Popular metaverse coin project Axie Infinity (AXS) has distributed the first batch of 10 million previously locked tokens to early investors and insiders, according to blockchain data. Crypto asset management firm Arca has already deposited its newly acquired AXS tokens on the FTX exchange. This is a move that shows the tendency to empty.

Popular metaverse coin project begins token distribution

Axie Infinity is a play-to-earn metaverse coin project that suddenly gained popularity last year. It began distributing previously restricted AXS tokens to early investors and insiders as part of a massive $200 million unlock event. However, unlocking came with unexpected drama. For a long time, some holders have bet that the distribution will cause a price drop. However, a sudden spike in the crypto market has wiped out some traders.

Crypto traders are watching the timing of the token vesting period, which could theoretically lower the price, in part because of the possibility that some investors may choose to sell their holdings. Vesting refers to the amount of time certain investors and insiders must wait before claiming their assets. The point is to make them invest long-term and avoid immediate sales. All will be in fair play once the qualifying period ends and the tokens are unlocked.

Early investors moved tokens to exchanges, now what?

Blockchain data shows that a wallet labeled “Axie Infinity: Token Vesting” transferred approximately 785,334 AXS tokens (worth $6.6 million) to six buyers. Buyers were listed as Axie’s advisors and initial investors in a special round of sales in mid-2020, according to TokenUnlock. 21.5 million AXS (worth $200 million) is about to be released in the coming days. Nearly 10 million tokens unlocked for early investors, advisors and developer team. This potentially creates selling pressure for the metaverse coin.

One of the institutional investors that bought AXS during the private sale is digital asset management firm Arca. A wallet affiliated with the company received $4 million in AXS (437,500 tokens). Then, according to Blockchain data from Etherscan and Nansen, he deposited them all, cryptocurrency exchange FTX. Another early investor received $1.7 million (187,500 tokens) in AXS, according to blockchain data. He soon moved the tokens to the crypto exchange Binance.

Streaming cryptocurrencies to exchanges likely indicates that these investors will dump their holdings and make a huge profit on their original investment. Investors participating in the private sale bought AXS for 8 cents. Crypto is currently trading at around $9. In this case, it is possible for them to make 11.150% profit on their first shares.

According to TokenUnlock, crypto investment firms DeFiance Capital and Delphi Digital are required to raise $1.5 million (160,000 tokens) and $6.8 million (750,000 tokens), respectively. Blockchain data shows they haven’t received their share of tokens yet.

short squeeze

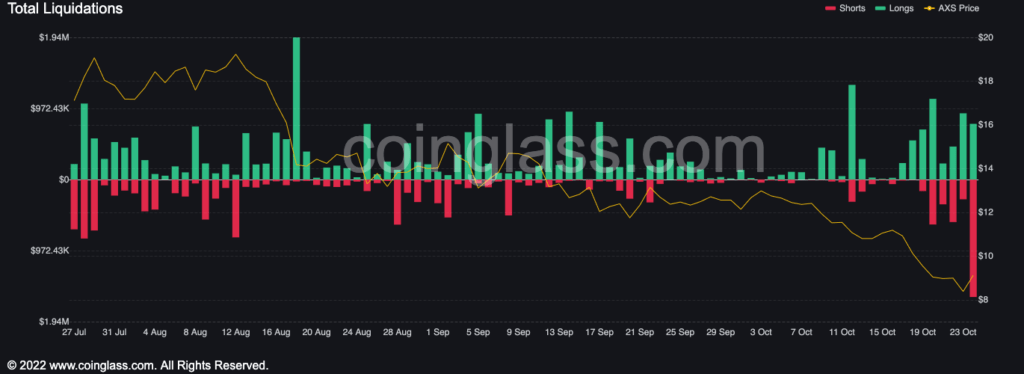

Similar to previous events, crypto traders predicted that the price of AXS would drop after unlocking. According to Messari, before unlocking, AXS saw a 24% drop in a week. This has made the metaverse coin project one of the worst performing crypto assets. According to data from Coinglass, traders have taken short positions in anticipation of further declines. As a result, funding rates turned overwhelmingly negative on most exchanges.

However, AXS is up 7% in the last 24 hours after a recent market-wide recovery. cryptocoin.comAs you follow from , thus traders were caught off-guard. Whip has liquidated $1.6 million in shorts, the highest in at least three months. At press time, AXS is trading at $8.99, down more than 90% from last year’s ATH.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.