According to K33 Research, traders continue to prefer Bitcoin over Ethereum due to the potential for higher futures premiums and spot Bitcoin ETF approvals. Despite growing optimism in the derivatives market, overall sentiment remains cautious.

Ethereum’s performance against Bitcoin will decrease!

The persistent rise in Bitcoin futures premiums continues, according to a new report. This indicates that Ethereum will continue its underperformance compared to Bitcoin throughout the year. K33 Research Senior Analyst Vetle Lunde and Vice President Anders Helseth include the following assessment in their latest report:

The explanation for this may be that Bitcoin as digital gold in a risk-off environment is more attractive than DeFi and NFT-related Ethereum, soon interspersed with the potential of spot Bitcoin ETFs. Until there is clear evidence of a spark in Ether, sticking with Bitcoin is probably the safest investment choice for now.

Spot Bitcoin ETFs

Lunde and Helseth do not expect the Securities and Exchange Commission (SEC) to appeal the Grayscale court’s decision by Friday’s deadline. In this case, the court will likely instruct the regulator to reconsider Grayscale’s application to convert its Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF. K33 analysts say whether it is appealed or not, the decision will likely lead to a strong market reaction in the short term before it is postponed to the next decision dates on delayed spot Bitcoin ETF applications, including those from BlackRock, Fidelity, VanEck and Invesco.

Last week, Bloomberg Senior ETF Analyst Eric Balchunas said the SEC was actively working with issuers on redemption, custody, legal considerations and “a break from the typical pattern of delay, postponement, radio silence and then denial.” It predicts a 75% chance of approval by the end of this year and a 90% chance of approval by March 2024.

Superior performance while not performing!

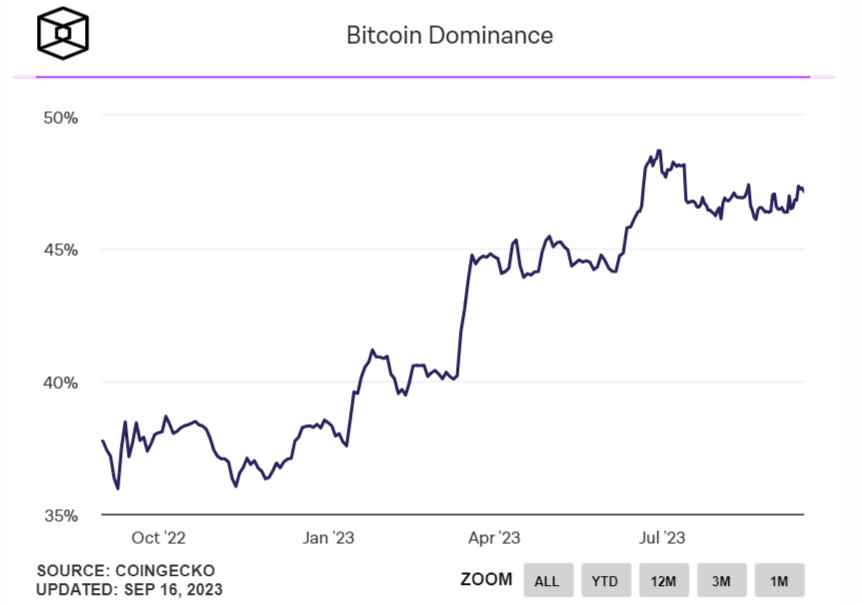

Along with most altcoins, Ethereum also showed low trading volume and underperformance in the spot market. In this environment, BTC volatility also decreased. With the launch of the ETH futures ETF, Ethereum’s performance against Bitcoin has declined. It even accelerated and started trading at 0.057, its lowest level in 14 months. Additionally, it lost 5% of its value in US dollar terms last week. Bitcoin also remained stable at 0% during the same period. So, it didn’t perform much better. However, market dominance is still approaching its highest levels in recent years. BNB, the third-largest non-stablecoin crypto by market cap, fell by 3%.

Bitcoin derivatives market more optimistic, but still not bullish

On the positive side, CME next month premiums and offshore funding rates for BTC have trended higher over the past week, Lunde and Helseth say. They also note that the 6-month Bitcoin options skew indicates strong demand for call options. However, offshore funding rates are still consistently below neutral. Despite the upward trend, the derivatives market does not emit strong bullish sentiments, according to K33. Because, Bitcoin futures ETF outflows paint a more cautious picture.

Bitcoin futures last week witnessed a five-day volatility rate of 9.4%. cryptokoin.comAs you follow from , this is the second highest rate in 2023. However, analysts say the increased activity has not translated into significant directional momentum. They also note that traders have a hard time navigating stubbornly stable market conditions.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!