bitcoin After its price exceeded $30,000 for the first time in 10 months, it lost 10% of its value, leaving the cryptocurrency market facing a tough picture. However, with multiple on-chainmetrics signaling green, bulls are expected to be able to reverse the decline. Here’s what it takes to break the $30,000 levels again.

As investors’ confidence in the cryptocurrency market wanes, investors are likely to re-fund from the altcoin sector to Bitcoin in the coming days.

Investor Confidence Records Low of Last Month

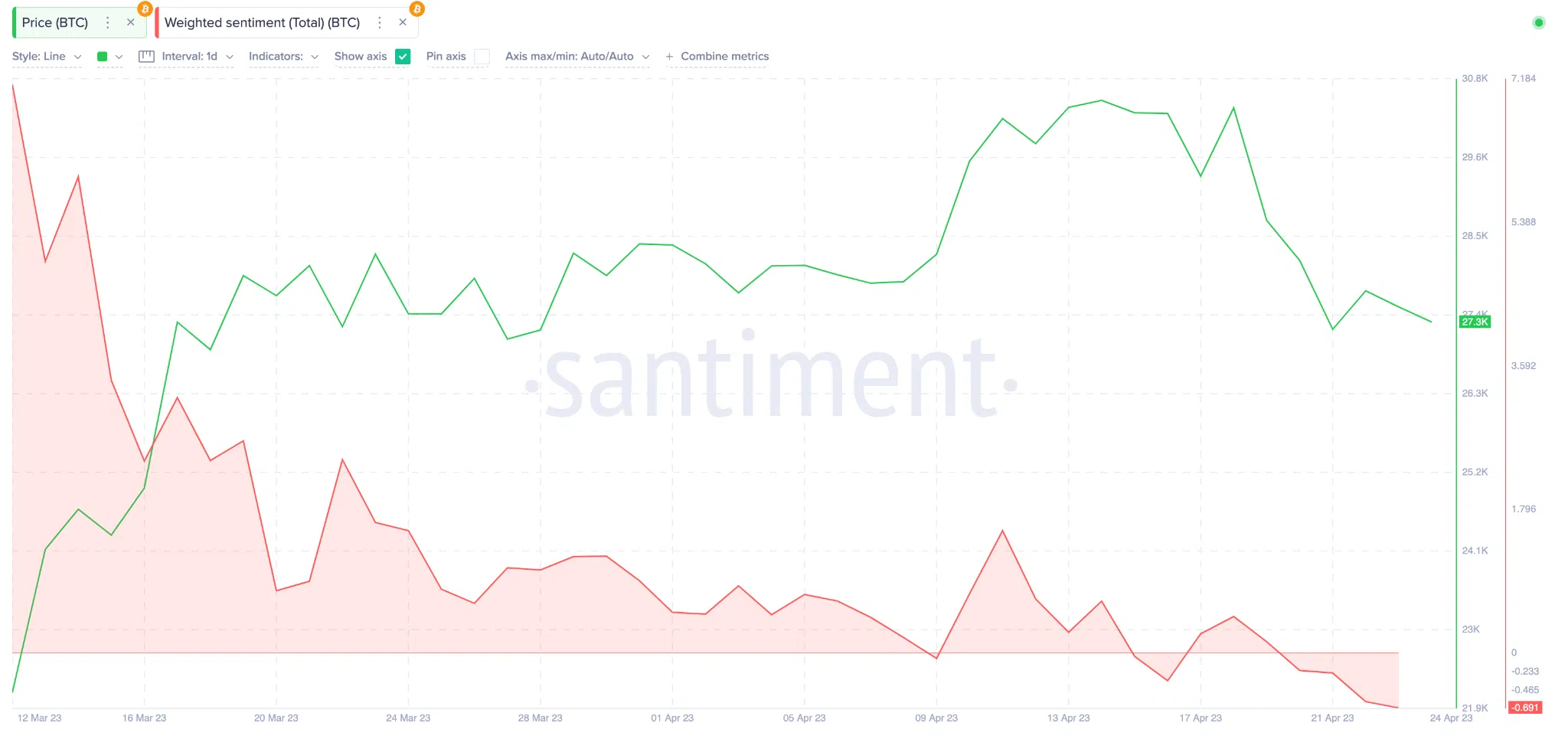

Market sentiment in Bitcoin peaked on March 12 following the US banking crisis. However, investor confidence has plummeted since the BTC price crossed $22,000, resulting in weighted sentiment hitting its lowest level since March 2.

Weighted Sentiment is a metric that evaluates investors’ expectations by comparing the ratio of positive to negative mentions of an asset on social media.

As can be seen in the chart below, it can be seen that Bitcoin-weighted sentiment decreased from 1.53 to -0.70 between April 11-24 and turned negative.

Decreased social sentiment, coupled with an increase in selling pressure, could lead to a temporary drop in price. However, when the negative sentiment hits the line, it may indicate the end of the selling frenzy and the start of a new bullish cycle.

If we look at the historical data, the price typically moves against the expectations of the investors. If this pattern is repeated, it is quite possible to see a recovery in the coming days.

Bitcoin Whales Make Strategic Purchases

Wallets that tend to make strategic purchases seem to have started an accumulation phase. With the rejection of the $30,000 resistance last week, a selling wave was triggered in BTC. However, some whales have already begun to buy at low prices. According to the data, they added 20,000 BTC to their wallets between April 16-24. It has an average value of $540 million.

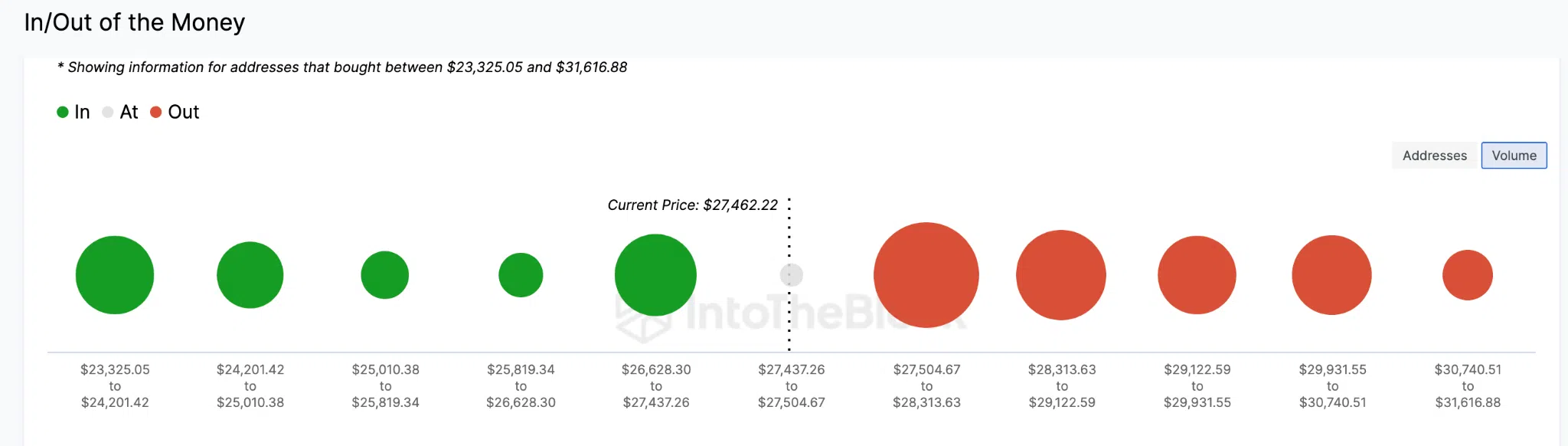

Data from IntoTheBlock’s “In Out of Money Around Price” shows that the probability of Bitcoin falling below $27,000 is low.

Currently, the $27,500 resistance cluster consisting of 61,000 addresses is holding 13,500 BTC. This means that this region is relatively weaker than the support of 252,000 addresses that bought 389,000 BTC at an average price of $27,100.

However, at the moment, $28,350 must be exceeded in the first stage. Although this level is difficult to overcome, here lies the key to the rise to $32,000 as a result.

However, a pullback below $27,000 means the bears may strengthen and invalidate bullish predictions. As seen above, bullish support from 252,000 addresses that bought 389,000 BTC at an average price of $27,100 will likely prevent the decline. However, if things don’t go well, a drop to $24,500 is possible.

You can follow the current price action here.