Litecoin (LTC) has followed the uptrend in the current crypto markets and since May 2021 LTC/USD It posted daily gains of around 20% on November 9, the highest levels for

LTC, the 14th largest crypto-asset by market cap, has risen nearly 25% in the past three days, pushing Coinbase up to $250 in price. With the total value of crypto assets reaching $3 trillion, Litecoin (LTC), which has been quiet for a while, followed the trends and pleased its investors.

Litecoin’s continued price rally followed similar upward moves in leading digital assets, according to data from Cointelegraph Markets Pro.

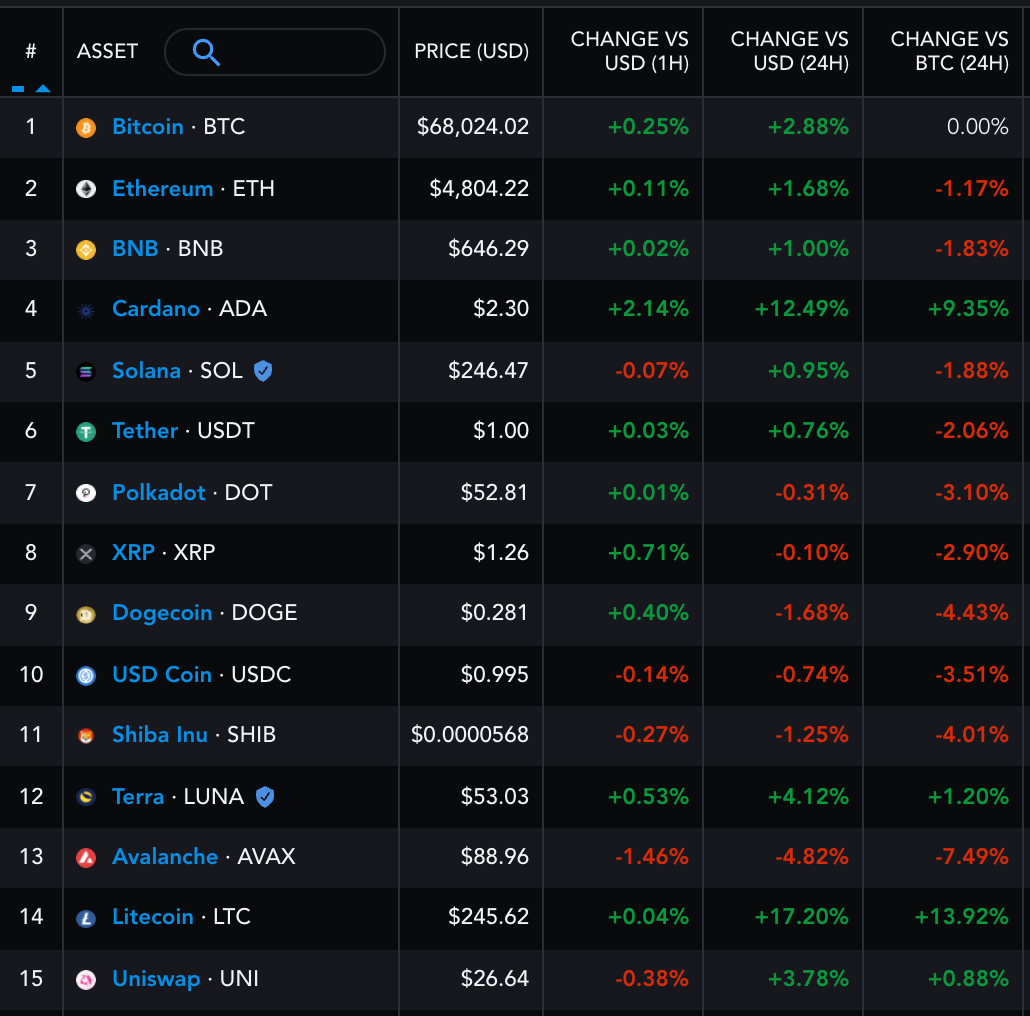

However, only a few key altcoinoutperformed Bitcoin in the previous 24 hours. According to data provided by Messari, the massively traded LTC/BTC pair rose by almost 14%, indicating an increase in transfer from Bitcoin to Litecoin markets.

LTC/BTC The technical outlook for the pair showed more gains ahead based on a classic bullish reversal pattern called the falling wedge.

Falling wedges start wide at the top, but begin to narrow as the price falls. The uptrend is confirmed when the price is above the upper trendline of the wedge. Analysts typically interpret the breakout as a signal for a rally towards the snow target that sits at a length equal to the maximum height of the wedge.

Recent rallies in LTC caused the price to break above the lower trendline of the lower wedge, creating additional bullish prospects.

LTC when I do this 0.006122 BTC It has set a profit target around. On the other hand, a bearish trend has been detected between rising prices and falling volume in the last three weeks on the LTC chart, indicating that the falling wedge break may be weaker.

Litecoin In USD terms, its price is up more than 150% after falling to $103 on July 20. However, the massive upside move of the “silver to Bitcoin gold” cryptocurrency also triggered the appearance of a bearish reversal. the rise indicates that it is due to a pause.

The pattern, called the rising wedge, represents the opposite of the falling wedge. It starts wider at the bottom but starts to narrow as the price increases. A bearish confirmation comes when the price breaks below the lower trendline and then targets levels with a length equal to the high of the wedge.

Depending on the level at which LTC starts its negative exit, the target of the wedge could range from $117 to $121.

Conversely, a definitive break above $250 could invalidate the ascending wedge pattern and test LTC towards the next price target of $300.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.