Today at 21:00 Fed meeting minutes will be published. Before the release of the minutes of the meeting on July 26-27, we see that there was a slight pullback in the markets.

We had a mixed course in the US stock markets yesterday. US futures continue to trade with a negative premium today. bitcoinVolatility rose.

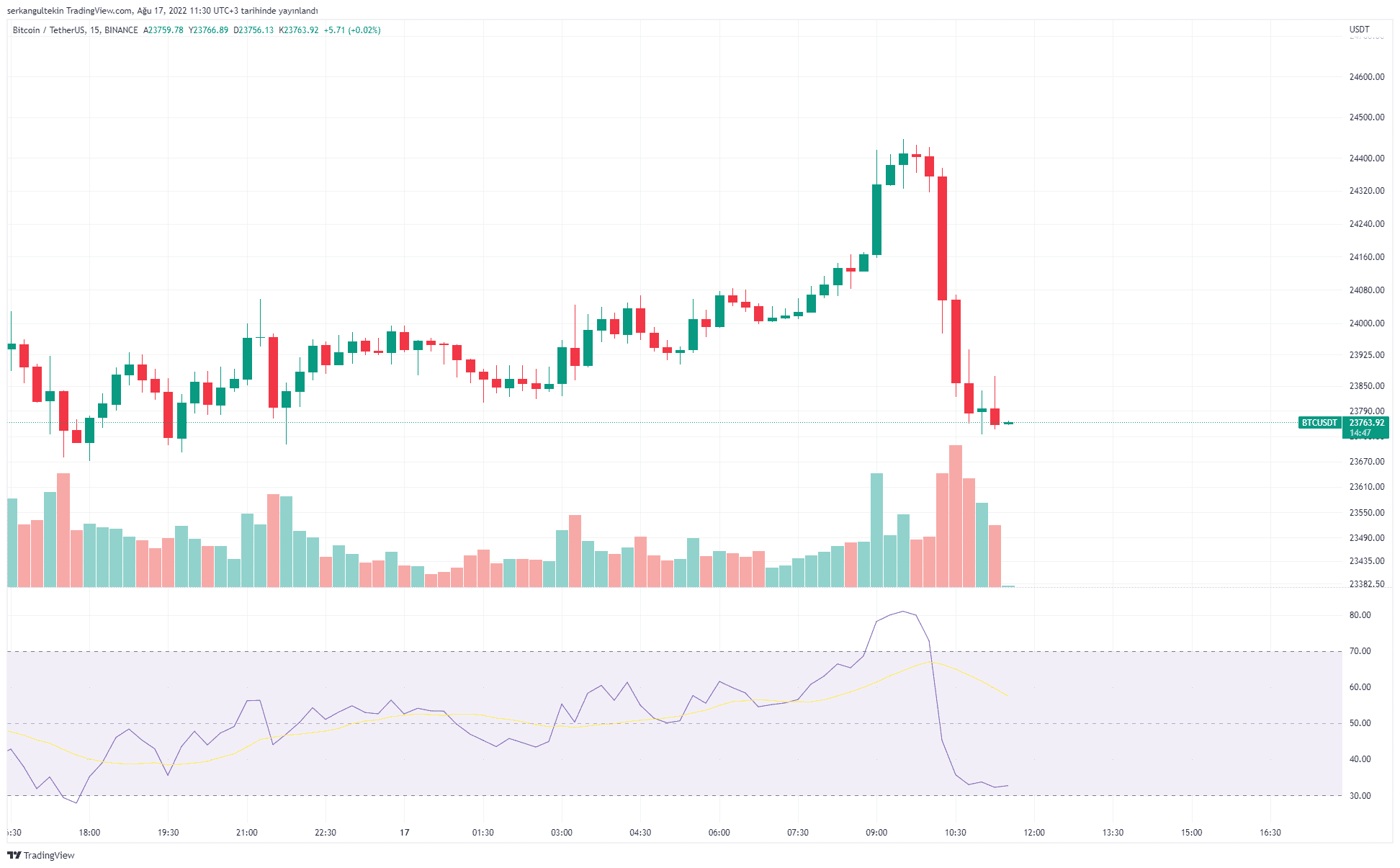

BTC, which went up to $ 24400 in the morning, regressed to $ 23700 with a 3% depreciation in the last 1 hour.

We see that there is a decrease in the commodity side before the FED minutes. Brent Oil while falling to $ 91.5 levels today, gold It continues to be traded at $ 1788 levels.

In today’s meeting minutes, new signals regarding the Fed’s interest rate policy will be sought.

As you know, FED members often emphasized that they would act based on data. Before the meeting, the minutes of which will be announced today, the US inflation peaked at 9.1%. For this reason, we can see hawkish statements about inflation risks in the meeting minutes.

After this meeting, inflation entered a downward trend for the first time and the final CPI rate was announced as 8.5%.

Unless there is a surprise in the meeting minutes impact on the market will be limited. we think.

What Did Powell Say?

At the meeting regarding the FED minutes to be announced today, a 75-point rate hike was made, and after the decision, Powell said:

“We are committed to lowering inflation and we are doing it. It is very important to bring inflation to our target of 2%.

We think that interest rate increases should continue. Rates of increase will depend on incoming data.

We are looking for convincing evidence that inflation will fall in the next few months.

Although some commodity prices have eased, additional upward pressures on inflation persist.

We made an extraordinary increase of 75 basis points. Such an increase may be appropriate at the next meeting.

There was broad support for this move at this meeting.

We do not hesitate to act larger and more aggressively if necessary.

Looking at the latest inflation increase, we made an aggressive move today.

The impact of interest rate hikes has not been fully felt yet.

The Fed also predicts rate hikes in 2023.”

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!