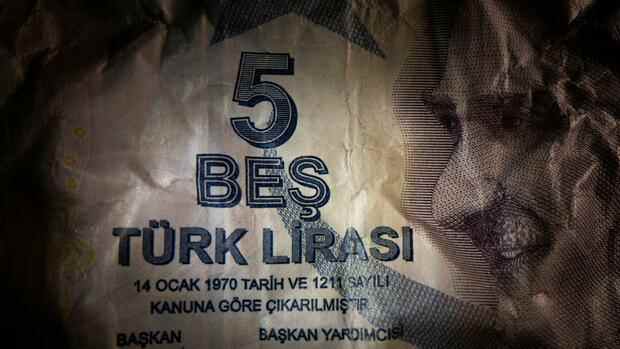

The currency has come under further pressure in the past few months.

(Photo: Reuters)

Istanbul The Turkish central bank fueled concerns about a further decline in the national currency and higher inflation: The central bankers cut the key rate on Thursday from 16 to 15 percent. Governor Sahap Kavcioglu has thus cut interest rates for the third time in a row – despite an inflation rate of almost 20 percent.

The decision was expected by economists. The Turkish lira fell by more than two percent after the announcement at 2 p.m. local time. The Turkish national currency fell to 10.9764 lira against the dollar and as much as 12.4533 lira against the euro – both are highs. The largest exchange in the country, the Borsa Istanbul, turned slightly into the red after the announcement from Ankara.

As a result of the interest rate cut, the key interest rate is almost five percentage points below the inflation rate of 19.9 percent, which means that the real interest rate is clearly in the negative range. This makes Turkey even less attractive for investors.

It is true that entrepreneurs can take out loans more easily and those Turkish companies that export to the dollar or euro area also benefit, since their products are cheaper abroad. However, liabilities in foreign currencies are also increasing. Imported products are becoming less affordable in view of the steep rise in prices.

Top jobs of the day

Find the best jobs now and

be notified by email.

This dangerous spiral has hit especially the socially disadvantaged as well as the middle class of the country. It is they who have become prosperous since the current President Recep Tayyip Erdogan took office almost 20 years ago. Now they are groaning under the ever increasing prices for food and the ever higher electricity and gas bills.

Erdogan wants to fight the “interest rate plague” in Turkey

The president repeatedly interferes directly in the country’s monetary policy. Under his pressure, the monetary authority has cut its key interest rate in two unexpected, consecutive steps by 300 basis points to 16 percent since September.

Erdogan himself said on Wednesday in front of the parliamentary group of his Islamic conservative ruling party AKP in Ankara: “We will take the interest plague off the shoulders of our people” – thereby repeating his unorthodox mantra that interest rates are the cause of higher consumer prices.

“We are definitely not going to let interest rates bring our people to their knees,” he said. “As long as I am in this position, I will continue my fight against interest rates until the end. And I will continue my fight against inflation. ”He could not work with proponents of high interest rates. The problem: With this attitude he pisses off those who once voted for him.

Low interest rates paired with high inflation and Erdogan’s constant intervention are shaking investors’ confidence in Turkey. This has been evident for months in the course of the Turkish lira, which has tumbled from one record low to the next in the past few days.

The lira has lost almost 30 percent against the dollar this year and more than 15 percent in this quarter alone. The currency thus has the worst performance of all major currencies recorded by Bloomberg.

The President doesn’t seem to care: He is sticking to his line – and also complains that investors ran away despite negative real interest rates. “What kind of people are you?” He said on Wednesday.

More: Why German companies earn well in Turkey.