Crypto analyst Justin Bennett Dogecoin (DOGE) says it may be ready to experience a rally to reach the next critical level, about 37% above current prices.

The popular analyst tells his Twitter followers that DOGE is trying to break out of a long descending line of resistance it has faced since May.

“[BTC işbirliği yaptığı sürece] DOGE looks ready. For it to rise above $0.34, it needs to rise above 0.27 on a daily close basis.”

In the short term, Bennett believes DOGE should turn the $0.26 support level into resistance and close above $0.27 before continuing to rise to its initial target of $0.34. According to CoinGecko, Dogecoin is trading at $0.26 at the time of writing.

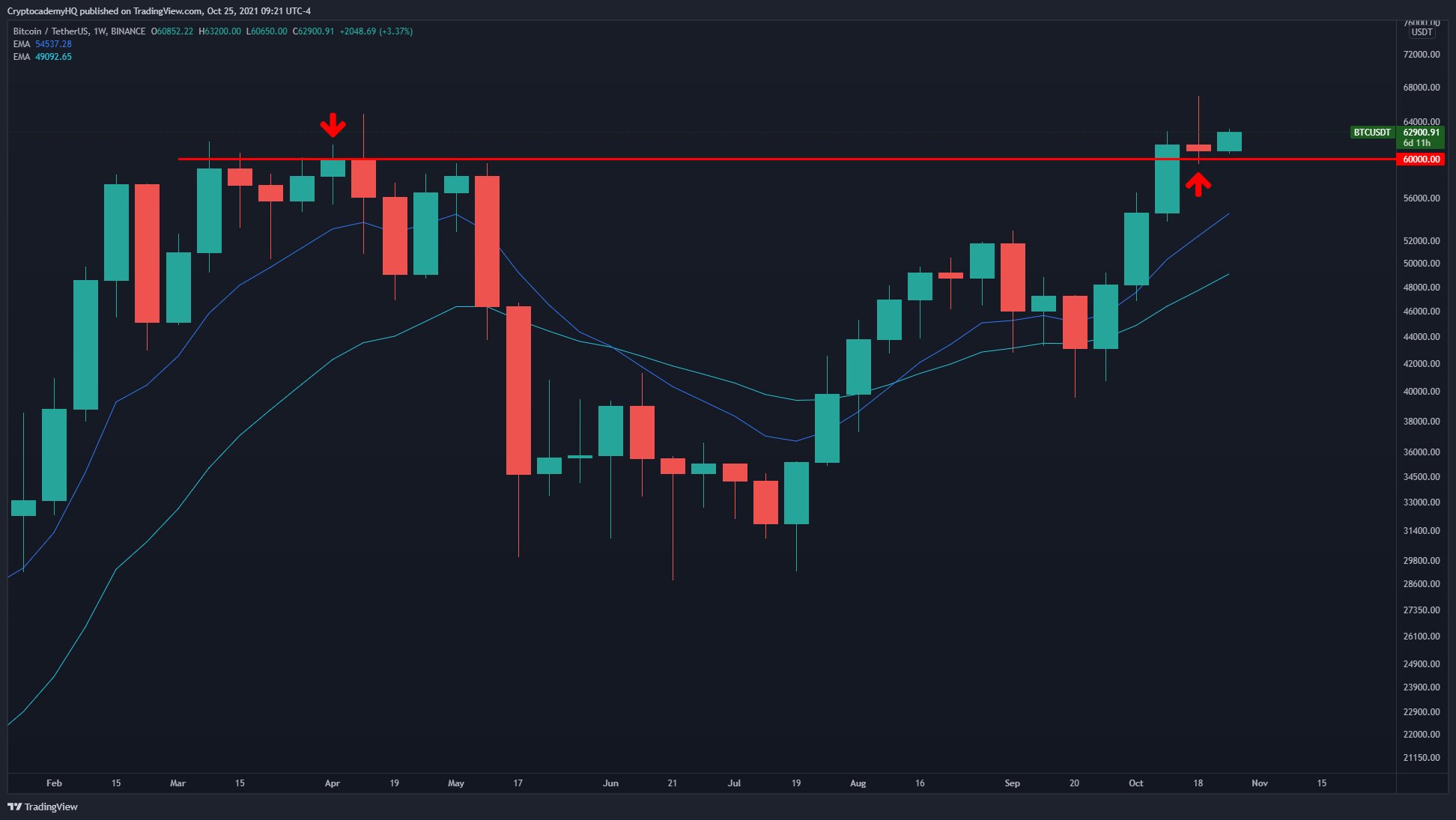

The analyst, who also studies Bitcoin, believes that BTC’s ability to maintain the $60,000 level is an important indicator of strength that could have far-reaching implications in wider markets.

“Although BTC’s weekly candle is not looking great, it’s still above $60k.

It was exactly what I was looking for. It doesn’t mean we won’t be able to see more pullbacks before we go higher, but it does mean that $60,000 is held as support on a weekly close basis.

This is huge.”

Bennett is also interested in Bitcoin dominance, which is the ratio of Bitcoin’s market cap to other cryptocurrency markets. The analyst claims that BTC.D has bounced off a support level and is now on its way up.

“BTC.D bounced from 44.5% support. What a pleasant surprise.”

While increased Bitcoin dominance usually means altcoins will underperform, Bennett says this may only be true in the short term. The analyst says that if the king cryptocurrency looks healthy, altcoins could take it as a signal to rise.

“This is not necessarily a bad sign for altcoins. Will they suffer if ‘BTC.D’ heats up again? In the short term and against BTC, yes. But Bitcoin’s current strength means it’s massively bullish for altcoins in the next few months.

Fiat money -> Bitcoin -> Altcoins”

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.