Uncertainty continues in all markets before the FED decision. Although the FED is not expected to increase interest rates at this meeting, the approach of the FED to this issue, which is faced with the highest inflation in the last 39 years, remains uncertain.

While criticism of Fed Chairman Powell, who has frequently emphasized that inflation is temporary in his previous statements, has increased, economists are wondering whether the FED will put forward the interest rate increase program that it plans to put into effect in 2023.

In the resolution text of the meeting, which started today and will continue until tomorrow, the evaluations and plans of the FED regarding inflation will be followed closely.

At this point, the answer will be sought whether the FED, which has reduced the asset purchase program with its previous decisions, will accelerate this program.

While the markets focused on the statements from the FED, the US markets opened with sellers today. The losses in the Nasdaq, which includes especially risky products and technology stocks, increased to 1.3%. Although the losses in Dow Jones and S&P 500 are more limited, we observe that the effect of the FED tension on the markets continues.

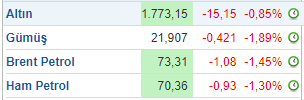

While there is a sale in the commodity group as well as the US stock markets, we observe that the Bitcoin and crypto money markets are positively differentiated today.

Looking at the Bitcoin side, we see a price trying to stay above $47,000. The positive divergence of Bitcoin, which continues to be traded at a premium of 1.44% on a daily basis, caused a slight relief in altcoins.

*Not Investment Advice.