April has been an interesting month for the cryptocurrency market, characterized by high volatility, new yearly highs and a sharp drop. What awaits us in the crypto world in May? According to crypto analyst Valdrin Tahiri, May may bring excitement to the crypto market again. The analyst shares his crypto predictions for the month of May.

The leading cryptocurrency will reach its first monthly monthly close in 2023

Bitcoin price has created three consecutive bullish monthly candlestick closes. If the price does not close below $28,476 in the last two days of April, the monthly candlestick will also turn bullish. Thus, it will lead to the fourth such candlestick. However, the future outlook for May is not very bright. The main reason for this is the downside reaction to the $31,000 horizontal resistance area. Although the BTC price initially rallied above this, it was sharply rejected. It also started a short-term decline. This area is crucial as it has acted as both support and resistance intermittently since the start of 2021.

Also, the weekly Relative Strength Index (RSI) looks ripe for rejection. Traders use the RSI as a momentum indicator to assess whether a market is overbought or oversold and to determine whether an asset should be accumulated or sold.

If the RSI is above 50 and the trend is up, the bulls still have the advantage. However, if the value is below 50, the opposite is true. As the RSI reaches the 50 line from below (red circle), it is possible for the indicator to align with rejection from the horizontal resistance area, causing rejection. This bearish prediction will be invalidated if BTC price closes above the $31,000 resistance area. This makes a pump of up to $42,000 possible.

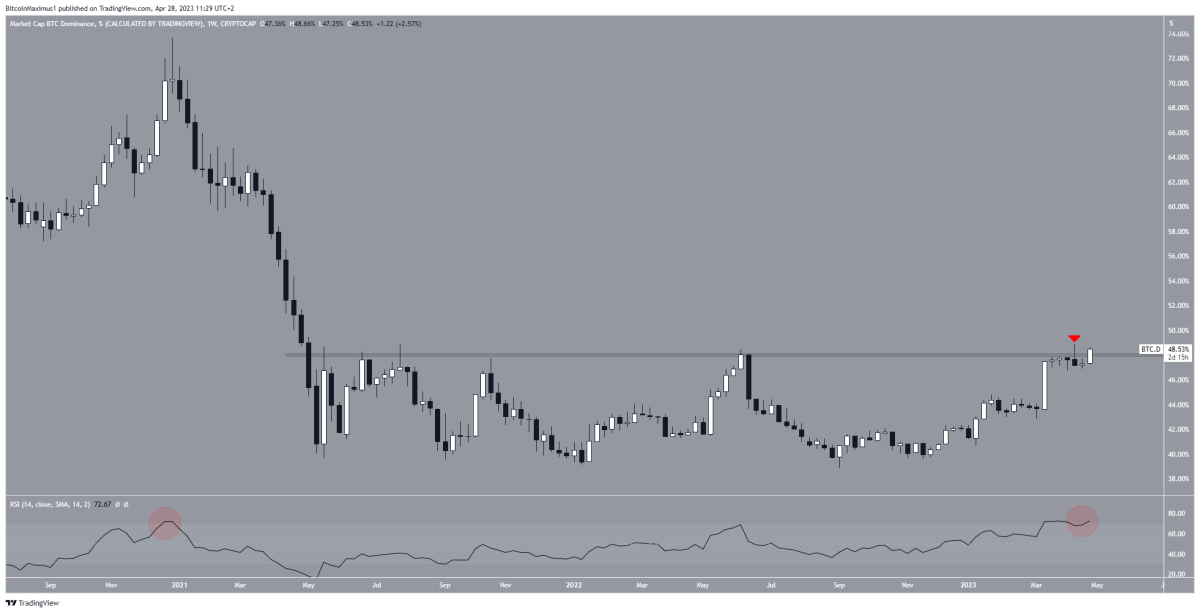

Bitcoin dominance rate (BTCD) will decrease significantly

The BTC dominance ratio shows the relationship between Bitcoin’s market cap and the rest of the cryptocurrency market. A BTCD value of 48.50 means that 48.50% of all cryptocurrency market capitalization comes from Bitcoin. BTCD is near a new year high. However, it is showing a few bearish signs. First, it created a shooting star candlestick on the weekly timeframe (red icon).

The shooting star is a type of bearish candlestick characterized by a long upper wick and a bearish close. This means that the upward move cannot be sustained and sellers push the price below the period opening.

Next, the weekly RSI shows overbought. The last time there was such an overbought and a very sharp drop in early 2021 (red circle). Hence, BTCD is likely to drop by 42%. This forecast will be invalidated with a one-week close above the 48% resistance area. In this case, it is possible for BTCD to rise to 62%.

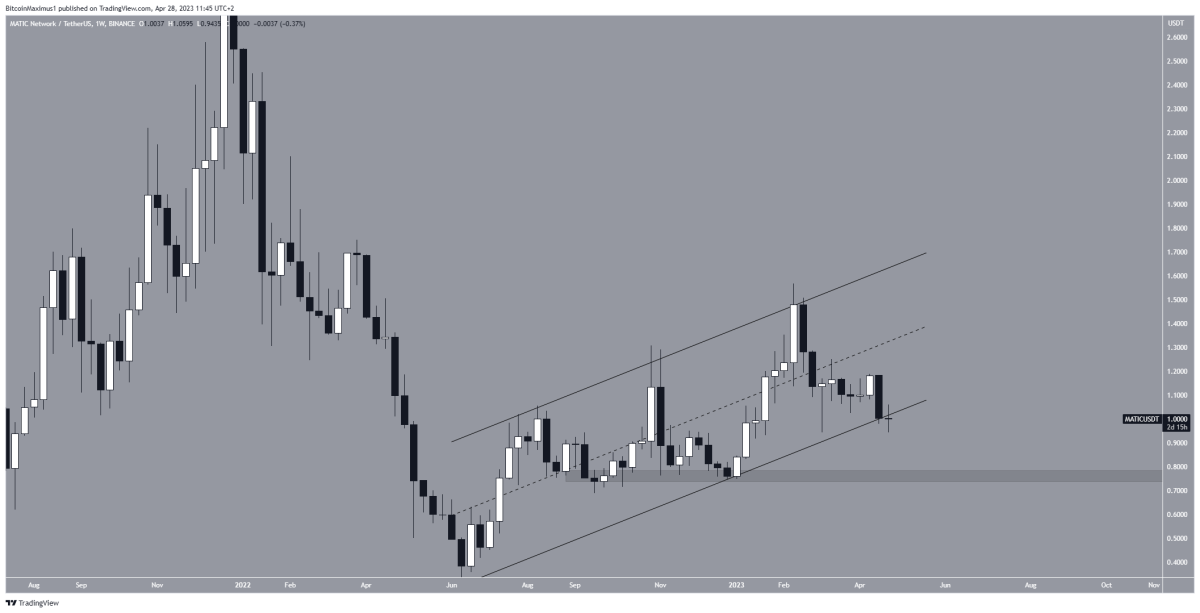

Polygon (MATIC) will drop from top 10

Looking at altcoins in May, crypto forecasts are not in favor of Polygon (MATIC). Currently, MATIC is among the top 10 cryptocurrencies by market cap. Moreover, cryptocoin.comAs you follow, crypto money has been in the top 10 for a long time. However, the price action is showing a few bearish signs that the next few months will not be positive for MATIC.

This is mainly because MATIC is trading slightly below the support line of a long-term ascending parallel channel. Such channels often contain corrective models. So an eventual break is the most likely scenario. If one occurs, MATIC price is likely to decline towards the $0.75 support area. Potentially a drop below the June 2022 low of $0.32 is possible.

In case of a close above the support line, this bearish forecast becomes invalid. In this case, it is possible for MATIC to move towards the midline of the channel at $1.45.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.