There are only a few days left until the new year. The year 2023 will be a year with many surprises for the markets. Many investment vehicles may not meet expectations this year. Because it looks like it will be a year with high surprises and risks. Well, let’s see what is the favorite investment tool of 2023 and why. However, first, let’s draw a picture of the year 2023 in our minds.

Hello New Year!

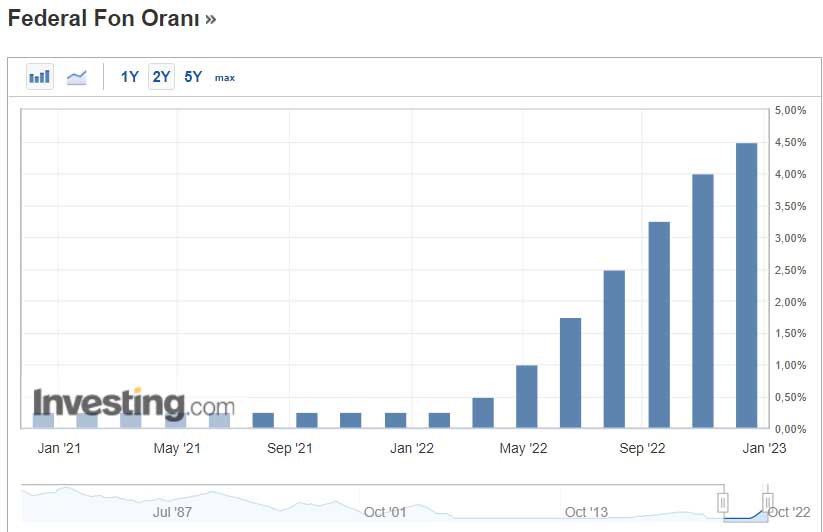

FED rates, which increased in 2022, were quite dominant. I expect the FED’s high interest policy to continue in 2023. Therefore, we will not encounter many market bubbles and FOMOs globally. However, I expect a slowdown in interest rate increases as well. If we look at the graphs, the rising FED interest rates (1) and the US inflation, which has been on a downward trend recently, show that the FED policy is working. Therefore, while high interest rates continue for 2023, interest rate increases can be expected to slow down.

Of course, we do not expect new peaks in the markets in a period of high interest rates. When interest rates rise, economies slow down and, in parallel, markets slow down.

On the other hand, geopolitical risks continue. Tensions are high in the China-Taiwan-US triangle. The exercises of China close to the island country are remarkable. A possible Chinese intervention in Taiwan is possible, especially in 2023. On the other hand, the Russia-Ukraine war is expected to continue in 2023. Especially Russia’s statements about nuclear are troubling. Political risks will undoubtedly affect the markets in 2023.

Koinfinans.com As we reported, the crypto market in general is one that seeks stories for bullishness. However, 2023 does not seem to offer much opportunity for new highs and FOMOs. As I mentioned in the global, a picture will keep the interest in crypto low.

So, What is Expected for Turkey and Turkish Investors in 2023?

2023 is a very complicated year for Turkey. First of all, since there will be an election, we will have to divide the year into two. The pre-election low interest policy will continue. After the election, no matter who comes, a high bill will come out.

I expect a currency rise in the first half of 2023. The rate moves calmly, as if drawn with a ruler for a long time. Or rather, it is held. I expect it to go like this until the election and not be a shock. However, FX-protected deposit yields and exporters will be allowed to go up a bit so they don’t get into trouble. I expect it to be like March.

We are seeing significant increases in stocks these days. There are serious returns on both TL and Dollar terms. There is no market in the world that gives these returns right now. However, there is swelling in the index. Now the choice of stock has become more important.

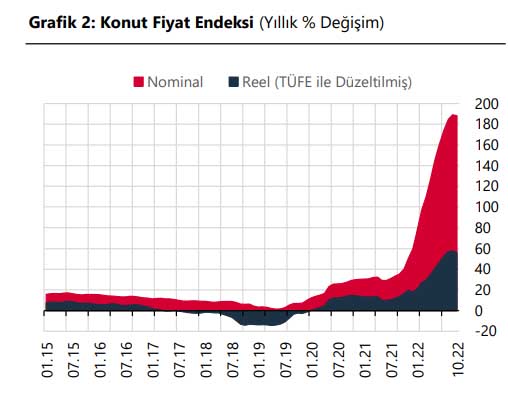

In the second half of 2023, we will encounter drastic interest rate hikes. Therefore, I expect a slowdown in equities, housing and auto markets (which are pretty inflated). In particular, the housing market will not bring (real) profits with interest increases. Therefore, housing investments would not make sense during this period.

With these sharp interest rate hikes, a very difficult period will be waiting for us. It is not possible to reduce such a high inflation without going into recession. Therefore, TR markets will be negatively affected. In the real economy, we will encounter a serious increase in unemployment and bankruptcies.

To Safe Harbors in 2023…

My favorite investment instrument in 2023 is gold. Considering both rising interest rates and accompanying recession expectations as well as geopolitical risks, I would expect $2,000 or more on the ounce side. Especially geopolitical risks are a big push for gold. On the gram gold side, 1.200 levels may come to the fore with my expectation of an increase in Dollar / TL.

In 2023, gold is positively differentiated from other investment instruments.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.

Source : Koinfinans.com

553 times read.