big buy set by Ali.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.