Polygon has been one of the few bright spots in the crypto market since the collapse of Terra earlier this year. Crypto Expert Mike Fay believes the extreme performance is justified given the daily active user growth and the partnerships Polygon is experiencing. The expert selects the altcoin project as the best bull for 2023 and explains why.

An altcoin at the peak of its dominance: Polygon

cryptocoin.comAs you follow, FTX crashed from early to mid-November. Prior to this, many assets in the crypto market were poised for positive returns by the end of the year. Unfortunately for the broad crypto bulls, FTX has come true. Thus, 2022 passed as one of the worst years for crypto investors. If Bitcoin closes the year at the current level of $17,750, 2022 will be the second-worst single-year performance for Bitcoin since 2011, with both a year-on-year decline (-62%) and a decline from an all-time high (-74%). However, this bear market cycle is a little different from its predecessors.

We saw Bitcoin’s crypto market dominance rise from 32% during Ethereum’s peak in early January 2018 to over 50% in the depths of the 2019 crypto market bottom. Many altcoins in the ICO failed to regain their all-time highs during the last bull run. Therefore, the dominance of Bitcoin continued to rise. Given the size of sales in crypto up to this point, Bitcoin’s 38% market dominance is currently very low compared to previous cycles.

This time around, assets other than Bitcoin have proven to be resilient in this current crypto winter cycle. Ethereum is stabilizing specifically in the 18-20% market dominance range. ETH dominance numbers, which were previously indicative of highs, may now be transitioning to dominance lows if ETH is to turn BTC from a market dominance perspective. Even more impressive is Polygon (MATIC), which is currently at the peak of its dominance with 0.9

Polygon has shown remarkable resilience in this bear market. It’s also in a terrific position to be one of MATIC’s top performing assets next year.

What is a polygon?

Polygon is a PoS Blockchain specifically designed to provide better scaling to Ethereum. Like other Tier 1 Blockchains, Ethereum suffers from the ‘Blockchain triad’.

Trilemma theory suggests that public blockchains cannot achieve all three characteristics (decentralization, security, and scalability) independently. Ethereum is secure and decentralized. However, it is not scalable. Ethereum’s scalability issue has led to the proliferation of other base-layer Blockchains that aim to offer better scalability through faster block times and more transactions per second. Other attempts to address Ethereum’s scalability drawback have come from building secondary ‘Layer 2’ blockchains on top of Ethereum. This is the route Polygon took.

Through Polygon, developers get fast and inexpensive transactions secured by Ethereum’s infrastructure. Anyone with an Ethereum wallet can use the Polygon network. They can also interact with applications built on Polygon at a fraction of the cost of building them on Ethereum. Developers use MATIC for applications they build on Polygon for gas charges. This lowers gas prices.

Evaluation of the altcoin project

Partnerships

Despite the crypto winter, Polygon is building an impressive list of partnerships with some of the best companies in the world. Polygon has been selected as a public blockchain tool by Starbucks (SBUX), Meta Platforms (META), Stripe, and Reddit. Additionally, Polygon was the only blockchain scaling protocol included in Disney’s (DIS) accelerator program earlier this year. Starbucks is using Polygon to launch its new rewards platform, Starbucks Odyssey.

Reddit avatar collectibles

The biggest challenge facing broader crypto adoption may not be regulatory clarity, institutional demand, or approval of ETFs. In my view, public blockchain takes it to the next level when people unknowingly interact with crypto rails. We’re already starting to see this with Polygon. Almost every crypto network has experienced serious daily user drops since the collapse of Terra (LUNC-USD) in May and June. Polygon was a notable exception. This is largely due to people buying MATIC indirectly without realizing it.

Reddit launched the Avatar Collectible NFT initiative in July. Since then, the project has produced over 5 million collectible avatars. According to Polygon, only 6.8% of Reddit avatar owners have more than 1 avatar. This means that avatars have been impressively accepted by the Reddit community. Notable given the feedback on NFTs from certain communities earlier this year.

Network activity

The Reddit project has seen a noticeable increase in daily active users on the Polygon Blockchain. There was actually a two-week period in October when Polygon averaged more DAUs than Ethereum. This average turned out to be quite high. Also, Blockchain currently averages just under 335,000 DAU:

This level of activity has helped the Polygon network stabilize in the 2-3 million daily transaction range, despite the massive drops in crypto-related transactions seen on other networks.

Price-to-fee valuation

Valuing blockchain is a little different than valuing traditional stocks. The crypto industry is still very new. So there really isn’t a set of standards for evaluating a network’s token. This is particularly true. Because crypto networks do not necessarily serve the same type of transaction demand. Payments are a solid base metric to consider when it comes to something like NVT or the ratio of network value to transactions.

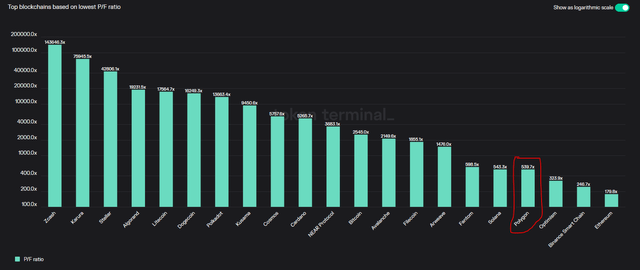

But prices and fees for smart contracts are also interesting. It somewhat mimics the price-to-sell ratio, as it divides the fully diluted cryptocurrency market cap by annual transaction fees on the network. When your network is all about cheap fees, this can create extremely high P/F rates.

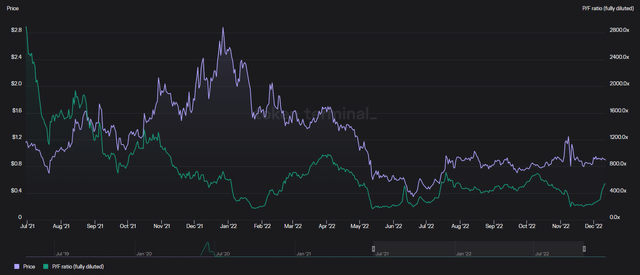

Polygon’s gas fees are less than a penny per transaction. However, high P/F ratio issues are not really like that. Currently, the P/F ratio for Polygon is 540. This is higher than Blockchains like Binance (BNB) or Ethereum. But it is much lower than other low-fee Blockchains like Avalanche (AVAX), Near Protocol (NEAR), Cardano (ADA) or Cosmos (ATOM). Looking at the metric over time, it’s possible to see Polygon growing towards its P/F value:

In July of 2021, the altcoin price was at a level very similar to where it is now. But the P/F multiplier was roughly 5 times higher than it is today. This demonstrates the network growth of Polygon outpacing the growth of the MATIC token price.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.