Certain altcoins, including Bitcoin and DOGE, continue to face higher sell-offs, a sign that the bears are not giving up yet. Is it possible for BTC and these altcoins to rise above their resistance levels and continue to rise? Crypto analyst Rakesh Upadhyay examines the charts of the top 10 cryptocurrencies to find out.

An overview of the cryptocurrency market

cryptocoin.comAs you follow, the cryptocurrency market witnessed a sharp surge on April 26, amid rumors that massive amounts of Bitcoin were released. BTC, defunct cryptocurrency exchange Mt. Gox and was on the move from wallets linked to the US government. A small positive development is that Bitcoin and certain altcoins maintain their own support levels.

After Bitcoin’s sharp rally in 2023, some traders seem to be planning to book profits. Coinglass reports that the balance of Bitcoin held on Binance has increased by 50,000 Bitcoin in the past 30 days. This has increased the short-term pressure. However, the bulls may find solace as the increase is not uniform across exchanges. Coinglass said the total increase in Bitcoin balance across exchanges was 14,000 Bitcoins.

The next major event for the market will likely be the Fed’s meeting on May 2 and 3. The FedWatch Tool predicts a 25 basis point rate hike with a 90% probability at the meeting. Most analysts expect this to be the last rate hike before a pivot later in the year.

BTC, ETH, BNB, XRP And ISLAND analysis

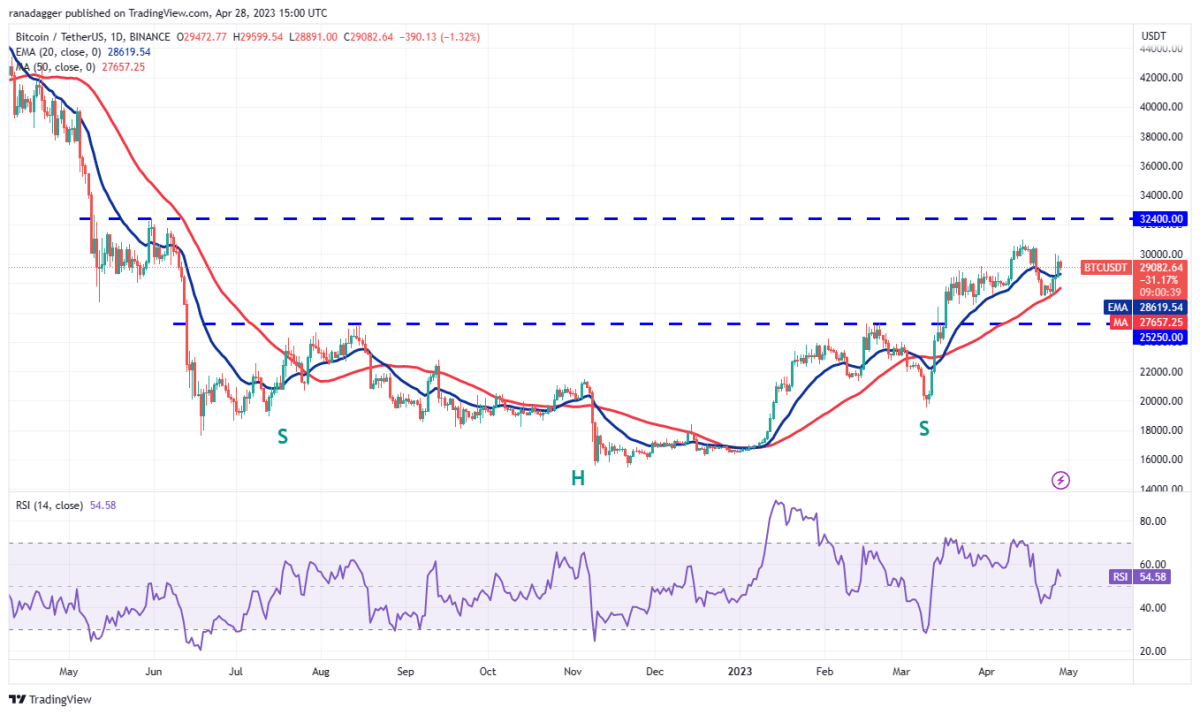

Bitcoin (BTC): Indecision between bulls and bears

Bitcoin formed a long-legged doji candlestick pattern on April 26. Thus, it signaled indecision about the next directional move between the bulls and bears. This uncertainty was resolved on the upside with a close above the 20-day exponential moving average ($28,619) on April 27.

The bears are trying to push the price below the 20-day EMA. The bulls will try to turn the level to support. If the buyers are successful, BTC will attempt to challenge the overhead resistance zone of $31,000 to $32,400. This region is likely to be the scene of a fierce battle between bulls and bears. Contrary to this assumption, if the price drops and dips below the 20-day EMA, it will indicate that sentiment has turned negative and traders are selling in rallies. It is possible for BTC to retest strong support at the 50-day simple moving average ($27,657) later. A break and close below this level is likely to open the doors for a decline to $25,250.

Ethereum (ETH): Bears try to stop the recovery

The bulls have kicked ETH. Thus, ETH broke above the 20-day EMA ($1,905) on April 26 and 27. However, it did not reach the psychological level of $2,000. This suggests that the bears are trying to stop the recovery below $2,000.

The 20-day EMA has flattened and the RSI is near the midpoint. This shows that there is a balance between supply and demand. This indicates that a range can be moved between $2,000 and $1,785 for a few days. If this happens, it will be a positive sign. Because it will show that the bulls are in no rush to split their profits. This will increase the likelihood of a potential rally to $2,200. This positive view will be invalidated if the price drops below $1,785. A further drop to the 61.8% Fibonacci retracement level to $1,663 is possible for ETH.

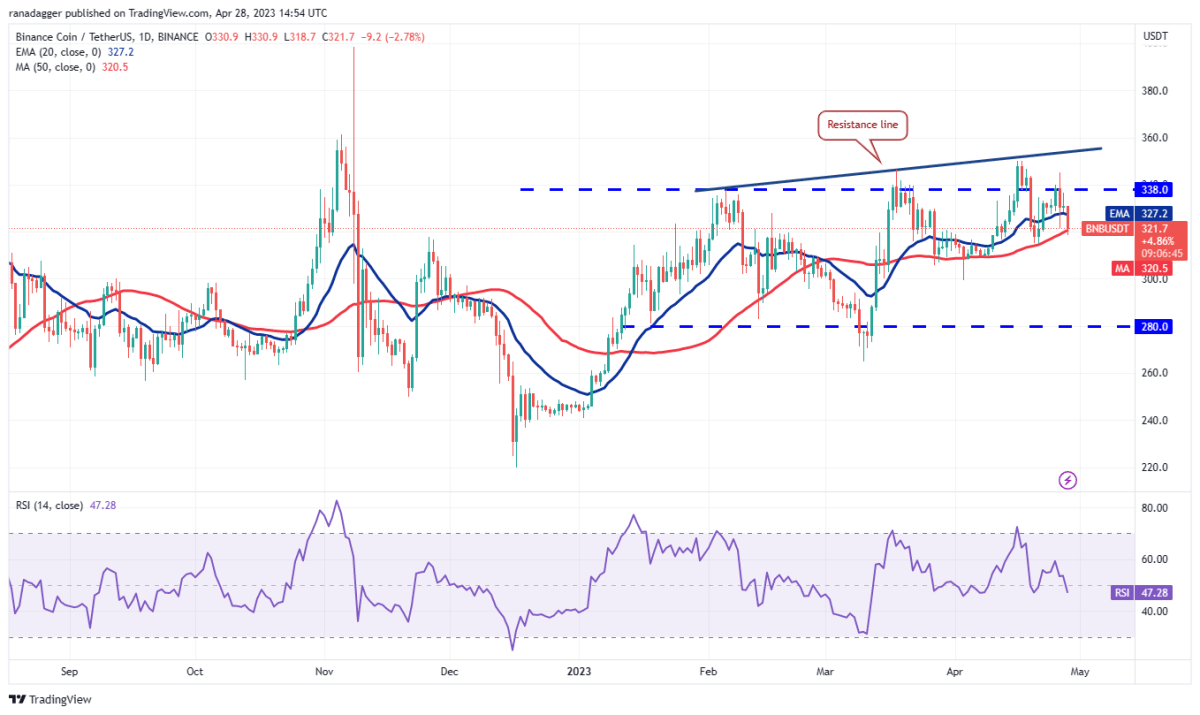

Binance Coin (BNB): Bulls failed to maintain highs

The bulls supported BNB and pushed it above the overhead resistance of $338 on April 26. However, it failed to sustain higher levels as seen by the long wick on the day’s candlestick.

The bulls tried to break the $338 barrier again on April 27. But the bears did not move. Selling gained momentum on April 28 and the bears are trying to push the price below the 50-day SMA ($321). If they are successful, it is possible for BNB to drop to $300 and then to $280. Instead, if the price rebounds from the current level, it will show that the bulls are not giving up and are buying on the dips. The bulls will need to clear the $350 hurdle to signal the start of a new uptrend towards $400.

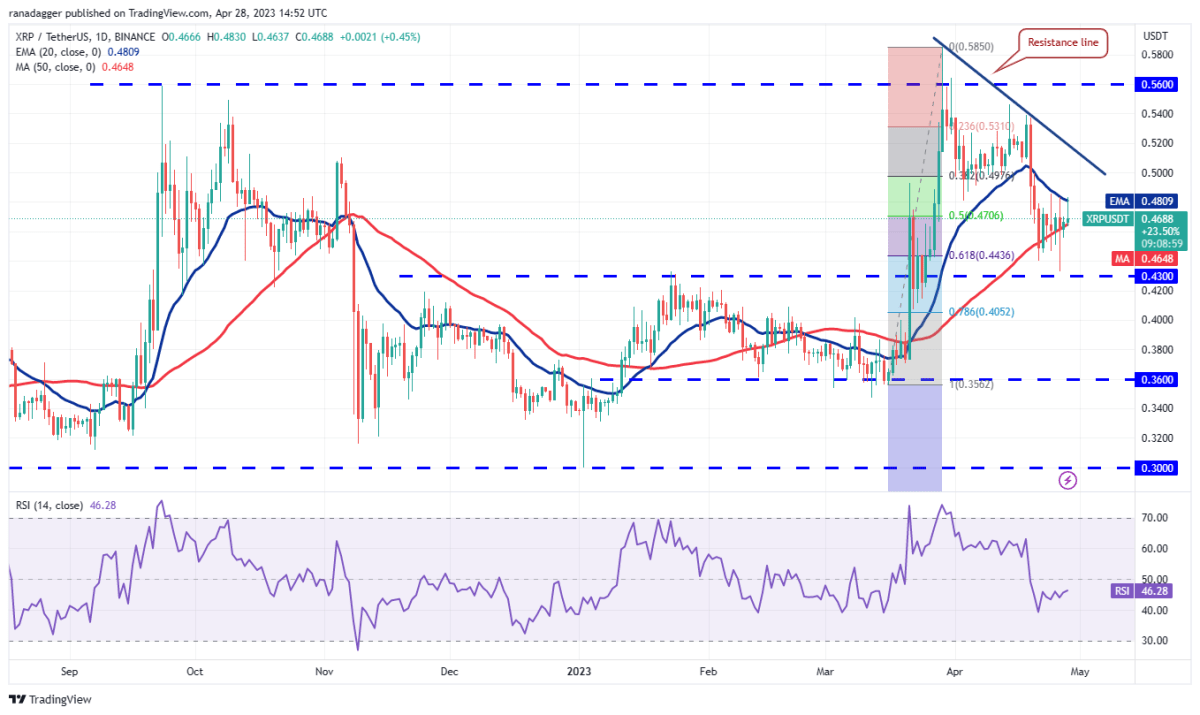

Ripple (XRP): Bulls are fiercely holding this level

The bounce of XRP from the $0.43 support on April 26 shows that the bulls are fiercely holding this level.

The price has reached the 20-day EMA ($0.48), which is an important level for the bears to defend in the near term. If the price turns down from this level, sellers will again try to push the price below $0.43. If they do, XRP is likely to drop as low as $0.36. On the contrary, if the buyers push the price above the 20-day EMA, it is possible for XRP to reach the resistance line. A break and close above this level will mark the end of the short-term corrective phase. XRP will then attempt to rise to $0.54 and then to $0.58.

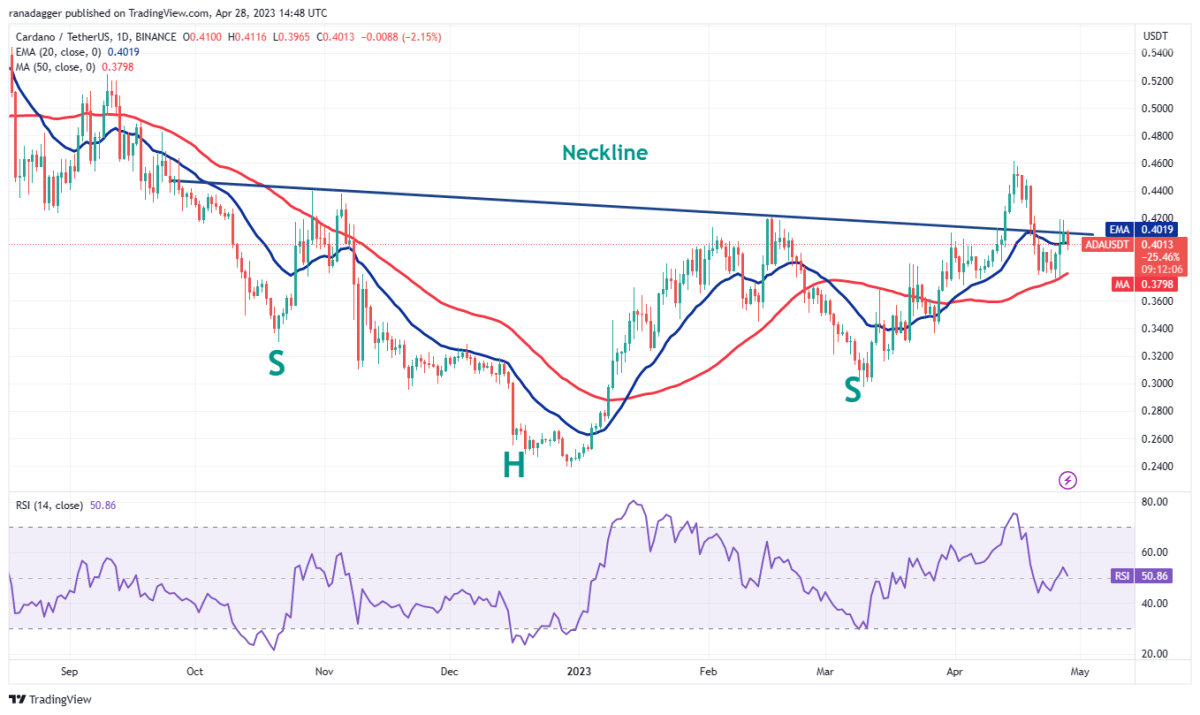

Cardano (ADA): Buyers try to start recovery

Cardano’s rebound from the 50-day SMA ($0.38) on April 25 and 26 suggests that buyers are attempting to start a recovery from this support.

ADA has reached the neckline of an inverse head and shoulders pattern where the bears are trying to stop the recovery. If the buyers outrun the sellers and keep the price above the neckline, the pair will rally to $0.46. Conversely, if the price turns down from the neckline, it will show that the bears are trying to prevent the reversal pattern from forming. Sellers will then make another attempt to push the price below the 50-day SMA. If they do, it is possible for ADA to drop as low as $0.34.

DOGE, MATIC, SOL, DOT and LTC analysis

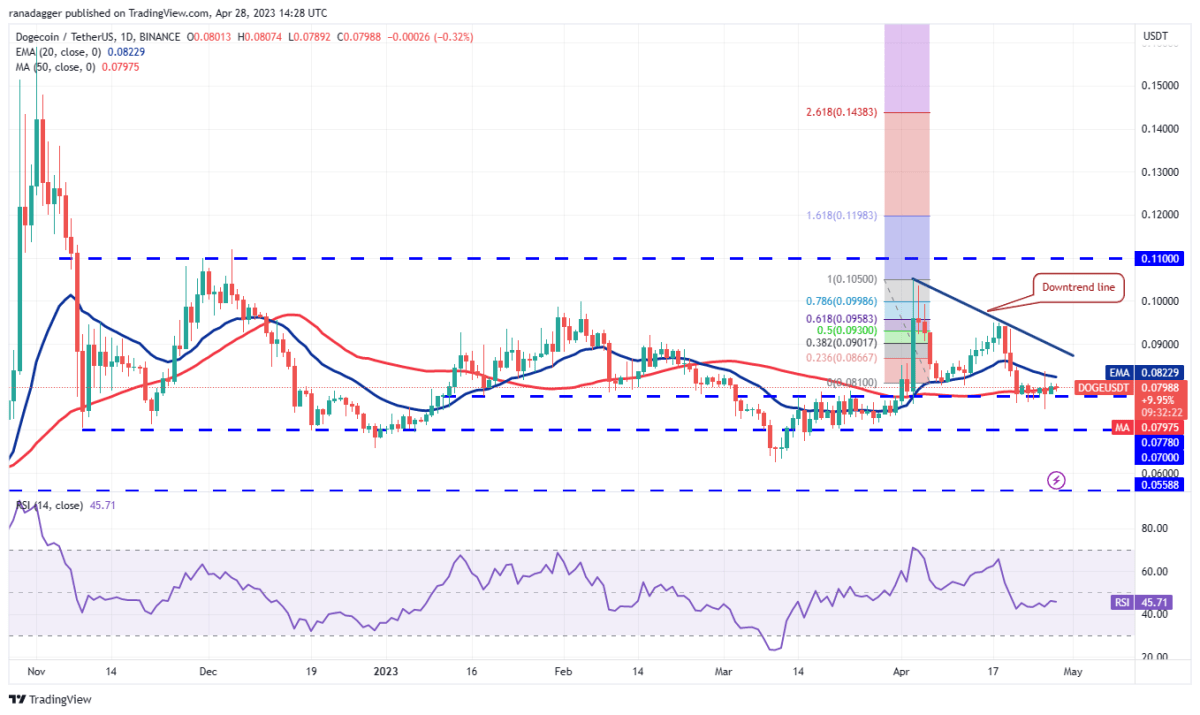

Dogecoin (DOGE): Buyers bought the dip

The bears pulled DOGE below support as low as $0.08 on April 26. However, he was unable to build on this decline. Buyers bought the drop. Thus, on April 27, DOGE pushed its price back above the 50-day SMA ($0.08).

The next resistance to watch out for is the 20-day EMA ($0.08). Then the downtrend line. Buyers will need to push the price above the downtrend line to clear the way for a possible rally to the $0.10 to $0.11 resistance zone. In the meantime, the bears are likely to have other plans. They will try to push DOGE price below the support near $0.08. If successful, DOGE could slide to vital support around $0.07. The bulls are likely to hold this level with all their might.

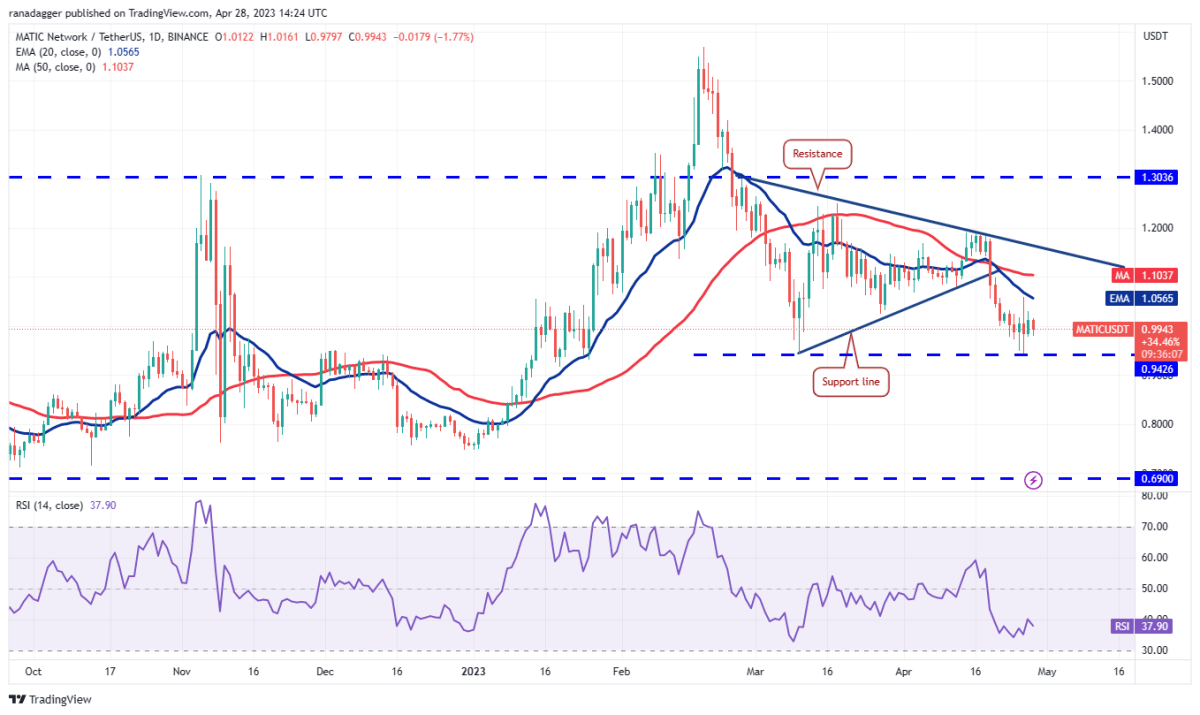

Polygon (MATIC): The bears haven’t given up yet

The long tail on the MATIC 25 and 26 April candlestick shows that the bulls are fiercely defending the $0.94 support, but the bears are not giving up yet.

The falling 20-day EMA ($1.05) and the RSI in the negative zone point to the bears’ dominance. Sellers will try to stop the recovery in the region between the 20-day EMA and the resistance line. If the price turns down from the resistance line, it will signal the formation of a potential descending triangle pattern that will be completed once it breaks below $0.94. If this support is broken, MATIC risks falling as low as $0.69.

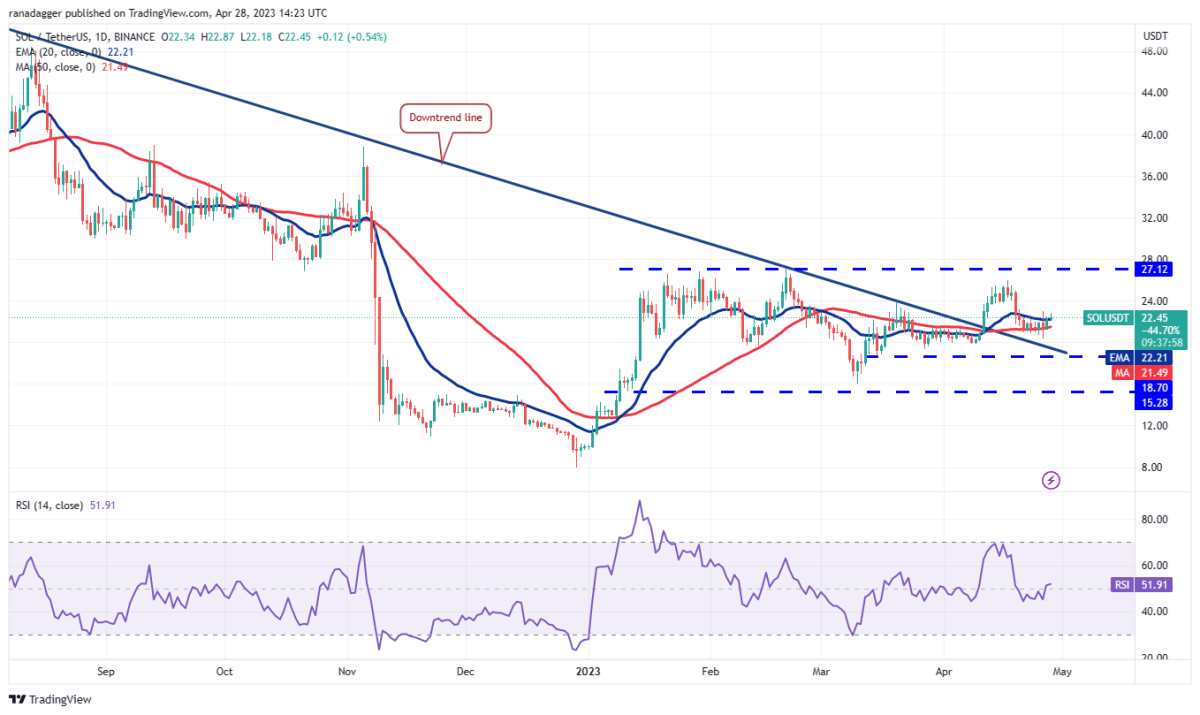

Solana (SOL): Bulls try to resolve uncertainty in their favor

Solana tried to exit narrow range trading on April 26. However, it failed. The bulls are again trying to resolve the uncertainty in their favor on April 28.

If the price rises above the $23.18 immediate resistance, it will signal that the bulls are absorbing supply. The SOL will then attempt to rally towards the hard overhead resistance of $27.12, the key level that the bulls must overcome. If they do, the SOL is likely to start a fresh bullish move and move higher to $39. If the bears want to prevent the rally, they will need to quickly push the price below the $18.70 support. It is also possible for this to drop the SOL to the next support at $15.28.

Polkadot (DOT): Seeking buyers at lower levels

The bears successfully defended the moving averages on April 26. However, it failed to sustain the decline below the $5.70 support. This shows that Polkadot has found buyers at lower levels.

The DOT could oscillate between $5.70 and the 50-day SMA ($6.20) for a while. If the consolidation is resolved to the downside, it is possible that the selling will intensify and the DOT drops to $5.15. This level is likely to attract buyers. Alternatively, if buyers push the price above the 50-day SMA, it will indicate that the bulls are in a reversal. The DOT can climb to $7 first and if this resistance scales, the rally could extend to $7.90.

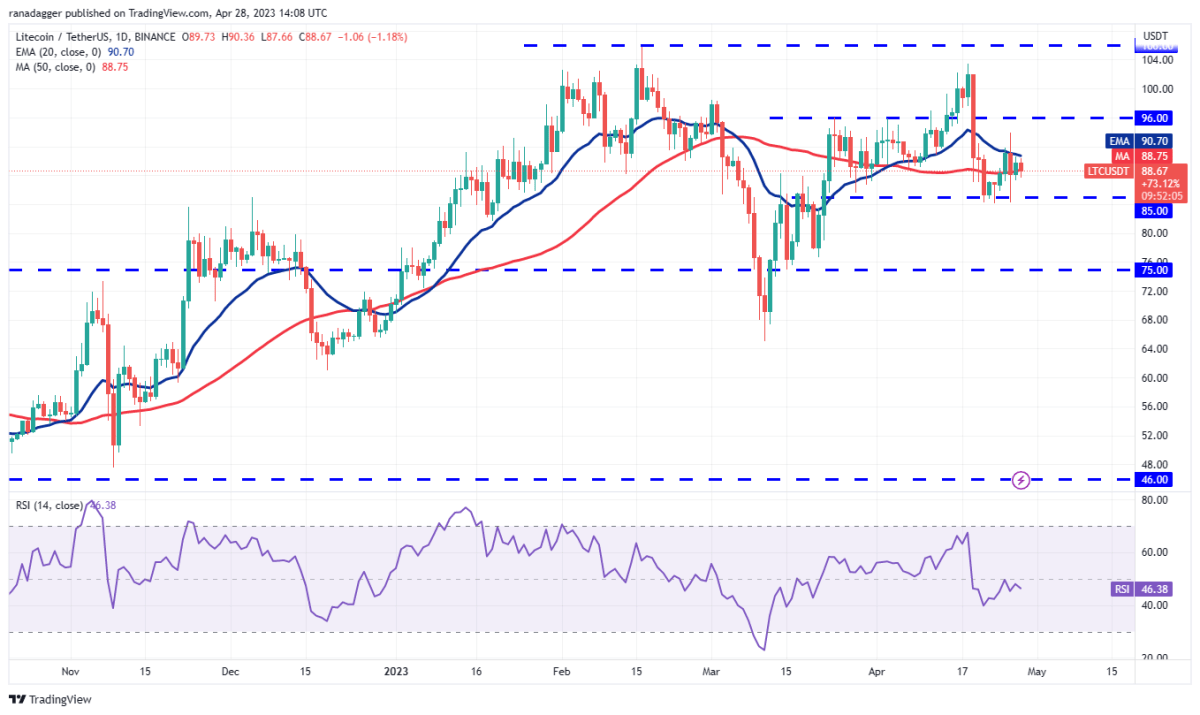

Litecoin (LTC): Bulls and bears failed to take full control

Litecoin witnessed an extremely volatile day on April 26, which saw bulls and bears try to gain full control but failed.

Usually, days of major volatility are followed by a range contraction of several days. The flat moving averages and the RSI just below the midpoint suggest a range-bound move in the near term. LTC is likely to fluctuate between $85 and $96 for a while. A break above $96 or below $85 will initiate the next leg of the trend move. If the bears sink the price below $85, it is possible for LTC to drop as low as $75. On the other hand, a rally above $96 is likely to open the doors for a possible rally to $106.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.