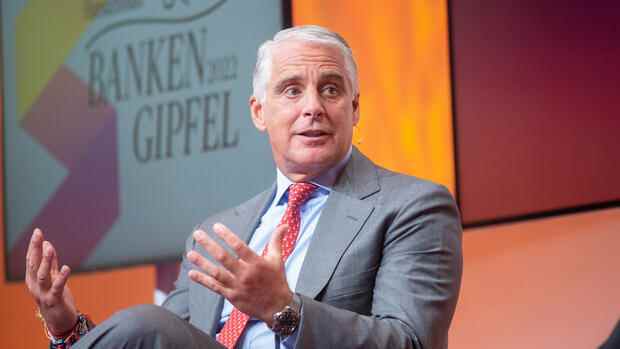

Frankfurt “We are all expecting a recession,” says Andrea Orcel at the Handelsblatt Bank Summit. The only question is how strong it will be. “It all depends on a series of political decisions and the war in Ukraine,” says the CEO of major Italian bank Unicredit. Based on the current indicators, he believes that the recession will be rather shallow in the coming year and that the economy will recover quickly in 2024.

For him, the debate is not about whether the central bank will raise interest rates by 50 or 75 basis points. “The question is how to proceed after that,” says Orcel. He expects interest rates to settle at around 2 percent. “If the ECB goes much further, it could have damaging effects on the economy.”

Orcel is more relaxed about the parliamentary elections in Italy at the end of September – although the polls are showing a clear right-wing majority. “I don’t think we will have an extreme right-wing government, but a centre-right government.”

Top jobs of the day

Find the best jobs now and

be notified by email.

Whoever governs Italy after September 25 will not touch the reforms started by Prime Minister Mario Draghi. “The reforms and the Corona reconstruction fund will continue to be implemented,” Orcel is convinced. Too many investments depended on it, around 200 billion euros. “This will not derail any government.”

Currently no environment for takeovers

The head of the Hypovereinsbank parent company does not see a new euro crisis coming up either. “We believe that the political risk for Italy is currently overestimated.” The national debt is still high, but also declining – recently the debt in relation to economic output fell from 155 to 151 percent.

At the end of this year, the figure will be 148 percent. “In addition, there is the wealth of the Italian families, which at a good ten trillion euros is the highest value in Europe,” emphasizes Orcel. Corporate cash deposits have also increased this year.

He remains optimistic about the development of his banking group. “We are still in line with our plan.” The focus was on increasing sales, reducing costs and maintaining “very strict risk discipline”. The hard equity ratio is 15.78 percent. “We are in a strong position to weather the recession,” says Orcel.

When asked about takeovers, Orcel declines. “We need stable markets for this. Carrying out an M&A transaction in the current market environment is very complicated.” On top of that, a coherent regulatory and legal environment is needed that enables synergy effects. “I believe that there will be further consolidation in Europe, but not only the banks have to want it, the framework conditions have to be different than today.”

Unicredit’s complicated business in Russia

A perennial rumor in the banking scene is that Unicredit will take over Commerzbank. “I’m not going to talk about competitors or friends,” says Orcel. However, he sees much more potential at Unicredit for organic growth.

In addition, every deal must offer the group added value. “If you look at deals in the past, most of them were made at prices that destroyed value,” Orcel points out.

In most of the markets where Unicredit’s market share is less than 20 or even 15 percent, acquisitions made sense. “But only under the right conditions and at the right time.”

>> Read here: The live blog from the Handelsblatt Bank Summit in Frankfurt

In contrast to many other European banks, Unicredit is sticking to its Russian business for the time being. Cross-border business has already been drastically reduced. “It’s much more complicated with the local presence because it touches people,” says Orcel.

Unicredit has 4,000 employees on site. In addition, there are 1,500 corporate customers in Russia, of which around 1,250 are European. “Companies are also trying to pull out of Russia and we are committed to helping them do business.”

More: Deutsche Bank CEO Christian Sewing: Germany must become more independent of China